Region:Europe

Author(s):Geetanshi

Product Code:KRAB2836

Pages:89

Published On:October 2025

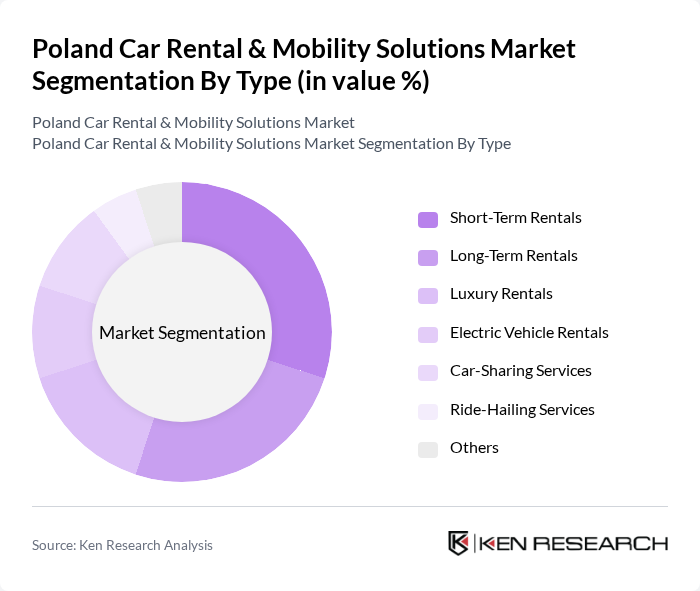

By Type:The market is segmented into various types of rental services, including short-term rentals, long-term rentals, luxury rentals, electric vehicle rentals, car-sharing services, ride-hailing services, and others. Each segment caters to different consumer needs and preferences, reflecting the diverse landscape of mobility solutions available in Poland. The market has seen a notable shift toward digital booking platforms and increased demand for electric and shared mobility solutions, driven by technological advancements and changing urban mobility patterns .

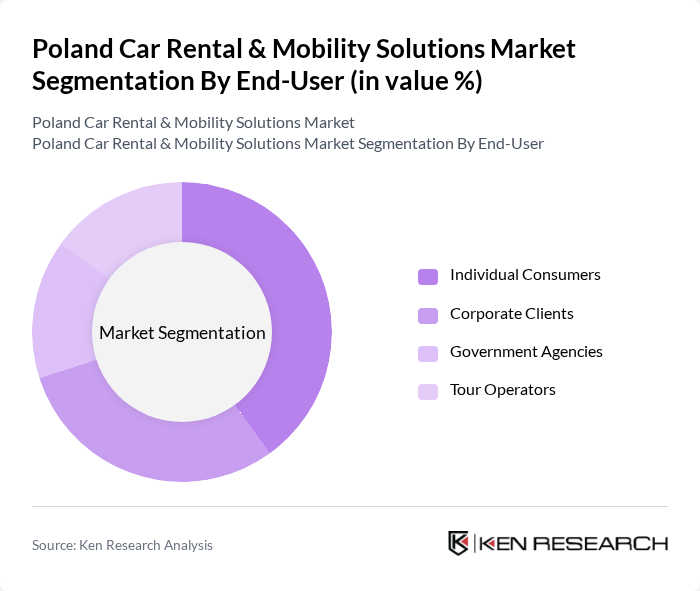

By End-User:The end-user segmentation includes individual consumers, corporate clients, government agencies, and tour operators. Each of these segments has distinct requirements and preferences, influencing the types of services offered by car rental companies in Poland. Corporate clients and individual consumers remain the largest segments, with growing demand from the tourism and business travel sectors .

The Poland Car Rental & Mobility Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Avis Budget Group, Hertz Global Holdings, Sixt SE, Europcar Mobility Group, Enterprise Holdings, CarNext, Getaround, Panek S.A., Express Sp. z o.o., Rentis S.A., Kaizen Rent, 99rent, Green Motion, Bolt, Traficar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Poland car rental and mobility solutions market appears promising, driven by technological advancements and evolving consumer preferences. The integration of AI in fleet management is expected to enhance operational efficiency, while the rise of mobile applications will streamline the rental process. Additionally, the increasing focus on sustainability will likely lead to a greater adoption of electric vehicles, aligning with government initiatives aimed at reducing carbon emissions and promoting eco-friendly transportation solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Short-Term Rentals Long-Term Rentals Luxury Rentals Electric Vehicle Rentals Car-Sharing Services Ride-Hailing Services Others |

| By End-User | Individual Consumers Corporate Clients Government Agencies Tour Operators |

| By Fleet Size | Small Fleet Operators Medium Fleet Operators Large Fleet Operators |

| By Rental Duration | Daily Rentals Weekly Rentals Monthly Rentals |

| By Payment Model | Pay-Per-Use Subscription-Based Pre-Paid Rentals |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Customer Segment | Business Travelers Leisure Travelers Local Residents |

| By Booking Type | Online Booking Offline Booking |

| By Vehicle Body Style | Hatchback Sedan SUV |

| By Vehicle Type | Economy Cars Luxury Cars |

| By Application | Leisure/Tourism Business |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Leisure Car Rentals | 100 | Frequent Travelers, Vacation Planners |

| Corporate Car Rentals | 80 | Corporate Travel Managers, HR Managers |

| Mobility-as-a-Service (MaaS) Solutions | 60 | Urban Planners, Mobility Service Providers |

| Electric Vehicle Rentals | 50 | Environmentally Conscious Consumers, Tech Enthusiasts |

| Peer-to-Peer Car Sharing | 40 | Car Owners, Local Residents |

The Poland Car Rental & Mobility Solutions Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by urbanization, tourism, and a preference for flexible transportation options among consumers.