Region:Middle East

Author(s):Rebecca

Product Code:KRAB7370

Pages:98

Published On:October 2025

By Type:The digital remittance platforms market can be segmented into various types, including Mobile Remittance Services, Online Remittance Platforms, Bank Transfers, Cash Pickup Services, Prepaid Debit Cards, Cryptocurrency Remittances, and Others. Among these, Mobile Remittance Services have gained significant traction due to their convenience and accessibility, especially among younger consumers who prefer using smartphones for financial transactions. Online Remittance Platforms also play a crucial role, providing competitive rates and user-friendly interfaces that attract a wide range of users.

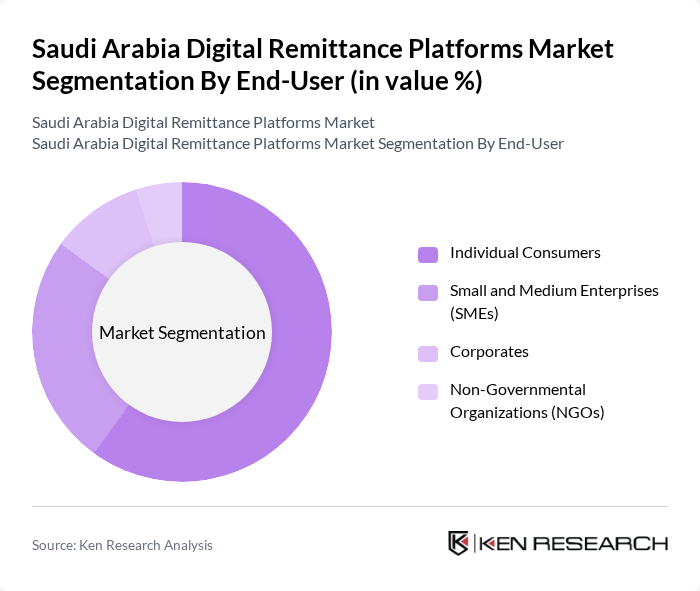

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Corporates, and Non-Governmental Organizations (NGOs). Individual Consumers dominate the market, driven by the need for personal remittances, especially among expatriates sending money back home. SMEs also represent a significant portion of the market, as they increasingly rely on digital remittance services for cross-border transactions and payments to suppliers.

The Saudi Arabia Digital Remittance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Western Union, MoneyGram, PayPal, TransferWise, Remitly, Xoom, Al Rajhi Bank, National Commercial Bank (NCB), STC Pay, Mobily Pay, Alinma Bank, Saudi Post, Raqami, Payoneer, and Tap Payments contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital remittance market in Saudi Arabia appears promising, driven by technological advancements and evolving consumer preferences. The increasing adoption of mobile-first solutions and the integration of artificial intelligence for fraud detection are expected to enhance security and user experience. Additionally, the rise of peer-to-peer payment platforms will likely reshape the competitive landscape, encouraging innovation and improved service delivery in the remittance sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Remittance Services Online Remittance Platforms Bank Transfers Cash Pickup Services Prepaid Debit Cards Cryptocurrency Remittances Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Corporates Non-Governmental Organizations (NGOs) |

| By Payment Method | Bank Transfers Mobile Wallets Cash Payments Credit/Debit Cards |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions |

| By Geographic Reach | Domestic Remittances International Remittances |

| By Frequency of Use | Daily Users Weekly Users Monthly Users |

| By Customer Segment | Expatriates Local Residents Businesses Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Expatriate Remittance Behavior | 150 | Expatriates from South Asia, Africa, and the Philippines |

| Digital Platform User Experience | 100 | Frequent users of digital remittance services |

| Regulatory Impact Assessment | 80 | Policy makers and financial regulators |

| Market Entry Strategies | 70 | Business development managers from fintech companies |

| Consumer Preferences in Remittance | 90 | Consumers using traditional vs. digital remittance services |

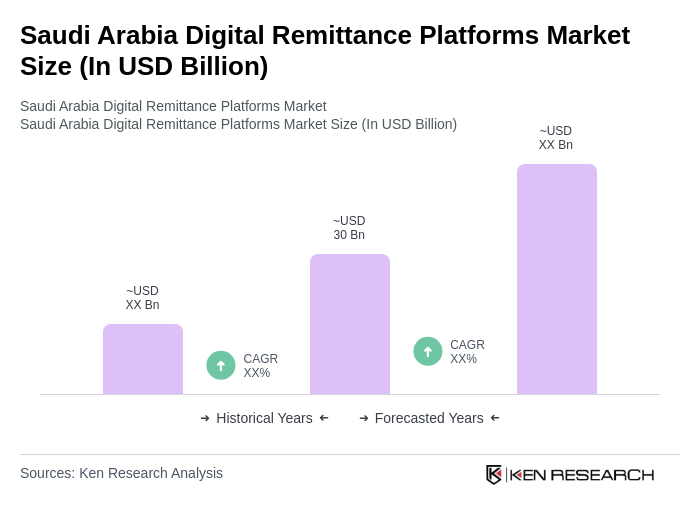

The Saudi Arabia Digital Remittance Platforms Market is valued at approximately USD 30 billion, driven by a growing expatriate population, increased digital payment adoption, and government initiatives promoting a cashless economy.