Region:Global

Author(s):Shubham

Product Code:KRAA0792

Pages:88

Published On:August 2025

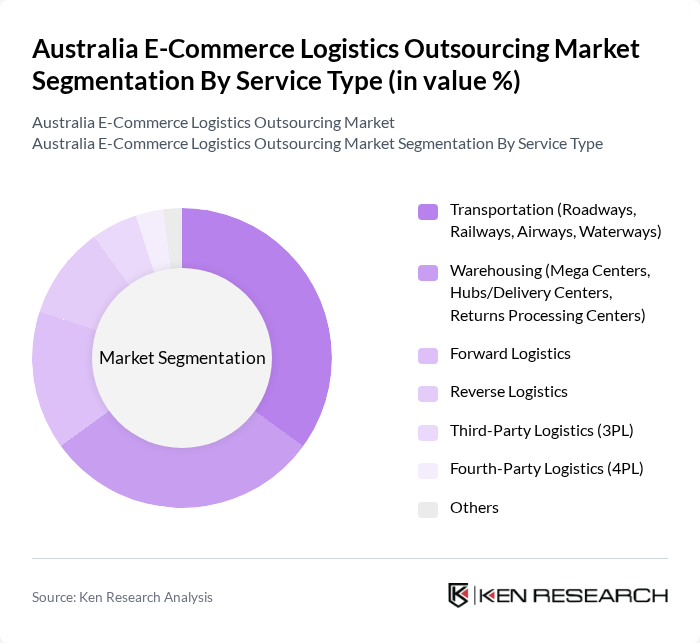

By Service Type:The service type segmentation includes various logistics services that cater to the needs of e-commerce businesses. The primary subsegments are Transportation (Roadways, Railways, Airways, Waterways), Warehousing (Mega Centers, Hubs/Delivery Centers, Returns Processing Centers), Forward Logistics, Reverse Logistics, Third-Party Logistics (3PL), Fourth-Party Logistics (4PL), and Others. Each of these subsegments plays a crucial role in ensuring the efficient movement and storage of goods .

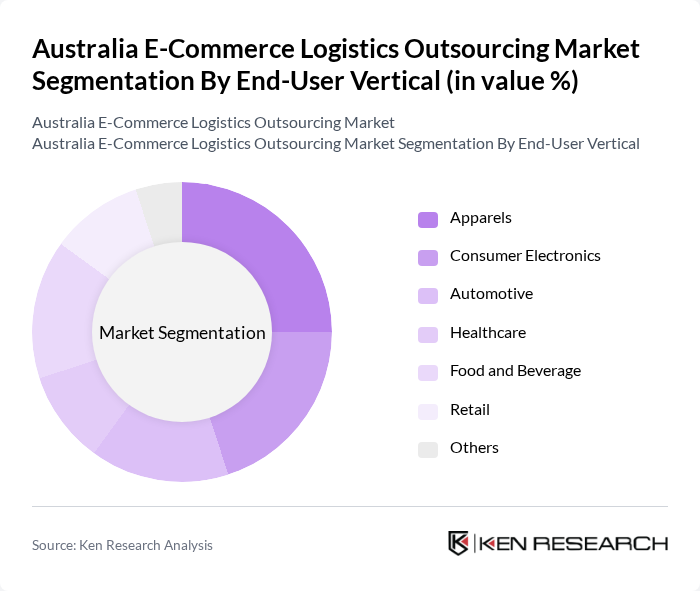

By End-User Vertical:The end-user vertical segmentation encompasses various industries that utilize e-commerce logistics services. The primary subsegments include Apparels, Consumer Electronics, Automotive, Healthcare, Food and Beverage, Retail, and Others. Each vertical has unique logistics requirements, influencing the demand for specific services and solutions .

The Australia E-Commerce Logistics Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Australia Post, Toll Group, StarTrack, DHL Supply Chain Australia, Linfox, Aramex Australia, FedEx Express Australia, UPS Australia, CouriersPlease, Sendle, eStore Logistics, DB Schenker Australia, Ceva Logistics Australia, Qantas Freight, Allied Express contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia e-commerce logistics outsourcing market appears promising, driven by ongoing technological advancements and evolving consumer preferences. As businesses increasingly adopt automation and AI, operational efficiencies are expected to improve significantly. Furthermore, the rise of sustainable practices in logistics will likely shape the industry, with companies focusing on eco-friendly solutions to meet consumer demand for responsible delivery options. This evolving landscape presents a fertile ground for innovation and growth in the logistics sector.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Transportation (Roadways, Railways, Airways, Waterways) Warehousing (Mega Centers, Hubs/Delivery Centers, Returns Processing Centers) Forward Logistics Reverse Logistics Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Others |

| By End-User Vertical | Apparels Consumer Electronics Automotive Healthcare Food and Beverage Retail Others |

| By Logistics Operation | Domestic International |

| By Customer Segment | B2C E-Commerce B2B E-Commerce C2C E-Commerce Small and Medium Enterprises (SMEs) Large Enterprises Startups Individual Consumers Others |

| By Delivery Period | Standard Delivery Express Delivery Same-Day Delivery Scheduled Delivery Others |

| By Sales Channel | Online Marketplaces Direct-to-Consumer Websites Social Media Platforms Mobile Applications Others |

| By Packaging Type | Eco-Friendly Packaging Standard Packaging Custom Packaging Bulk Packaging Others |

| By Price Range | Budget-Friendly Options Mid-Range Options Premium Options Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General E-commerce Logistics | 100 | Logistics Managers, E-commerce Directors |

| Last-Mile Delivery Solutions | 60 | Operations Managers, Delivery Coordinators |

| Returns Management Strategies | 50 | Customer Service Managers, Returns Analysts |

| Warehouse Management Systems | 40 | Warehouse Managers, IT Systems Analysts |

| Cross-Border E-commerce Logistics | 40 | International Trade Managers, Compliance Officers |

The Australia E-Commerce Logistics Outsourcing Market is valued at approximately AUD 10.7 billion, reflecting significant growth driven by the expansion of online retail and consumer demand for faster delivery options.