Region:Europe

Author(s):Shubham

Product Code:KRAA1736

Pages:85

Published On:August 2025

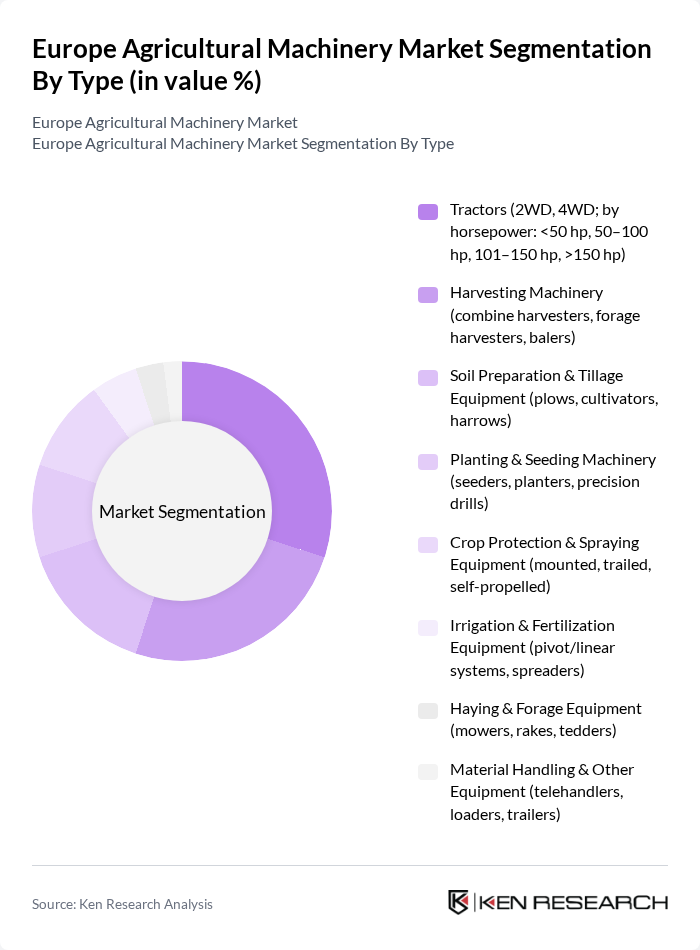

By Type:The agricultural machinery market can be segmented into various types, including tractors, harvesting machinery, soil preparation and tillage equipment, planting and seeding machinery, crop protection and spraying equipment, irrigation and fertilization equipment, haying and forage equipment, and material handling and other equipment. Each of these segments plays a crucial role in enhancing agricultural productivity and efficiency.

By End-User:The end-user segmentation includes large-scale commercial farms, medium-scale farms, smallholder/family farms, and agricultural cooperatives and contractors. Each segment has distinct needs and purchasing behaviors, influencing the types of machinery they invest in to enhance productivity and efficiency.

The Europe Agricultural Machinery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deere & Company (John Deere), CNH Industrial N.V. (New Holland, Case IH, Steyr), AGCO Corporation (Fendt, Massey Ferguson, Valtra, Challenger), CLAAS KGaA mbH, Kubota Corporation, SDF Group (Same, Deutz-Fahr, Lamborghini Trattori, Hürlimann), JCB (J.C. Bamford Excavators Ltd.), KUHN Group (Bucher Industries), AMAZONE-Werke H. Dreyer GmbH & Co. KG, Lemken GmbH & Co. KG, Kverneland Group (part of Kubota), Hardi International A/S (HARDI/Evrard, part of EXEL Industries), Argo Tractors S.p.A. (Landini, McCormick, Valpadana), Krone (Maschinenfabrik Bernard Krone GmbH & Co. KG), Väderstad AB contribute to innovation, geographic expansion, and service delivery in this space.

Enhancements to growth drivers and trends (validated): - Precision agriculture penetration is rising, supported by GPS-guided tractors, IoT/telematics, variable-rate tech, and farm management software; these technologies are now a major influence on equipment purchases in Western Europe and increasingly in Central/Eastern Europe. - EU and national subsidies under the CAP, including eco-schemes and modernization supports, are accelerating mechanization and uptake of low-emission and smart machinery across Germany, France, Italy, and the Netherlands. - Labor constraints and an aging farming workforce are increasing demand for automation-ready equipment, higher horsepower tractors, and combines with advanced operator assistance, boosting replacement demand.

The future of the European agricultural machinery market appears promising, driven by technological innovations and a strong focus on sustainability. As farmers increasingly adopt precision agriculture techniques, the demand for advanced machinery equipped with IoT capabilities is expected to rise. Additionally, the ongoing shift towards eco-friendly practices will likely encourage the development of sustainable machinery solutions. These trends indicate a dynamic market landscape, where adaptability and innovation will be key to success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Tractors (2WD, 4WD; by horsepower: <50 hp, 50–100 hp, 101–150 hp, >150 hp) Harvesting Machinery (combine harvesters, forage harvesters, balers) Soil Preparation & Tillage Equipment (plows, cultivators, harrows) Planting & Seeding Machinery (seeders, planters, precision drills) Crop Protection & Spraying Equipment (mounted, trailed, self-propelled) Irrigation & Fertilization Equipment (pivot/linear systems, spreaders) Haying & Forage Equipment (mowers, rakes, tedders) Material Handling & Other Equipment (telehandlers, loaders, trailers) |

| By End-User | Large-Scale Commercial Farms Medium-Scale Farms Smallholder/Family Farms Agricultural Cooperatives & Contractors |

| By Application | Arable Crop Production (cereals, oilseeds, pulses) Livestock & Forage Operations Horticulture & Specialty Crops (vineyards, orchards, vegetables) Forestry & Agroforestry |

| By Distribution Channel | Direct OEM Sales Authorized Dealers & Distributors Online & Marketplace Sales |

| By Region | Western Europe (Germany, France, Netherlands, Belgium) Eastern Europe (Poland, Czech Republic, Hungary, Romania) Northern Europe (UK, Ireland, Denmark, Sweden, Norway, Finland) Southern Europe (Italy, Spain, Portugal, Greece) |

| By Price Range | Entry-Level Mid-Range Premium |

| By Technology | Conventional Mechanical Precision/Smart-Enabled (GPS/RTK, ISOBUS, telematics) Autonomous & Robotics (robotic tractors, swarm robots) Electrified/Hybrid Powertrains |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Tractor Manufacturers | 90 | Product Managers, Sales Directors |

| Harvesting Equipment Suppliers | 80 | Operations Managers, Technical Support Leads |

| Farmers and End-Users | 150 | Farm Owners, Agricultural Consultants |

| Agri-Tech Innovators | 70 | R&D Managers, Technology Officers |

| Government Agricultural Policy Makers | 60 | Policy Analysts, Agricultural Economists |

The Europe Agricultural Machinery Market is valued at approximately USD 50 billion, reflecting strong demand driven by technological upgrades, farm consolidation, and steady mechanization across Western and Central/Eastern Europe.