Australia Digital Remittance Platforms Market Overview

- The Australia Digital Remittance Platforms Market is valued at USD 7 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing number of international migrants and the rising demand for cost-effective and efficient money transfer solutions. The digitalization of financial services and the proliferation of mobile technology have further accelerated the adoption of digital remittance platforms, making them a preferred choice for consumers.

- Key players in this market include major cities such as Sydney, Melbourne, and Brisbane, which dominate due to their large expatriate populations and robust financial infrastructure. The presence of numerous fintech companies and traditional banks in these urban centers enhances competition and innovation, leading to better services and lower fees for consumers.

- In 2023, the Australian government implemented regulations to enhance the security and transparency of digital remittance services. This includes the requirement for service providers to register with the Australian Transaction Reports and Analysis Centre (AUSTRAC) and comply with anti-money laundering (AML) and counter-terrorism financing (CTF) laws, ensuring consumer protection and trust in digital transactions.

Australia Digital Remittance Platforms Market Segmentation

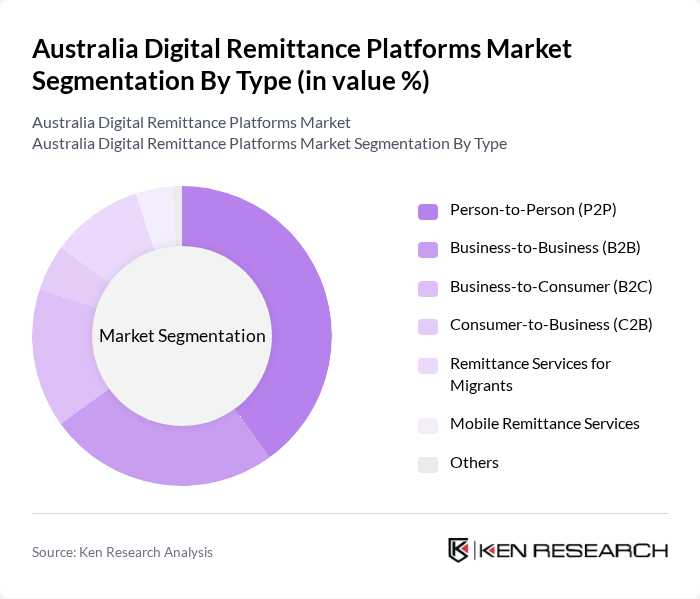

By Type:The market is segmented into various types, including Person-to-Person (P2P), Business-to-Business (B2B), Business-to-Consumer (B2C), Consumer-to-Business (C2B), Remittance Services for Migrants, Mobile Remittance Services, and Others. Among these, the Person-to-Person (P2P) segment is the most dominant, driven by the increasing number of individuals sending money to family and friends abroad. The convenience and speed of P2P services, coupled with competitive pricing, have made them the preferred choice for consumers.

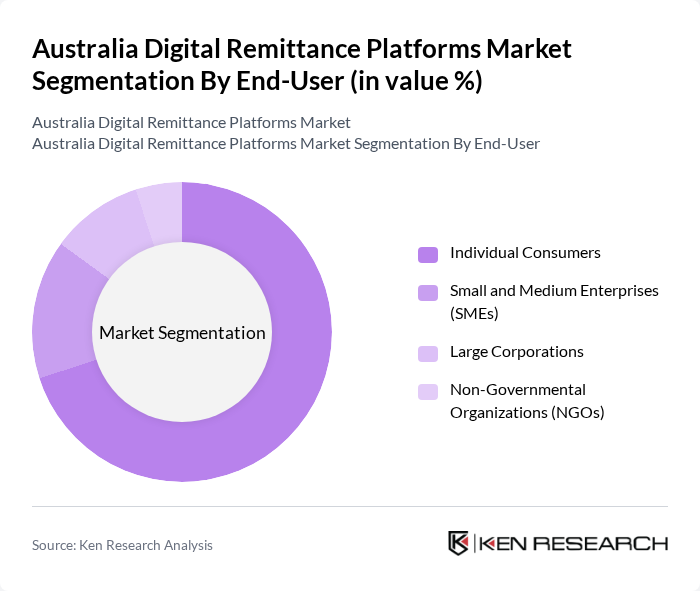

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Non-Governmental Organizations (NGOs). Individual Consumers dominate this segment, as they represent the majority of users sending remittances for personal reasons, such as family support or education. The growing trend of online money transfers among individuals has significantly contributed to the expansion of this segment.

