Region:Middle East

Author(s):Geetanshi

Product Code:KRAA2036

Pages:81

Published On:August 2025

By Service Type:The service type segmentation includes various logistics services that cater to the e-commerce sector. The primary subsegments are Transportation (Road, Air, Sea, Rail), Warehousing & Inventory Management, Value-Added Services (Packaging, Labeling, Returns Management), Last-Mile Delivery, Fulfillment Centers, Reverse Logistics, and Others. Among these,Last-Mile Deliveryis currently dominating the market due to the increasing demand for quick and efficient delivery services, driven by consumer expectations for fast shipping and convenience in online shopping. The trend toward regional fulfillment hubs and gateway facilities is further accelerating the importance of last-mile delivery in the market.

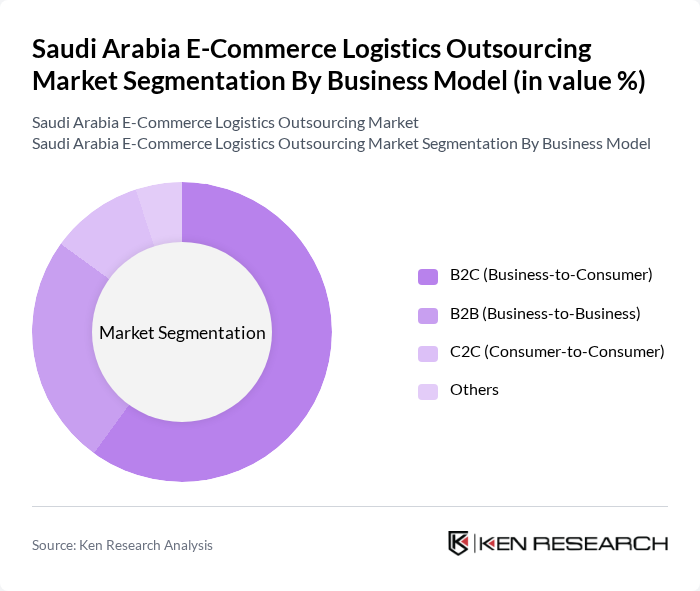

By Business Model:This segmentation focuses on the different business models utilized in the e-commerce logistics outsourcing market. The primary subsegments include B2C (Business-to-Consumer), B2B (Business-to-Business), C2C (Consumer-to-Consumer), and Others. TheB2C modelis leading the market, driven by the surge in online shopping and the increasing number of consumers preferring to purchase goods directly from e-commerce platforms. The dominance of B2C is reinforced by rising internet penetration, mobile commerce, and the expansion of major e-commerce platforms in Saudi Arabia.

The Saudi Arabia E-Commerce Logistics Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aramex, DHL Supply Chain, FedEx, UPS, Naqel Express, Zajil Express, Saudi Post, SMSA Express, SAB Express, ESNAD Express, Shipa Delivery, Almajdouie Logistics, Agility Logistics, Alma Express, and AliExpress contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia e-commerce logistics outsourcing market appears promising, driven by technological advancements and evolving consumer preferences. The integration of AI and automation in logistics operations is expected to enhance efficiency and reduce costs. Furthermore, the shift towards sustainable logistics practices will likely gain momentum, aligning with global trends. As the market matures, companies that adapt to these changes will be well-positioned to capitalize on emerging opportunities and meet the growing demands of consumers.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Transportation (Road, Air, Sea, Rail) Warehousing & Inventory Management Value-Added Services (Packaging, Labeling, Returns Management) Last-Mile Delivery Fulfillment Centers Reverse Logistics Others |

| By Business Model | B2C (Business-to-Consumer) B2B (Business-to-Business) C2C (Consumer-to-Consumer) Others |

| By Destination | Domestic International (Cross-Border) |

| By Product Category | Fashion and Apparel Consumer Electronics Home Appliances Furniture Beauty and Personal Care Others |

| By Region | Central (Riyadh) Western (Jeddah, Makkah) Eastern (Dammam, Khobar) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Retail Logistics | 60 | Logistics Managers, E-commerce Directors |

| Third-Party Logistics Providers | 50 | Operations Managers, Business Development Heads |

| Last-Mile Delivery Services | 40 | Delivery Coordinators, Fleet Managers |

| Warehousing Solutions for E-commerce | 45 | Warehouse Managers, Supply Chain Analysts |

| Returns Management in E-commerce | 50 | Customer Service Managers, Returns Specialists |

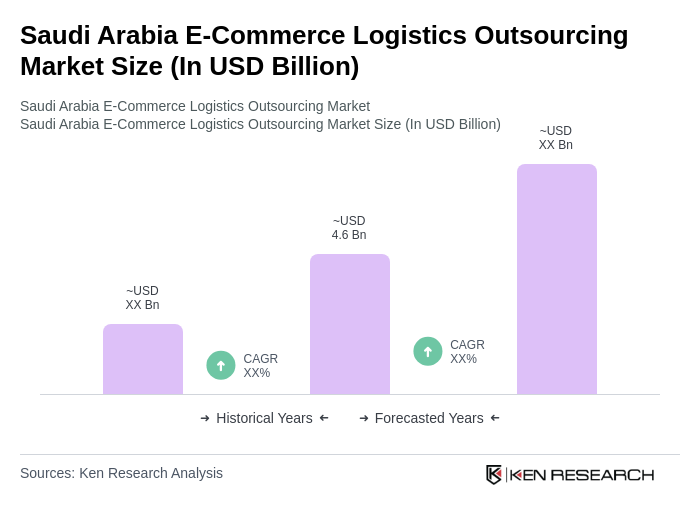

The Saudi Arabia E-Commerce Logistics Outsourcing Market is valued at approximately USD 4.6 billion, reflecting significant growth driven by the rapid expansion of the e-commerce sector and increased consumer preference for online shopping.