Region:Global

Author(s):Geetanshi

Product Code:KRAB2817

Pages:95

Published On:October 2025

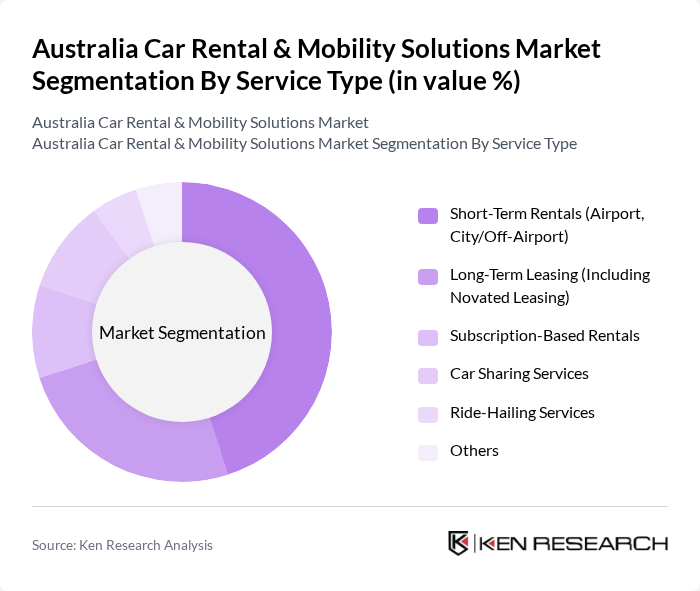

By Service Type:

The service type segmentation includes various subsegments such as Short-Term Rentals (Airport, City/Off-Airport), Long-Term Leasing (Including Novated Leasing), Subscription-Based Rentals, Car Sharing Services, Ride-Hailing Services, and Others. Among these, Short-Term Rentals dominate the market due to the increasing number of tourists and business travelers seeking flexible transportation options for short durations. The convenience of airport rentals and city-based services has led to a surge in demand, making this subsegment a key player in the overall market landscape. The rise of online booking platforms and mobile apps has further accelerated growth in this segment, enabling customers to access real-time availability and competitive pricing .

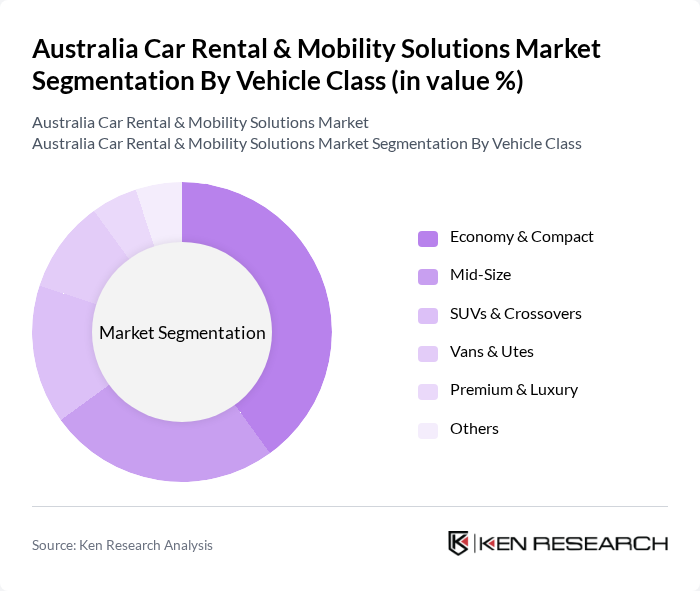

By Vehicle Class:

This segmentation includes Economy & Compact, Mid-Size, SUVs & Crossovers, Vans & Utes, Premium & Luxury, and Others. The Economy & Compact class leads the market, driven by cost-conscious consumers and businesses looking for affordable rental options. This segment appeals to a wide range of customers, including tourists and local residents, making it a staple in the car rental industry. The growing trend of urbanization and the need for efficient transportation solutions further bolster the demand for this vehicle class. Additionally, the popularity of hybrid and electric vehicles within the Economy & Compact segment is increasing as sustainability becomes a key consideration for both operators and customers .

The Australia Car Rental & Mobility Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hertz Australia, Avis Australia, Budget Rent a Car Australia, Europcar Australia, Thrifty Car Rental Australia, Redspot Car Rentals, Sixt Australia, Car Next Door (now Uber Carshare), GoGet Carshare, Orix Australia, Apollo Motorhome Holidays, DriveMyCar (now part of Splend), Tullamarine Car Rentals, A2B Australia (13cabs, Silver Service), Ace Rental Cars contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia car rental and mobility solutions market appears promising, driven by urbanization and technological advancements. As cities expand, the demand for flexible transportation options will likely increase. Additionally, the integration of smart technologies and electric vehicles into rental fleets will enhance customer experiences. Companies that adapt to these trends and invest in sustainable practices are expected to thrive, positioning themselves favorably in a competitive landscape while meeting evolving consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Short-Term Rentals (Airport, City/Off-Airport) Long-Term Leasing (Including Novated Leasing) Subscription-Based Rentals Car Sharing Services Ride-Hailing Services Others |

| By Vehicle Class | Economy & Compact Mid-Size SUVs & Crossovers Vans & Utes Premium & Luxury Others |

| By Powertrain Type | Petrol Diesel Hybrid Battery Electric (BEV) Plug-in Hybrid (PHEV) Others |

| By Rental Duration | Daily Rentals Weekly Rentals Monthly/Mid-Term Rentals Long-Term Operating Lease Finance/Balloon & Novated Lease |

| By Booking Type | Offline Booking Online Booking |

| By Application | Leisure and Tourism Business |

| By End User | Individual/Leisure Consumers Corporate SME Corporate Enterprise Government & Public Sector Insurance Replacement Rideshare Programs Others |

| By Region | New South Wales & Australian Capital Territory Victoria & Tasmania Queensland Western Australia Northern Territory & South Australia |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Car Rental Services | 100 | Rental Company Managers, Operations Directors |

| Corporate Mobility Solutions | 60 | Corporate Travel Managers, HR Directors |

| Ride-Sharing Services | 50 | Product Managers, Marketing Executives |

| Electric Vehicle Rentals | 40 | Fleet Managers, Sustainability Officers |

| Consumer Preferences in Mobility | 80 | Frequent Travelers, Urban Commuters |

The Australia Car Rental & Mobility Solutions Market is valued at approximately AUD 3.6 billion, reflecting a significant growth driven by urbanization, tourism, and the adoption of digital booking platforms.