Region:North America

Author(s):Dev

Product Code:KRAC0421

Pages:82

Published On:August 2025

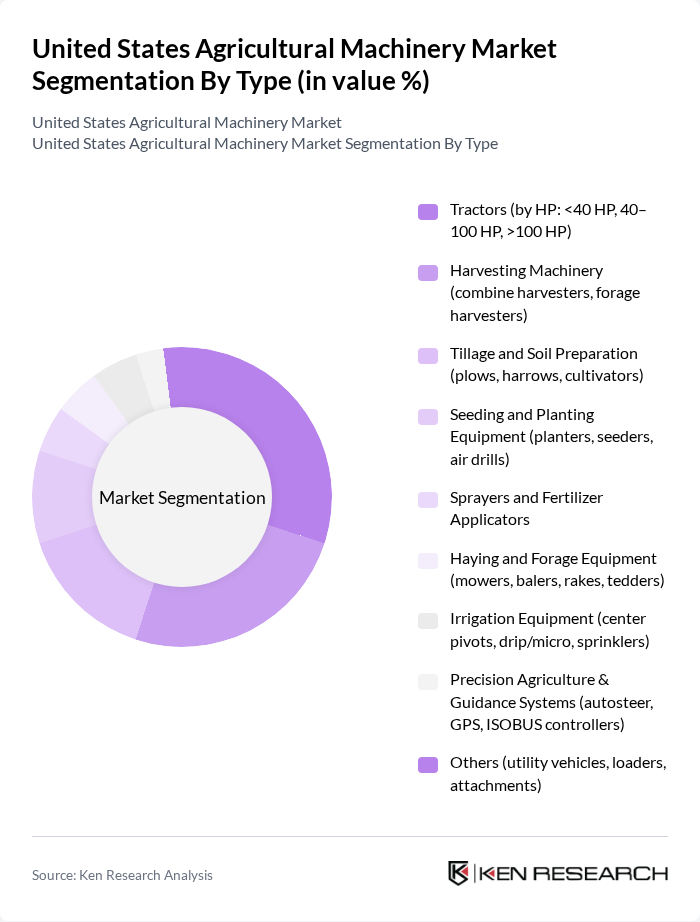

By Type:The agricultural machinery market can be segmented into various types, including tractors, harvesting machinery, tillage and soil preparation equipment, seeding and planting equipment, sprayers and fertilizer applicators, haying and forage equipment, irrigation equipment, precision agriculture and guidance systems, and others. Each of these subsegments plays a crucial role in enhancing agricultural productivity and efficiency.

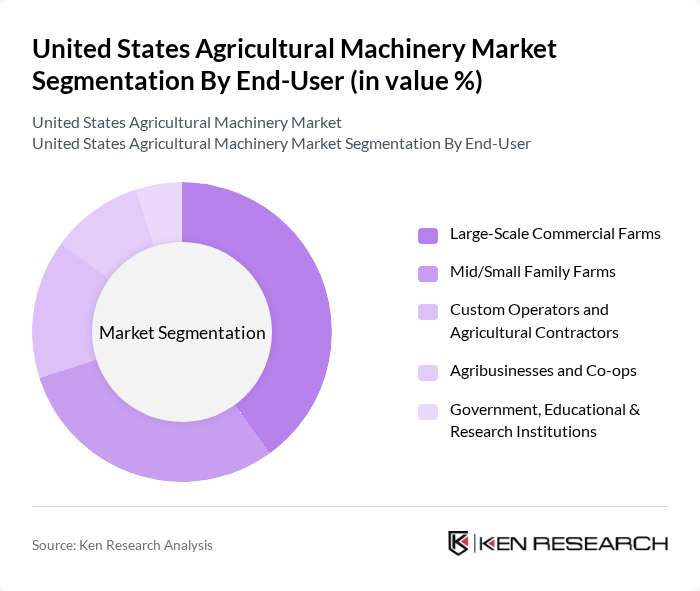

By End-User:The end-user segmentation of the agricultural machinery market includes large-scale commercial farms, mid/small family farms, custom operators and agricultural contractors, agribusinesses and co-ops, and government, educational, and research institutions. Each of these segments has distinct needs and purchasing behaviors that influence the types of machinery they invest in.

The United States Agricultural Machinery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deere & Company (John Deere), AGCO Corporation (Fendt, Massey Ferguson, Challenger, Precision Planting), CNH Industrial (Case IH, New Holland), Kubota Corporation, Mahindra & Mahindra Ltd. (Mahindra North America), Trimble Inc., Raven Industries, Inc. (a CNH Industrial brand), CLAAS Group, AG Leader Technology, Yanmar Co., Ltd. (Yanmar America), SDF Group (Deutz-Fahr), JCB, Bobcat Company, Vermeer Corporation, Great Plains Manufacturing (a Kubota company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. agricultural machinery market appears promising, driven by ongoing technological advancements and increasing adoption of precision agriculture. As farmers seek to enhance productivity and sustainability, the integration of IoT and automation will likely become standard practice. Additionally, the shift towards electric and hybrid machinery is expected to gain momentum, aligning with environmental regulations and consumer preferences for sustainable practices, ultimately transforming the agricultural landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Tractors (by HP: <40 HP, 40–100 HP, >100 HP) Harvesting Machinery (combine harvesters, forage harvesters) Tillage and Soil Preparation (plows, harrows, cultivators) Seeding and Planting Equipment (planters, seeders, air drills) Sprayers and Fertilizer Applicators Haying and Forage Equipment (mowers, balers, rakes, tedders) Irrigation Equipment (center pivots, drip/micro, sprinklers) Precision Agriculture & Guidance Systems (autosteer, GPS, ISOBUS controllers) Others (utility vehicles, loaders, attachments) |

| By End-User | Large-Scale Commercial Farms Mid/Small Family Farms Custom Operators and Agricultural Contractors Agribusinesses and Co-ops Government, Educational & Research Institutions |

| By Application | Row Crops (corn, soybeans, cotton) Specialty Crops and Horticulture (fruits, vegetables, vineyards, orchards) Livestock & Forage Operations Pasture & Hay Management Others |

| By Sales Channel | OEM Dealer Networks Independent Distributors Direct Sales Online Sales and Marketplaces Retail and Farm Supply Outlets |

| By Distribution Mode | Wholesale Distribution Retail Distribution Direct-to-Farm Others |

| By Price Range | Entry-Level/Compact Equipment Mid-Range Equipment High-End/Premium Equipment |

| By Component | Engine and Powertrain Transmission and Driveline Hydraulics and PTO Systems Electronic Control Units, Sensors & Displays Attachments & Implements Aftermarket Parts & Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Tractor Market Insights | 140 | Farm Owners, Equipment Operators |

| Harvesting Equipment Usage | 100 | Agricultural Managers, Crop Producers |

| Tillage Equipment Preferences | 80 | Farm Equipment Dealers, Agronomists |

| Precision Agriculture Technologies | 70 | Technology Providers, Farm Consultants |

| Market Trends in Sustainable Machinery | 90 | Environmental Specialists, Policy Makers |

The United States Agricultural Machinery Market is valued at approximately USD 40 billion, driven by technological advancements, increasing food production demands, and the adoption of precision agriculture technologies that enhance productivity and reduce operational costs for farmers.