Region:Europe

Author(s):Geetanshi

Product Code:KRAB2843

Pages:82

Published On:October 2025

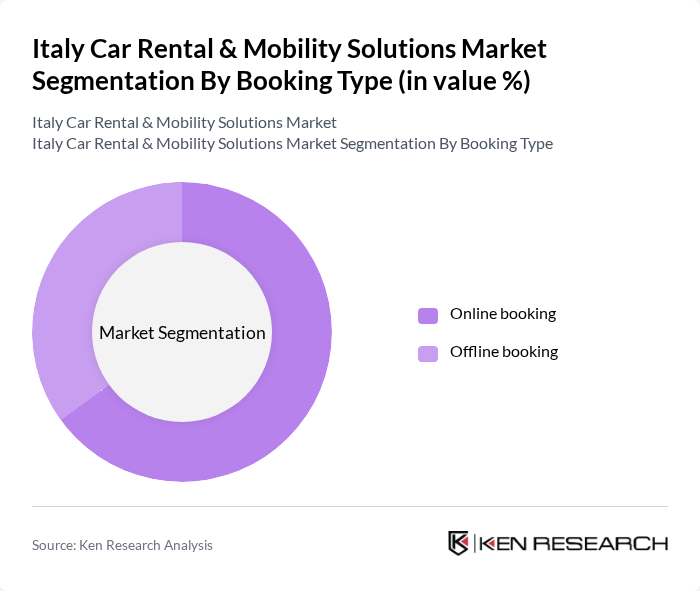

By Booking Type:The booking type segmentation includes online and offline booking methods. Online booking has gained significant traction due to the convenience and accessibility of digital platforms, allowing customers to reserve vehicles from anywhere. Offline booking, while still relevant, is gradually declining as more consumers prefer the ease of online transactions. The online booking segment is currently leading the market, driven by the increasing use of mobile applications and websites for car rental services. Online bookings now account for the majority of transactions, reflecting the digitalization trend in the industry .

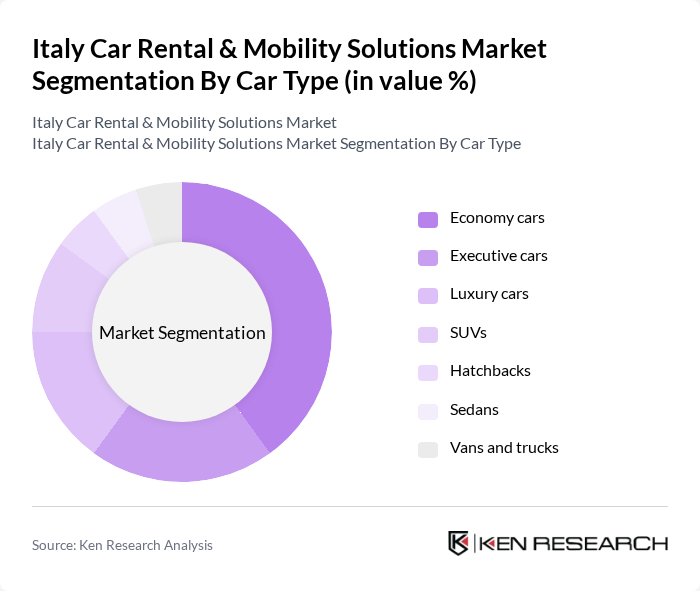

By Car Type:The car type segmentation encompasses various categories, including economy cars, executive cars, luxury cars, SUVs, hatchbacks, sedans, and vans and trucks. Economy cars dominate the market due to their affordability and fuel efficiency, appealing to budget-conscious travelers. Luxury and executive cars are also popular among business clients and affluent tourists seeking premium experiences. The diverse range of options caters to different consumer preferences, with economy cars leading the market share. Executive cars are experiencing rapid growth, driven by increased demand from corporate clients .

The Italy Car Rental & Mobility Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hertz Italiana S.r.l., Europcar Italia S.p.A., Sixt Italia S.r.l., Avis Budget Italia S.p.A., Maggiore Rent S.p.A., Leasys S.p.A., Locauto Rent S.p.A., Rent It Easy S.r.l., Sicily by Car S.p.A., Alamo Rent A Car (Enterprise Holdings), Goldcar Italy S.r.l., Firefly Car Rental Italy, Budget Rent a Car Italia S.p.A., Drivalia S.p.A., Targarent S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italy car rental and mobility solutions market appears promising, driven by technological advancements and evolving consumer preferences. The integration of electric vehicles into rental fleets is expected to gain momentum, aligning with sustainability trends. Additionally, the rise of digital platforms for seamless booking experiences will likely enhance customer engagement. As urbanization continues, rental services will increasingly adapt to meet the needs of a mobile population, ensuring sustained growth in this dynamic sector.

| Segment | Sub-Segments |

|---|---|

| By Booking Type | Online booking Offline booking |

| By Car Type | Economy cars Executive cars Luxury cars SUVs Hatchbacks Sedans Vans and trucks |

| By Rental Length | Short-term rentals Long-term rentals |

| By Application | Leisure/Tourism Business |

| By Fuel Type | Petrol Diesel Electric |

| By Distribution Channel | Online platforms Travel agencies Direct bookings |

| By Geographic Coverage | Urban areas Suburban areas Rural areas |

| By Customer Segment | Individual consumers Corporate clients Government agencies Tour operators |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Short-term Car Rentals | 85 | Rental Company Managers, Customer Experience Directors |

| Long-term Leasing Solutions | 65 | Fleet Managers, Corporate Procurement Officers |

| Mobility-as-a-Service (MaaS) Providers | 55 | Product Managers, Business Development Executives |

| Electric Vehicle Rentals | 45 | Sustainability Officers, Operations Managers |

| Tourism-related Car Rentals | 75 | Tourism Operators, Travel Agency Managers |

The Italy Car Rental & Mobility Solutions Market is valued at approximately USD 4.6 billion, reflecting a significant growth trend driven by increasing tourism, urbanization, and the demand for flexible transportation options.