Region:Middle East

Author(s):Geetanshi

Product Code:KRAB2831

Pages:87

Published On:October 2025

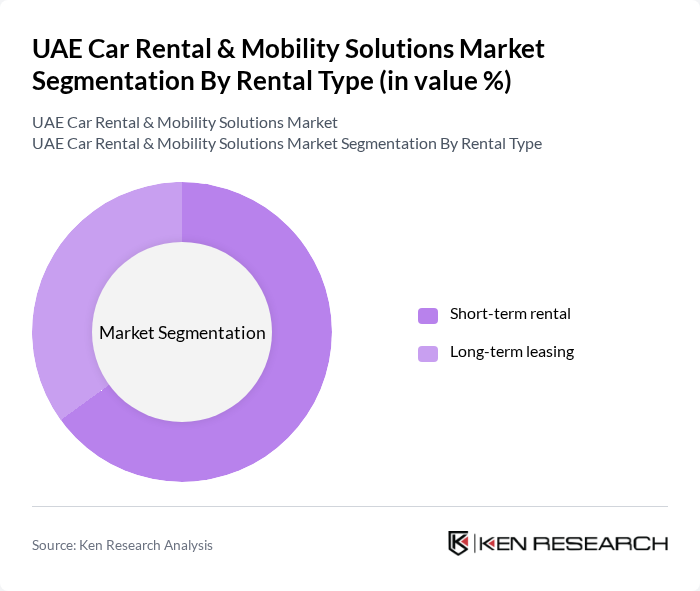

By Rental Type:

The rental type segmentation includes short-term rental and long-term leasing. Short-term rentals are particularly popular among tourists and business travelers seeking flexibility, while long-term leasing appeals to residents and businesses looking for cost-effective transportation solutions. The short-term rental segment is currently dominating the market due to the influx of tourists, the growing trend of on-demand mobility services, and the convenience of digital booking platforms. This segment caters to the immediate needs of consumers, making it a preferred choice for many.

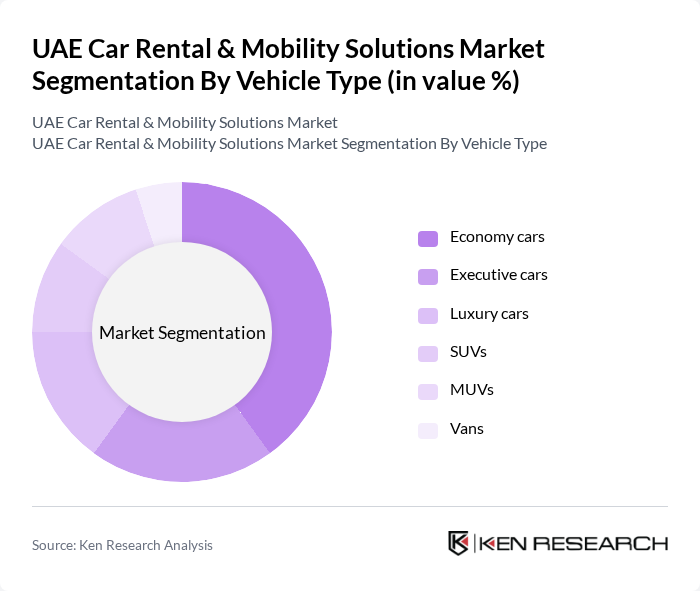

By Vehicle Type:

The vehicle type segmentation encompasses economy cars, executive cars, luxury cars, SUVs, MUVs, and vans. Economy cars dominate the market due to their affordability and fuel efficiency, making them a popular choice among budget-conscious consumers. The luxury car segment is also witnessing growth, driven by the increasing number of affluent tourists and business executives visiting the UAE. Executive cars are emerging as the fastest-growing segment, reflecting rising demand from corporate clients. The diverse vehicle offerings cater to various consumer preferences, ensuring a competitive landscape.

The UAE Car Rental & Mobility Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Car Rental, Hertz UAE, Budget Rent A Car, Avis Budget Group, Sixt SE, Eco Rent A Car, Enterprise Holdings, Carzonrent India Pvt. Ltd., AVR Van Rental, Localiza Rent A Car, Al-Futtaim Motors, Fast Rent A Car, Diamondlease, Thrifty Car Rental, Europcar UAE contribute to innovation, geographic expansion, and service delivery in this space.

The UAE car rental and mobility solutions market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of electric vehicles into rental fleets is expected to gain momentum, aligning with global sustainability trends. Additionally, the rise of subscription-based models will cater to changing consumer demands for flexibility. As the market adapts to these trends, companies that embrace innovation and prioritize customer experience will likely thrive in this dynamic environment.

| Segment | Sub-Segments |

|---|---|

| By Rental Type | Short-term rental Long-term leasing |

| By Vehicle Type | Economy cars Executive cars Luxury cars SUVs MUVs Vans |

| By Booking Channel | Online platforms Offline bookings |

| By End-User | Commercial Private Government |

| By Geographic Region | Dubai Abu Dhabi Sharjah Ajman Umm Al Quwain Ras Al Khaimah Fujairah |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Car Rental Services | 120 | Fleet Managers, Rental Company Executives |

| Ride-Hailing Services | 90 | Operations Managers, Business Development Managers |

| Corporate Mobility Solutions | 60 | HR Managers, Procurement Officers |

| Tourism-Related Rentals | 50 | Tour Operators, Travel Agency Managers |

| Electric Vehicle Rentals | 40 | Environmental Officers, Fleet Sustainability Managers |

The UAE Car Rental & Mobility Solutions Market is valued at approximately USD 2.4 billion, driven by increasing demand for flexible transportation options, tourism growth, and the rise of digital platforms facilitating car rentals.