Region:Africa

Author(s):Rebecca

Product Code:KRAB4052

Pages:82

Published On:October 2025

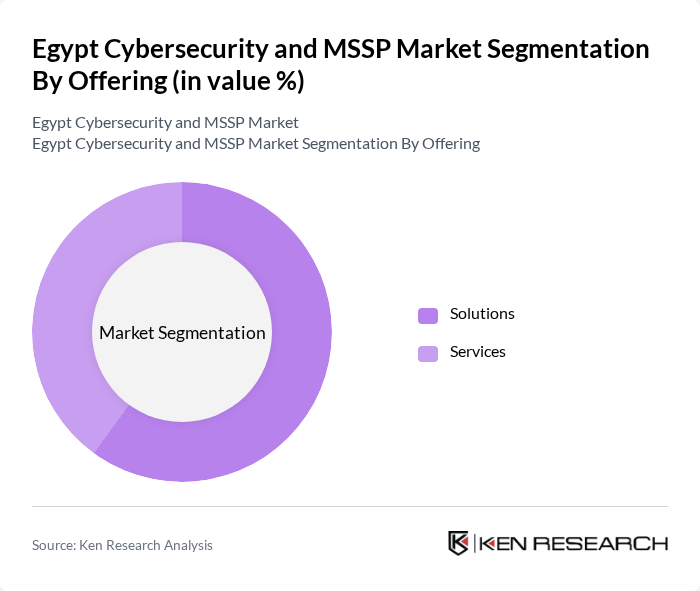

By Offering:The market is segmented into Solutions and Services. Solutions include various cybersecurity technologies, while Services encompass professional and managed security services.

The Solutions segment is dominating the market, driven by the increasing need for advanced technologies such as firewalls, intrusion detection systems, and endpoint protection. Organizations are investing heavily in these solutions to mitigate risks associated with cyber threats. The growing trend of digital transformation has further accelerated the demand for integrated cybersecurity solutions that can protect various digital assets across multiple platforms. As a result, the Solutions segment is expected to maintain its leadership position in the market, with network security equipment being a particularly significant sub-segment.

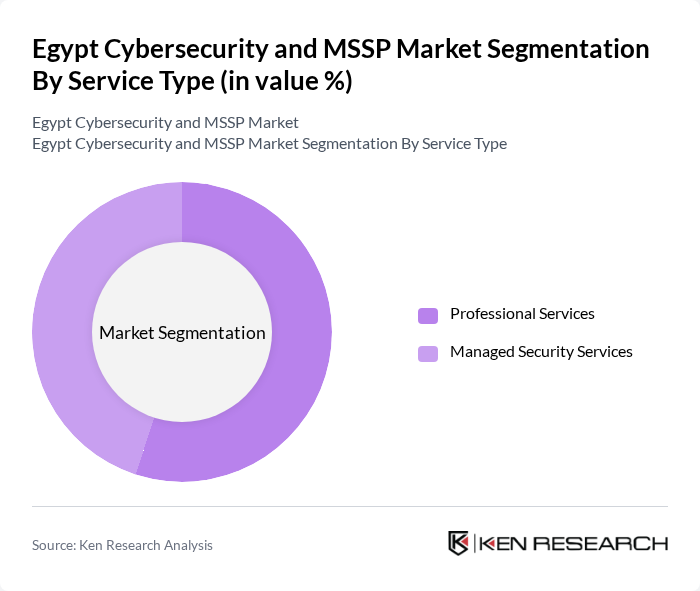

By Service Type:The market is segmented into Professional Services and Managed Security Services. Professional Services include consulting and implementation, while Managed Security Services provide ongoing security management.

The Professional Services segment is leading the market, as organizations increasingly seek expert guidance to navigate complex cybersecurity challenges. The demand for consulting, risk assessment, and compliance services has surged, driven by regulatory pressures and the need for tailored security solutions. Managed Security Services are also gaining traction as businesses look to outsource their security operations to specialized providers, allowing them to focus on core activities while ensuring robust protection against cyber threats.

The Egypt Cybersecurity and MSSP Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Egypt, Palo Alto Networks Egypt, Fortinet Egypt, Microsoft Egypt, Orange CyberDefense Egypt, SecureMisr, Cyberteq, Absega Egypt Technology Services, Kaspersky Lab Egypt, Check Point Software Technologies Egypt, Symantec Egypt (Broadcom), McAfee Egypt, CyberSecuritas, Sphinx Cybersecurity, SecureTech Egypt contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Egyptian cybersecurity and MSSP market appears promising, driven by increasing investments in technology and a heightened focus on security. As organizations continue to embrace digital transformation, the demand for advanced cybersecurity solutions will likely surge. Furthermore, the government's commitment to enhancing national cybersecurity infrastructure will foster a more secure environment, encouraging businesses to invest in protective measures. This evolving landscape presents significant opportunities for growth and innovation within the cybersecurity sector.

| Segment | Sub-Segments |

|---|---|

| By Offering | Solutions Services |

| By Solution Type | Application Security Cloud Security Consumer Security Software Data Security Identity and Access Management Infrastructure Protection Integrated Risk Management Network Security Equipment Other Solutions |

| By Service Type | Professional Services Managed Security Services |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By End-User Industry | IT and Telecom BFSI (Banking, Financial Services, and Insurance) Retail and E-Commerce Oil, Gas, and Energy Manufacturing Government and Defense Healthcare Education Other End-users |

| By Pricing Model | Subscription-Based Pay-As-You-Go One-Time License Fee |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Sector Cybersecurity | 85 | CIOs, IT Security Managers |

| Healthcare Cybersecurity Solutions | 65 | Compliance Officers, IT Directors |

| Government Cybersecurity Initiatives | 55 | Policy Makers, Cybersecurity Analysts |

| Retail Sector Cybersecurity Practices | 45 | Operations Managers, Risk Management Officers |

| Telecommunications Cybersecurity Strategies | 75 | Network Security Engineers, IT Managers |

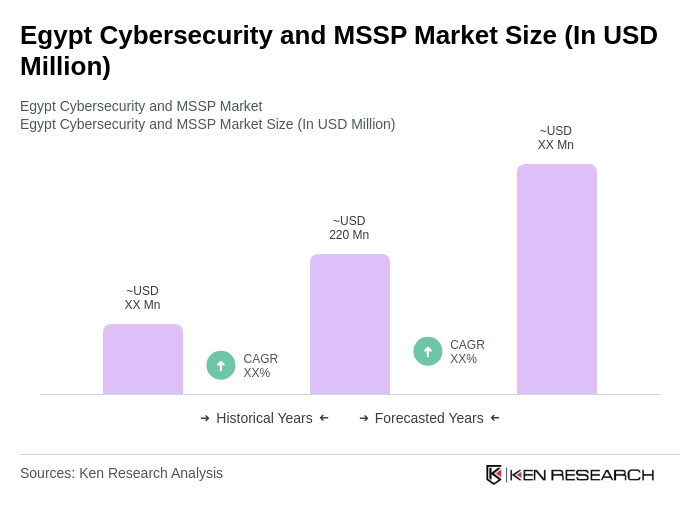

The Egypt Cybersecurity and MSSP Market is valued at approximately USD 220 million, driven by increasing cyber threats, digital transformation initiatives, and heightened awareness of data protection regulations among businesses.