Region:Asia

Author(s):Geetanshi

Product Code:KRAB2813

Pages:98

Published On:October 2025

By Type:The market can be segmented into various types of rental services, includingshort-term rentals, long-term rentals, luxury car rentals, commercial vehicle rentals, electric vehicle rentals, ride-sharing services, chauffeured car services, self-drive car rentals, and others. Each of these segments caters to different consumer needs and preferences. Short-term rentals are popular among tourists and business travelers, while long-term rentals and corporate fleet outsourcing are increasingly adopted by businesses. The rise of electric vehicle rentals and ride-sharing reflects growing consumer interest in sustainability and digital mobility platforms.

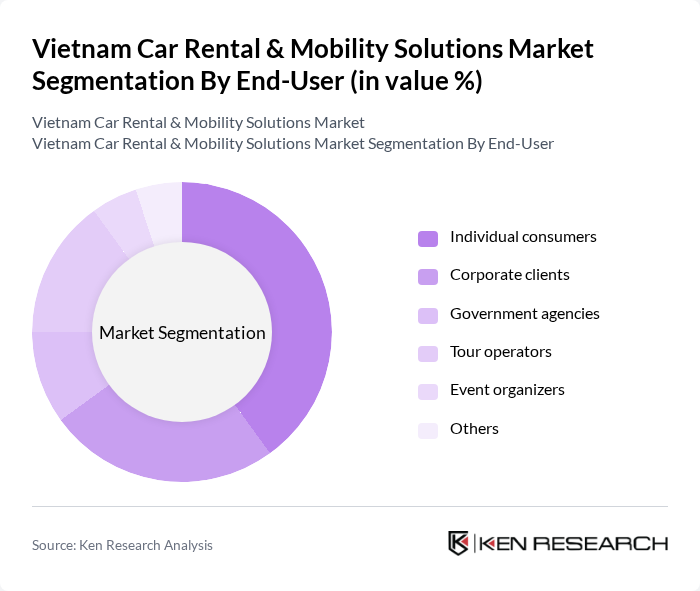

By End-User:The end-user segmentation includesindividual consumers, corporate clients, government agencies, tour operators, event organizers, and others. Each segment has distinct requirements and preferences, influencing the types of services offered by rental companies. Individual consumers and corporate clients represent the largest demand, with government and tourism-related segments also contributing significantly to market growth.

The Vietnam Car Rental & Mobility Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such asVinasun Corporation, Mai Linh Group, Thue Xe Viet, Grab Holdings Inc., FastGo Vietnam, Avis Vietnam (Avis Budget Group Inc.), Hertz Vietnam (Hertz Global Holdings Inc.), Sixt Vietnam (Sixt SE), Europcar Vietnam (Europcar Mobility Group), Gojek Vietnam, Xe Mua, TMG Travel (Thien Minh Group), Vietnam Car Rental, Dichung.vn, GreenCar Vietnamcontribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam car rental and mobility solutions market is poised for significant transformation as digital platforms become increasingly prevalent. In future, the integration of advanced technologies such as AI and data analytics will enhance service delivery, improving customer experiences. Additionally, the rise of eco-friendly transportation options will align with global sustainability trends, attracting environmentally conscious consumers. As partnerships with local businesses and tourism sectors strengthen, the market is expected to adapt and thrive in a rapidly evolving landscape, fostering innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Short-term rentals Long-term rentals Luxury car rentals Commercial vehicle rentals Electric vehicle rentals Ride-sharing services Chauffeured car services Self-drive car rentals Others |

| By End-User | Individual consumers Corporate clients Government agencies Tour operators Event organizers Others |

| By Vehicle Class | Economy Standard Premium SUVs Vans/Minivans Electric/Hybrid vehicles Others |

| By Rental Duration | Daily rentals Weekly rentals Monthly rentals Annual rentals Others |

| By Booking Channel | Online platforms Mobile applications Travel agencies Direct bookings Others |

| By Payment Method | Credit/debit cards Mobile wallets Cash payments Corporate accounts Others |

| By Geographic Coverage | Urban areas (e.g., Ho Chi Minh City, Hanoi, Da Nang) Suburban areas Rural areas Tourist hotspots (e.g., Ha Long Bay, Nha Trang) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Car Rental Services | 100 | Rental Company Managers, Urban Mobility Planners |

| Tourism-Driven Rentals | 80 | Tour Operators, Travel Agency Executives |

| Corporate Mobility Solutions | 60 | Corporate Travel Managers, HR Executives |

| Technology Integration in Rentals | 50 | IT Managers, Digital Transformation Leads |

| Consumer Preferences in Car Rentals | 90 | Frequent Renters, Casual Users |

The Vietnam Car Rental & Mobility Solutions Market is valued at approximately USD 780 million, driven by increasing demand for convenient transportation, urbanization, rising disposable incomes, and a rebound in tourism, alongside a shift towards app-based and online bookings.