Region:Europe

Author(s):Dev

Product Code:KRAB3086

Pages:81

Published On:October 2025

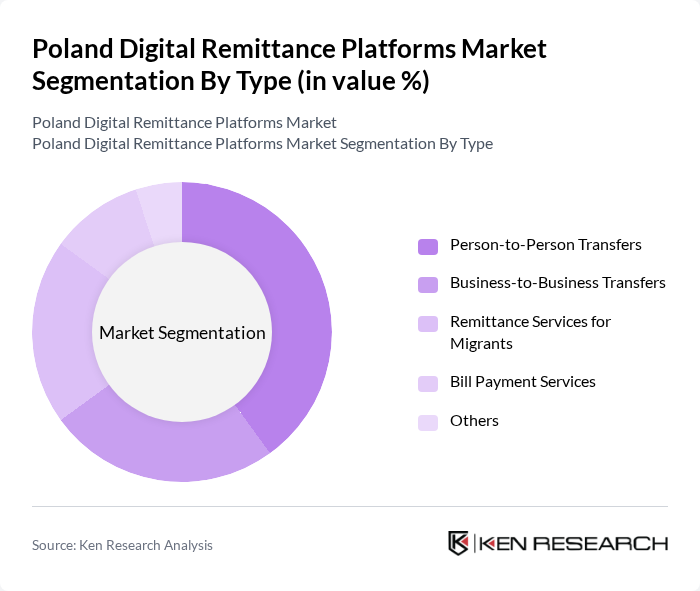

By Type:The segmentation by type includes various services offered in the digital remittance space. The subsegments are Person-to-Person Transfers, Business-to-Business Transfers, Remittance Services for Migrants, Bill Payment Services, and Others. Each of these subsegments caters to different consumer needs and preferences, contributing to the overall market dynamics.

The Person-to-Person Transfers subsegment dominates the market due to the high volume of individual transactions, particularly among expatriates sending money back home. This segment benefits from user-friendly mobile applications and competitive pricing, making it the preferred choice for many consumers. The increasing reliance on digital platforms for personal transactions further solidifies its leading position.

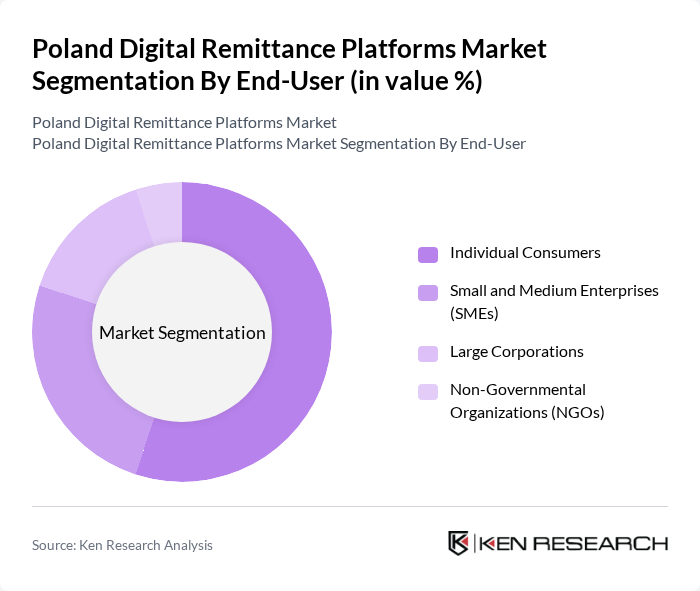

By End-User:The segmentation by end-user includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Non-Governmental Organizations (NGOs). Each end-user category has distinct requirements and usage patterns, influencing the overall market landscape.

Individual Consumers represent the largest end-user segment, driven by the need for personal remittances and bill payments. The convenience of digital platforms and the growing trend of online transactions among consumers have led to increased adoption. SMEs also play a significant role, particularly in cross-border trade, but the sheer volume of individual transactions keeps the consumer segment at the forefront.

The Poland Digital Remittance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Western Union, MoneyGram, TransferWise, Revolut, PayPal, Remitly, WorldRemit, Xoom, Skrill, Azimo, OFX, Ria Money Transfer, Wise, Payoneer, N26 contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital remittance market in Poland appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence for fraud detection and the growing acceptance of cryptocurrencies are expected to reshape the landscape. Additionally, as more consumers demand instant transfer capabilities, platforms that can offer real-time services will likely gain a competitive edge. The focus on user experience and security will also play a crucial role in attracting and retaining customers in this dynamic market.

| Segment | Sub-Segments |

|---|---|

| By Type | Person-to-Person Transfers Business-to-Business Transfers Remittance Services for Migrants Bill Payment Services Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Non-Governmental Organizations (NGOs) |

| By Payment Method | Bank Transfers Mobile Payments Cash Pickup Services Prepaid Cards |

| By Currency | Euro US Dollar Polish Zloty Others |

| By Transaction Speed | Instant Transfers Same-Day Transfers Standard Transfers |

| By Customer Segment | Domestic Users International Users Expatriates |

| By Service Provider Type | Traditional Banks Fintech Companies Money Transfer Operators Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Expatriate Remittance Users | 150 | Polish expatriates, International students |

| Digital Remittance Platform Providers | 100 | Product Managers, Business Development Executives |

| Financial Institutions | 80 | Banking Executives, Compliance Officers |

| Regulatory Bodies | 50 | Policy Makers, Financial Regulators |

| End-User Experience | 120 | Regular remittance senders, First-time users |

The Poland Digital Remittance Platforms Market is valued at approximately USD 8.5 billion, reflecting significant growth driven by increasing Polish expatriates abroad, cross-border trade, and the adoption of digital payment solutions.