Region:Europe

Author(s):Geetanshi

Product Code:KRAB2824

Pages:81

Published On:October 2025

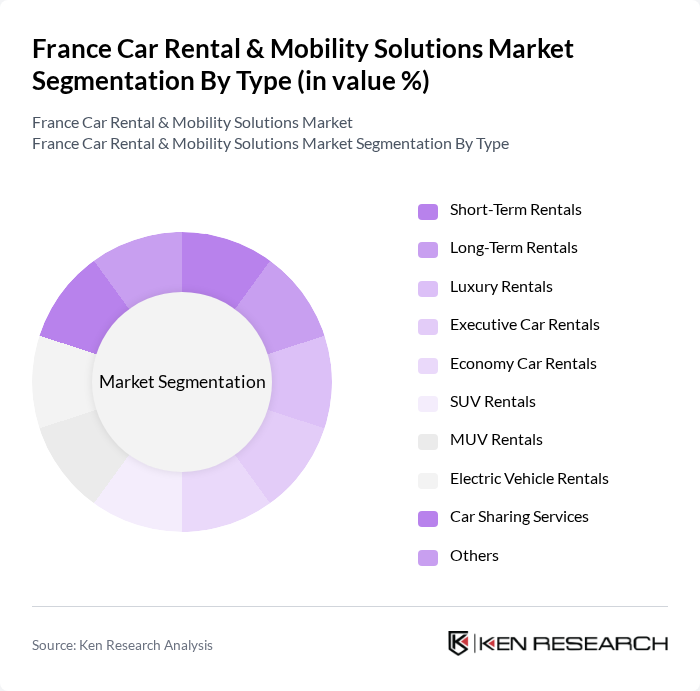

By Type:The market is segmented into various types of rental services, including Short-Term Rentals, Long-Term Rentals, Luxury Rentals, Executive Car Rentals, Economy Car Rentals, SUV Rentals, MUV Rentals, Electric Vehicle Rentals, Car Sharing Services, and Others. Each segment caters to different consumer needs and preferences, reflecting the diverse landscape of mobility solutions .

The Short-Term Rentals segment dominates the market, driven by the high volume of tourists and business travelers seeking flexible, on-demand transportation. This segment appeals to consumers looking for convenience and cost-effectiveness, especially in urban centers where public transport may not address all travel needs. The growing adoption of digital platforms has further facilitated access to short-term rental services, boosting their popularity .

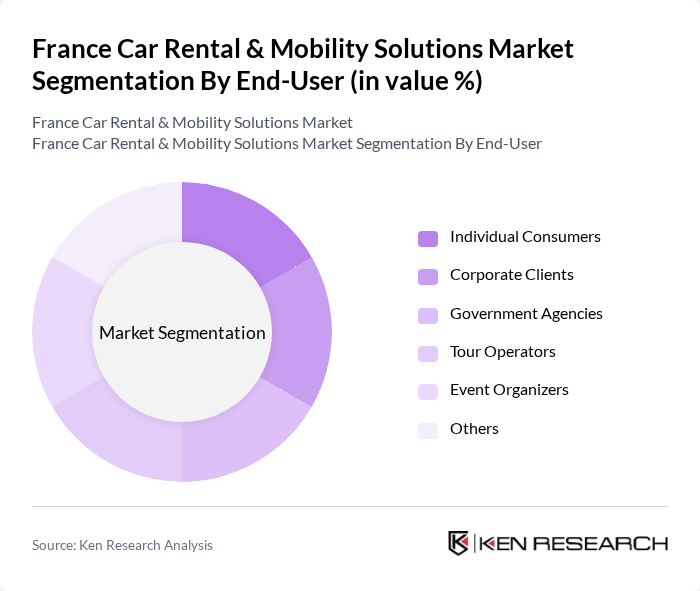

By End-User:The market is segmented by end-users, including Individual Consumers, Corporate Clients, Government Agencies, Tour Operators, Event Organizers, and Others. Each segment reflects the diverse needs of different customer groups, influencing the types of rental services offered .

Individual Consumers represent the largest segment in the market, driven by the growing trend of leisure travel and the need for personal mobility solutions. This segment includes both tourists and local residents who value the flexibility and convenience of rental services. The increasing availability of online booking platforms has made it easier for individual consumers to access rental options, further reinforcing their market dominance .

The France Car Rental & Mobility Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Europcar Mobility Group, Sixt SE, Hertz Global Holdings, Inc., Avis Budget Group, Inc., Enterprise Holdings, Inc., Getaround, BlaBlaCar, Ubeeqo, Rent A Car, Keddy by Europcar, Goldcar, Flizzr, Ada, OuiCar, Leasys contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France car rental and mobility solutions market appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for flexible and sustainable transportation options will likely increase. Companies are expected to invest in electric vehicle fleets and smart mobility solutions, enhancing customer experiences. Additionally, partnerships with local governments may facilitate infrastructure improvements, further supporting the growth of the sector and addressing urban mobility challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Short-Term Rentals Long-Term Rentals Luxury Rentals Executive Car Rentals Economy Car Rentals SUV Rentals MUV Rentals Electric Vehicle Rentals Car Sharing Services Others |

| By End-User | Individual Consumers Corporate Clients Government Agencies Tour Operators Event Organizers Others |

| By Rental Duration | Daily Rentals Weekly Rentals Monthly Rentals Annual Rentals |

| By Vehicle Class | Economy Class Mid-Range Class Luxury Class Executive Class SUV and Crossovers MUVs |

| By Distribution Channel | Online Platforms Offline Counters (Airport/Train Station) Travel Agencies Direct Rentals Corporate Contracts |

| By Payment Method | Credit/Debit Cards Mobile Payments Cash Payments Corporate Billing |

| By Customer Type | Business Travelers Leisure Travelers Local Residents Tourists |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Leisure Car Rentals | 100 | Frequent Travelers, Vacation Planners |

| Corporate Car Rentals | 80 | Corporate Travel Managers, HR Executives |

| Mobility-as-a-Service (MaaS) Users | 60 | Urban Commuters, Tech-Savvy Consumers |

| Electric Vehicle Rentals | 50 | Environmentally Conscious Consumers, Early Adopters |

| Long-term Rentals | 40 | Business Professionals, Relocating Individuals |

The France Car Rental & Mobility Solutions Market is valued at approximately USD 6.1 billion, reflecting a significant growth driven by urbanization, tourism, and the increasing demand for flexible transportation options.