Region:Asia

Author(s):Rebecca

Product Code:KRAB4091

Pages:91

Published On:October 2025

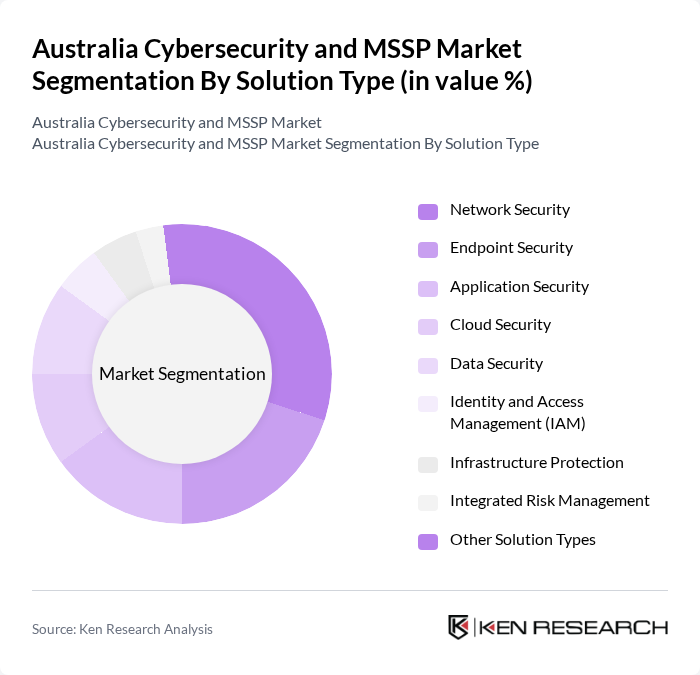

By Solution Type:

The solution type segmentation of the Australia Cybersecurity and MSSP Market includes various subsegments such as Network Security, Endpoint Security, Application Security, Cloud Security, Data Security, Identity and Access Management (IAM), Infrastructure Protection, Integrated Risk Management, and Other Solution Types. Among these, Network Security is the leading subsegment, driven by the increasing need to protect networks from unauthorized access and advanced cyber threats. Organizations are prioritizing investments in network security solutions to safeguard their infrastructure and data, reflecting a growing awareness of the importance of cybersecurity in maintaining operational integrity. The market also shows robust growth in cloud security and IAM, reflecting the shift to remote work and cloud-based environments .

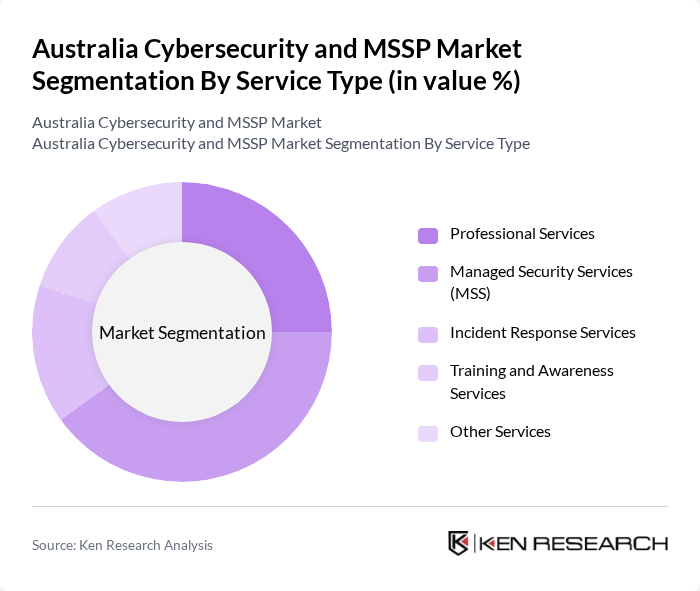

By Service Type:

The service type segmentation encompasses Professional Services, Managed Security Services (MSS), Incident Response Services, Training and Awareness Services, and Other Services. Managed Security Services (MSS) is the dominant subsegment, as organizations increasingly outsource their cybersecurity needs to specialized providers. This trend is fueled by the complexity of cyber threats, the need for continuous monitoring and rapid response, and a shortage of in-house cybersecurity expertise. Professional services and incident response are also growing, driven by regulatory requirements and the need for rapid risk mitigation .

The Australia Cybersecurity and MSSP Market is characterized by a dynamic mix of regional and international players. Leading participants such as Telstra Corporation Limited, Optus Business, CyberCX, Tesserent Limited, Secureworks, Trustwave, IBM Security, Palo Alto Networks, Fortinet, Cisco Systems, Check Point Software Technologies, CrowdStrike, McAfee, Trend Micro, Splunk contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia cybersecurity and MSSP market is poised for significant transformation, driven by technological advancements and evolving threat landscapes. As organizations increasingly adopt zero trust security models and integrate cybersecurity with IT operations, the demand for innovative solutions will rise. Additionally, the growing emphasis on data privacy and protection will further shape the market, compelling businesses to enhance their cybersecurity frameworks and invest in advanced technologies to mitigate risks effectively.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Network Security Endpoint Security Application Security Cloud Security Data Security Identity and Access Management (IAM) Infrastructure Protection Integrated Risk Management Other Solution Types |

| By Service Type | Professional Services Managed Security Services (MSS) Incident Response Services Training and Awareness Services Other Services |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Organization Size | Small and Medium Enterprises (SMEs) Large Enterprises |

| By End-User Industry | Banking, Financial Services, and Insurance (BFSI) Government & Defense Healthcare IT & Telecommunications Retail Energy & Utilities Manufacturing Others |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Tasmania Northern Territory Australian Capital Territory Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cybersecurity | 100 | IT Security Managers, Compliance Officers |

| Healthcare Data Protection | 80 | Chief Information Officers, Data Privacy Officers |

| Government Cybersecurity Initiatives | 70 | Cybersecurity Policy Makers, IT Directors |

| Retail Sector Cyber Threat Management | 50 | IT Managers, Risk Management Officers |

| Manufacturing Cyber Resilience | 40 | IT Infrastructure Leads, Operations Managers |

The Australia Cybersecurity and MSSP Market is valued at approximately USD 7.6 billion, reflecting significant growth driven by increasing cyber threats, regulatory compliance, and digital transformation initiatives across various sectors.