Region:Europe

Author(s):Rebecca

Product Code:KRAB2992

Pages:95

Published On:October 2025

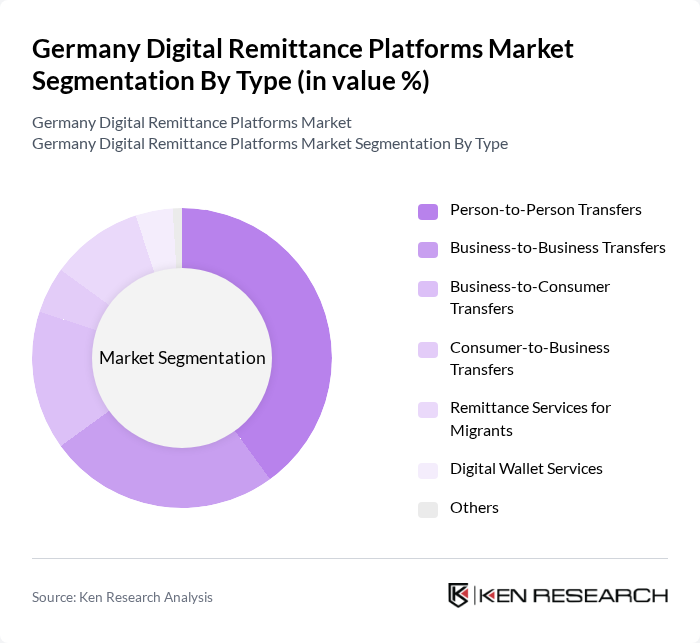

By Type:The segmentation by type includes various subsegments such as Person-to-Person Transfers, Business-to-Business Transfers, Business-to-Consumer Transfers, Consumer-to-Business Transfers, Remittance Services for Migrants, Digital Wallet Services, and Others. Among these, Person-to-Person Transfers is the leading subsegment, driven by the increasing need for individuals to send money to family and friends across borders. The convenience and low fees associated with these services have made them highly popular among consumers.

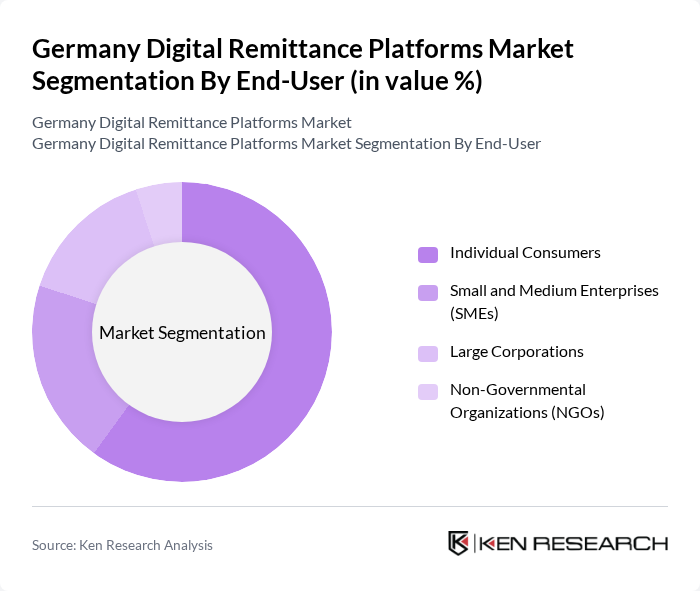

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Non-Governmental Organizations (NGOs). Individual Consumers dominate this segment, as they are the primary users of digital remittance services for personal transactions. The increasing number of expatriates and the need for quick and affordable money transfers have significantly contributed to the growth of this subsegment.

The Germany Digital Remittance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as TransferWise Ltd., PayPal Holdings, Inc., Revolut Ltd., Western Union Company, MoneyGram International, Inc., Remitly, Inc., WorldRemit Ltd., Skrill Limited, Xoom Corporation, OFX Limited, Azimo Limited, N26 GmbH, Wise Payments Ltd., Pangea Money Transfer, Inc., Payoneer Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital remittance market in Germany appears promising, driven by technological advancements and evolving consumer preferences. As blockchain technology gains traction, platforms are expected to leverage its capabilities for enhanced security and reduced transaction costs. Additionally, the integration of artificial intelligence in customer service will likely improve user experiences, making platforms more accessible and efficient. These trends indicate a dynamic landscape where innovation will play a crucial role in shaping the market's trajectory.

| Segment | Sub-Segments |

|---|---|

| By Type | Person-to-Person Transfers Business-to-Business Transfers Business-to-Consumer Transfers Consumer-to-Business Transfers Remittance Services for Migrants Digital Wallet Services Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Non-Governmental Organizations (NGOs) |

| By Payment Method | Bank Transfers Credit/Debit Cards Mobile Payments Cash Payments |

| By Currency Type | Euro US Dollar British Pound Others |

| By Transaction Speed | Instant Transfers Same-Day Transfers Standard Transfers |

| By Customer Segment | Retail Customers Corporate Customers Government Entities |

| By Distribution Channel | Online Platforms Mobile Applications Physical Outlets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Users of Digital Remittance Services | 150 | Frequent Users, Occasional Users |

| Small and Medium Enterprises (SMEs) Utilizing Remittance Platforms | 100 | Business Owners, Financial Managers |

| Financial Institutions Partnering with Remittance Services | 80 | Banking Executives, Compliance Officers |

| Regulatory Bodies Overseeing Digital Payments | 50 | Policy Makers, Regulatory Analysts |

| Fintech Experts and Analysts | 70 | Industry Analysts, Technology Consultants |

The Germany Digital Remittance Platforms Market is valued at approximately USD 7.5 billion, reflecting significant growth driven by increasing international migration, cross-border trade, and the adoption of digital payment solutions.