Australia Digital Remittance Platforms Market Competitive Landscape

The Australia Digital Remittance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Western Union, MoneyGram, PayPal, TransferWise (now Wise), OFX, Remitly, WorldRemit, Revolut, Azimo, Xoom, Skrill, Ria Money Transfer, Payoneer, WiseAlpha, Airwallex contribute to innovation, geographic expansion, and service delivery in this space.

Australia Digital Remittance Platforms Market Industry Analysis

Growth Drivers

- Increasing Demand for Cross-Border Transactions:The Australian digital remittance market is experiencing a surge in cross-border transactions, driven by a 10% annual increase in international trade volume, reaching AUD 1.3 trillion in future. This growth is fueled by the rising number of Australians engaging in overseas business and personal transactions, with over 1.6 million Australians sending remittances abroad. The convenience and speed of digital platforms are further enhancing this demand, making them the preferred choice for consumers.

- Rise in Expatriate Population:Australia is home to approximately 8 million expatriates, contributing significantly to the remittance market. In future, the expatriate community is projected to send AUD 23 billion in remittances, reflecting a 15% increase from the previous year. This demographic shift is driven by job opportunities and lifestyle choices, leading to a higher demand for efficient remittance services. Digital platforms are capitalizing on this trend by offering tailored solutions for expatriates.

- Technological Advancements in Payment Systems:The integration of advanced technologies in payment systems is revolutionizing the digital remittance landscape in Australia. In future, the adoption of AI and machine learning in transaction processing is expected to enhance efficiency, reducing transaction times by up to 25%. Additionally, the rise of mobile payment solutions, with over 70% of users preferring mobile apps for remittances, is driving growth. These innovations are making remittance services more accessible and user-friendly.

Market Challenges

- Regulatory Compliance Complexities:The digital remittance sector in Australia faces significant regulatory challenges, with compliance costs estimated at AUD 600 million annually. Stricter Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations require platforms to invest heavily in compliance infrastructure. In future, the Australian Transaction Reports and Analysis Centre (AUSTRAC) is expected to increase scrutiny, making it imperative for companies to navigate these complexities to avoid hefty fines and operational disruptions.

- Currency Exchange Rate Fluctuations:Currency volatility poses a substantial risk to digital remittance platforms, impacting transaction costs and profitability. In future, the Australian dollar is projected to fluctuate between AUD 0.68 and AUD 0.78 against the US dollar, creating uncertainty for users. This volatility can lead to increased fees and reduced consumer trust, as customers may seek more stable alternatives. Platforms must develop strategies to mitigate these risks to maintain competitiveness.

Australia Digital Remittance Platforms Market Future Outlook

The future of the digital remittance market in Australia appears promising, driven by ongoing technological advancements and a growing expatriate population. As platforms increasingly adopt AI and blockchain technologies, transaction efficiency and security will improve, attracting more users. Additionally, the demand for real-time payment solutions is expected to rise, with consumers seeking faster and more reliable services. The market is likely to witness further consolidation as companies strive to enhance their offerings and expand their customer base.

Market Opportunities

- Expansion into Underserved Markets:There is a significant opportunity for digital remittance platforms to expand into underserved markets, particularly in rural and remote areas of Australia. With over 1.3 million Australians living in these regions, the demand for accessible remittance services is high. By leveraging mobile technology, platforms can provide tailored solutions that cater to the unique needs of these communities, potentially increasing their market share.

- Partnerships with Financial Institutions:Collaborating with established financial institutions presents a lucrative opportunity for digital remittance platforms. In future, partnerships can enhance credibility and expand service offerings, allowing platforms to tap into the existing customer base of banks and credit unions. This strategy can lead to increased transaction volumes and improved customer trust, ultimately driving growth in the competitive remittance landscape.