Region:Middle East

Author(s):Geetanshi

Product Code:KRAC1032

Pages:89

Published On:October 2025

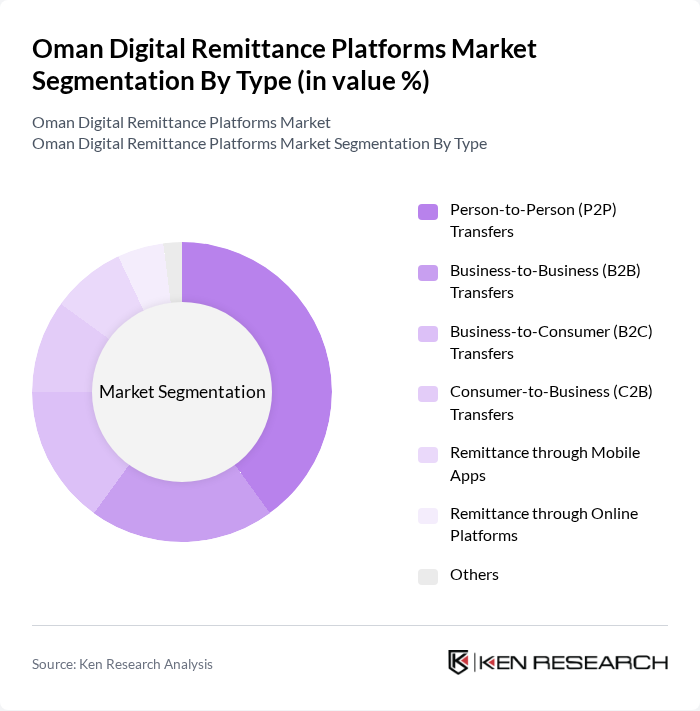

By Type:

The segmentation by type includes various subsegments such as Person-to-Person (P2P) Transfers, Business-to-Business (B2B) Transfers, Business-to-Consumer (B2C) Transfers, Consumer-to-Business (C2B) Transfers, Remittance through Mobile Apps, Remittance through Online Platforms, and Others. Among these, Person-to-Person (P2P) Transfers dominate the market due to the high volume of individual remittances sent by expatriates to their families. The ease of use and accessibility of mobile apps and online platforms, along with the growing preference for digital channels over traditional cash-based methods, have further contributed to the growth of this subsegment .

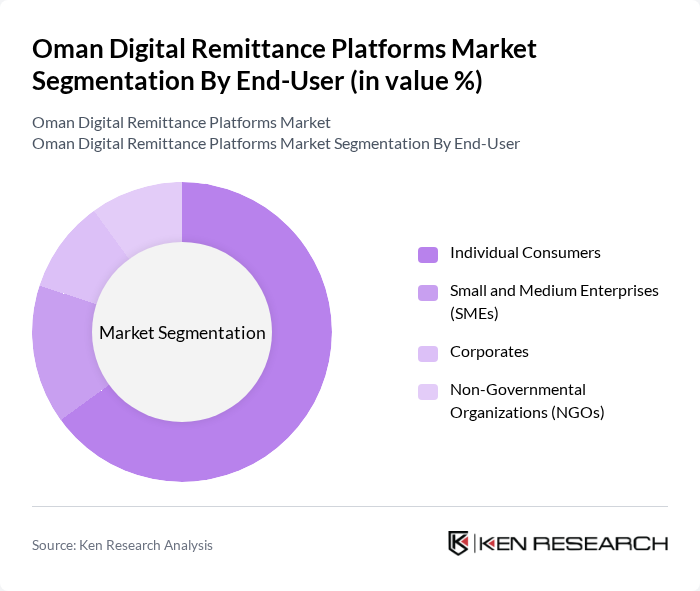

By End-User:

This segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Corporates, and Non-Governmental Organizations (NGOs). Individual Consumers represent the largest segment, driven by the high number of expatriates sending money back home. The increasing reliance on digital platforms for personal remittances, combined with the demand for fast, affordable, and secure transfer options, has solidified this subsegment's dominance. SMEs and corporates are also increasingly adopting digital remittance solutions for cross-border business payments, reflecting broader digital transformation trends in the financial sector .

The Oman Digital Remittance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Western Union, MoneyGram, Wise (formerly TransferWise), Remitly, Xoom (PayPal), PayPal, WorldRemit, Ria Money Transfer, OFX, Azimo, Revolut, Alipay, Payoneer, Skrill, CashU, FRiENDi Pay, Lulu Exchange, Oman UAE Exchange, Al Ansari Exchange contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Oman digital remittance market appears promising, driven by technological innovations and a growing expatriate base. As mobile-first solutions gain traction, service providers are likely to enhance their platforms to improve user experience. Furthermore, the integration of blockchain technology could revolutionize transaction processes, making them more secure and efficient. With the government’s push for financial inclusion, the market is poised for significant growth, attracting both local and international players seeking to capitalize on emerging opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Person-to-Person (P2P) Transfers Business-to-Business (B2B) Transfers Business-to-Consumer (B2C) Transfers Consumer-to-Business (C2B) Transfers Remittance through Mobile Apps Remittance through Online Platforms Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Corporates Non-Governmental Organizations (NGOs) |

| By Payment Method | Credit/Debit Cards Bank Transfers Mobile Wallets Cash Payments |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions |

| By Frequency of Use | Daily Users Weekly Users Monthly Users |

| By Geographic Reach | Domestic Transfers International Transfers |

| By Customer Segment | Expatriates Local Residents Businesses |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Expatriate Remittance Behavior | 120 | Expatriates from South Asia, Middle East, and Africa |

| Digital Platform User Experience | 90 | Users of various digital remittance platforms |

| Service Provider Insights | 60 | Executives from remittance service providers and fintech companies |

| Regulatory Impact Assessment | 50 | Regulatory officials and compliance officers |

| Market Trends and Innovations | 55 | Industry analysts and technology experts in financial services |

The Oman Digital Remittance Platforms Market is valued at approximately USD 5 billion, driven by the increasing number of expatriates in Oman who utilize digital platforms for remittances to their home countries.