Region:Middle East

Author(s):Geetanshi

Product Code:KRAB4025

Pages:84

Published On:October 2025

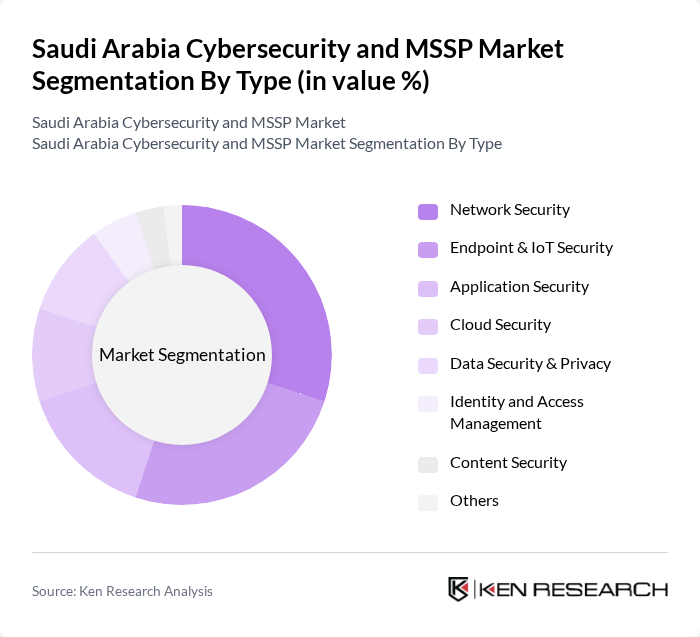

By Type:The market is segmented into Network Security, Endpoint & IoT Security, Application Security, Cloud Security, Data Security & Privacy, Identity and Access Management, Content Security, and Others. Each segment addresses distinct security challenges, with network and endpoint security leading due to the expanding attack surface from digital transformation and IoT adoption. Cloud security is gaining momentum as organizations migrate workloads to the cloud, while data security and privacy are prioritized amid evolving regulatory requirements .

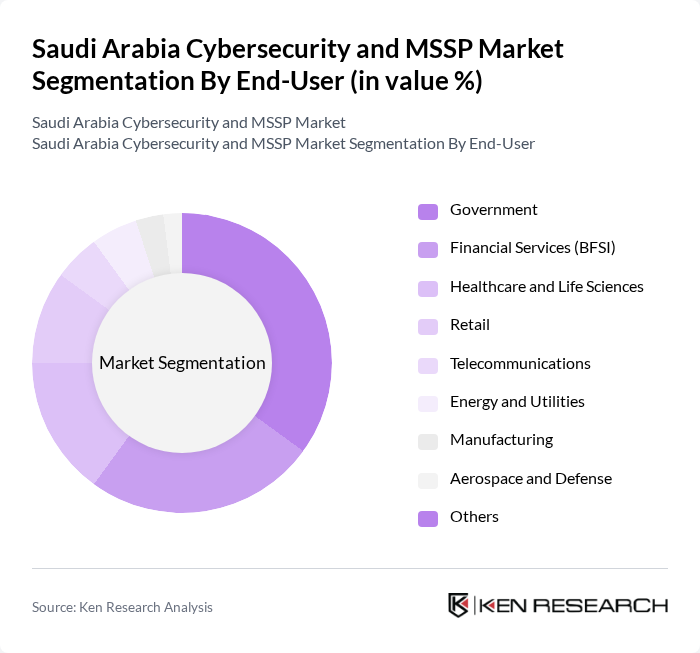

By End-User:The end-user segmentation includes Government, Financial Services (BFSI), Healthcare and Life Sciences, Retail, Telecommunications, Energy and Utilities, Manufacturing, Aerospace and Defense, and Others. Government and BFSI sectors account for the largest share, reflecting stringent regulatory requirements and high-value data at risk. Healthcare and life sciences are rapidly growing due to electronic health record adoption and telemedicine expansion. Energy, utilities, and manufacturing are also key segments, driven by the need to protect operational technology and critical infrastructure .

The Saudi Arabia Cybersecurity and MSSP Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Solutions (STC Advanced Solutions), Elm Company, Sirar by STC, Cyberani (Aramco subsidiary), IBM Security, Cisco Systems, Fortinet, Check Point Software Technologies, Palo Alto Networks, Trend Micro, Kaspersky, CrowdStrike, Spire Solutions, Help AG (an e& enterprise company), and Securitas Arabia contribute to innovation, geographic expansion, and service delivery in this space .

The future of the cybersecurity market in Saudi Arabia appears promising, driven by increasing investments in technology and a heightened focus on security. As organizations continue to embrace digital transformation, the demand for advanced cybersecurity solutions will grow. Additionally, the government's commitment to enhancing national cybersecurity capabilities will foster innovation and collaboration within the industry. In future, the market is expected to witness significant advancements in AI-driven security solutions, further strengthening the defense against evolving cyber threats.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Endpoint & IoT Security Application Security Cloud Security Data Security & Privacy Identity and Access Management Content Security Others |

| By End-User | Government Financial Services (BFSI) Healthcare and Life Sciences Retail Telecommunications Energy and Utilities Manufacturing Aerospace and Defense Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Service Type | Managed Security Services (MSS) Professional Services Consulting Services |

| By Industry Vertical | BFSI Government Healthcare and Life Sciences Manufacturing Retail Energy and Utilities Aerospace and Defense Others |

| By Security Type | Threat Intelligence Incident Response Vulnerability Management Risk and Compliance Management Firewall & UTM |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Tiered/Volume-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Sector Cybersecurity | 85 | CIOs, IT Security Managers |

| Healthcare Cybersecurity Solutions | 75 | Healthcare IT Directors, Compliance Officers |

| Energy Sector Cybersecurity Strategies | 65 | Operations Managers, Risk Management Officers |

| Government Cybersecurity Initiatives | 55 | Policy Makers, Cybersecurity Advisors |

| Retail Sector Cybersecurity Measures | 80 | IT Managers, E-commerce Directors |

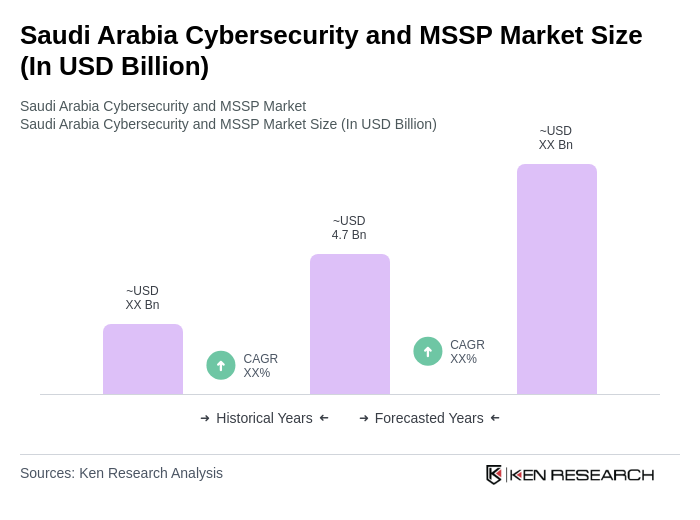

The Saudi Arabia Cybersecurity and MSSP Market is valued at approximately USD 4.7 billion, driven by increasing cyber threats, digital transformation, and government initiatives focused on enhancing national cybersecurity frameworks.