Region:Middle East

Author(s):Rebecca

Product Code:KRAC1133

Pages:82

Published On:October 2025

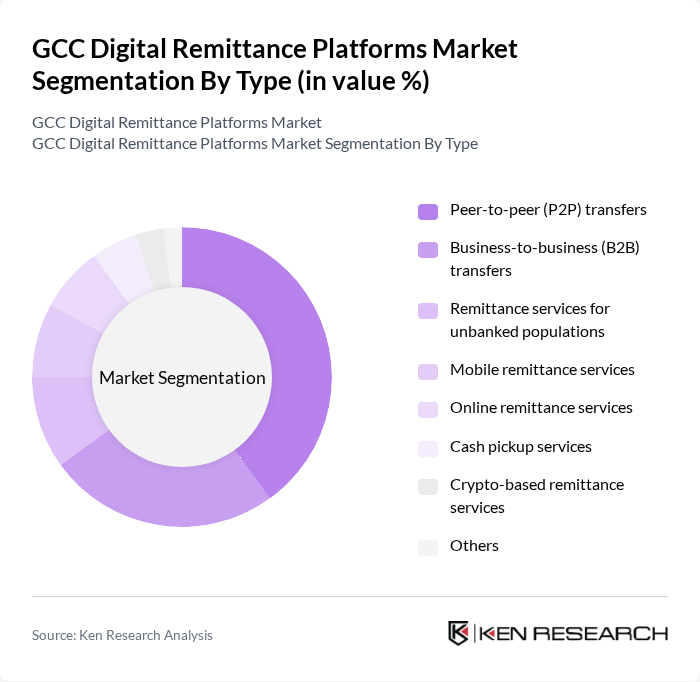

By Type:The digital remittance platforms can be categorized into various types, including Peer-to-peer (P2P) transfers, Business-to-business (B2B) transfers, remittance services for unbanked populations, mobile remittance services, online remittance services, cash pickup services, crypto-based remittance services, and others. Among these, Peer-to-peer (P2P) transfers remain the most dominant segment, driven by the increasing number of individuals seeking to send money to family and friends across borders. The convenience and lower fees associated with P2P services have made them a preferred choice for many users. Mobile remittance services have gained substantial traction, with mobile apps commanding approximately 55% of channel preferences due to ubiquitous smartphone penetration and intuitive user experiences. Crypto-based remittance services are experiencing rapid growth, with stablecoins slashing conversion costs and real-time blockchain settlement reducing transaction times to seconds.

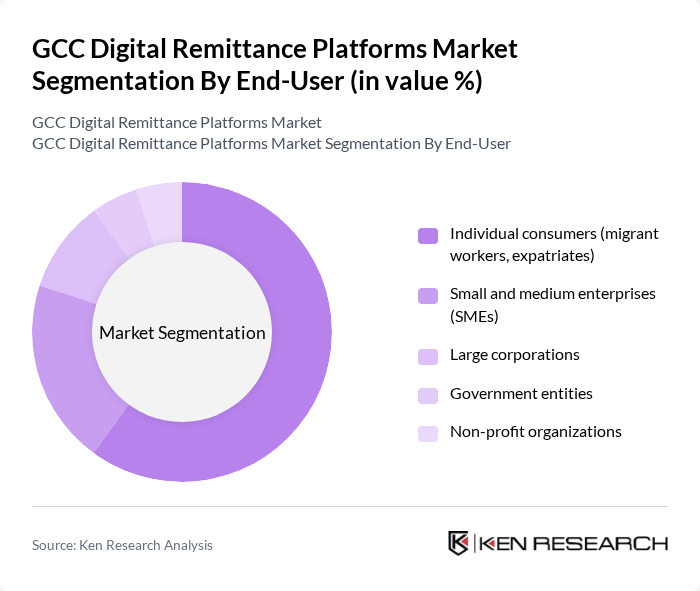

By End-User:The end-users of digital remittance platforms include individual consumers (migrant workers, expatriates), small and medium enterprises (SMEs), large corporations, government entities, and non-profit organizations. The individual consumers segment remains the most significant, accounting for approximately 62% of market activity, as a large portion of remittances is sent by expatriates to their families back home. This segment's growth is fueled by the increasing number of migrant workers in the GCC region, who rely on remittances as a primary source of income for their families. Small businesses are experiencing the fastest growth, benefiting from bundled FX hedging and installment features that facilitate overseas supplier payments. Regulatory liberalization in several emerging markets has further eroded legacy caps on remittance amounts, accelerating volume across all end-user segments.

The GCC Digital Remittance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Western Union, MoneyGram, Wise (formerly TransferWise), Remitly, Xoom (a PayPal Service), PayPal, Ria Money Transfer, WorldRemit, Al Rajhi Bank, Emirates NBD, Lulu Exchange, UAE Exchange (now part of Finablr), CashU, Payoneer, Azimo, ADCB (Abu Dhabi Commercial Bank), National Commercial Bank (NCB), Bank Albilad, Qatar National Bank (QNB), Kuwait Finance House, Alinma Bank, Saudi Post (Enjaz), Oman Arab Bank, Revolut, OFX, Skrill, Stripe, Visa Direct, Mastercard Send, Alipay contribute to innovation, geographic expansion, and service delivery in this space.

The GCC digital remittance market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As the region embraces mobile-first solutions, platforms will increasingly focus on enhancing user experience and security. The integration of AI for fraud detection and the rise of digital wallets will further streamline transactions. Additionally, partnerships with local banks will facilitate access to underserved markets, creating a more inclusive financial ecosystem for expatriates and local residents alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Peer-to-peer transfers Business-to-business transfers Remittance services for unbanked populations Mobile remittance services Online remittance services Cash pickup services Crypto-based remittance services Others |

| By End-User | Individual consumers Small and medium enterprises Large corporations Government entities Non-profit organizations |

| By Payment Method | Bank transfers Credit/debit cards E-wallets Cash payments Mobile money |

| By Transaction Size | Small transactions Medium transactions Large transactions |

| By Geographic Focus | Intra-GCC remittances GCC to South Asia GCC to Southeast Asia GCC to Africa GCC to Europe/North America |

| By Customer Segment | Expatriates Local residents Businesses |

| By Service Provider Type | Banks Fintech companies Traditional money transfer operators Digital-only remittance platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Expatriate Remittance Users | 120 | Low to Middle-Income Expatriates, Financial Service Users |

| Digital Remittance Service Providers | 40 | Product Managers, Business Development Executives |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Financial Analysts | 40 | Market Researchers, Economic Analysts |

| Consumer Advocacy Groups | 40 | Consumer Rights Advocates, Financial Literacy Educators |

The GCC Digital Remittance Platforms Market is valued at approximately USD 3.2 billion, driven by a growing expatriate population, increased digital adoption, and demand for cost-effective remittance solutions.