Region:North America

Author(s):Geetanshi

Product Code:KRAA0264

Pages:92

Published On:August 2025

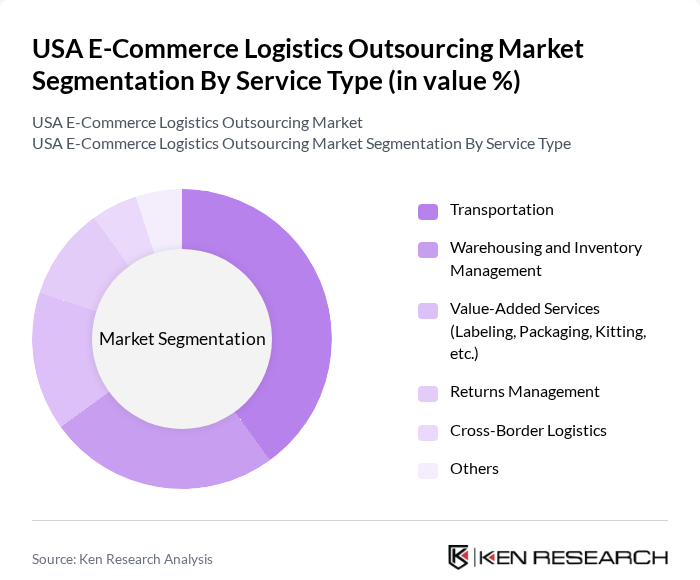

By Service Type:The service type segmentation includes various subsegments such as Transportation, Warehousing and Inventory Management, Value-Added Services, Returns Management, Cross-Border Logistics, and Others. Among these, Transportation is the leading subsegment, driven by the increasing demand for fast and reliable delivery services. The rise of same-day and next-day delivery options has significantly influenced consumer expectations, pushing logistics providers to enhance their transportation capabilities. Warehousing and Inventory Management also play a crucial role, as efficient inventory handling is essential for meeting the demands of e-commerce businesses .

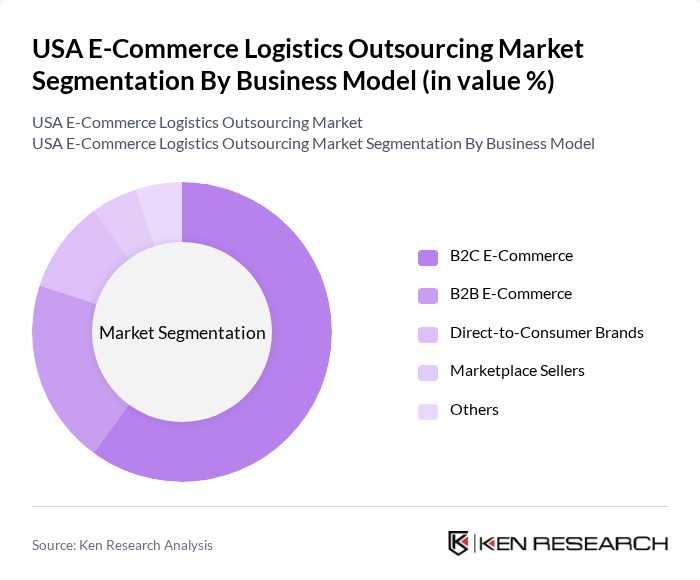

By Business Model:This segmentation includes B2C E-Commerce, B2B E-Commerce, Direct-to-Consumer Brands, Marketplace Sellers, and Others. The B2C E-Commerce model is the dominant segment, fueled by the increasing number of consumers shopping online. The convenience of online shopping and the growing trend of home delivery have led to a surge in demand for logistics services tailored to B2C operations. B2B E-Commerce is also significant, as businesses increasingly rely on efficient logistics to manage their supply chains and fulfill orders .

The USA E-Commerce Logistics Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Logistics, FedEx Logistics, UPS Supply Chain Solutions, DHL eCommerce Solutions, XPO Logistics, ShipBob, Rakuten Super Logistics, Ryder Supply Chain Solutions, Geodis, Pitney Bowes, BlueGrace Logistics, Onfleet, C.H. Robinson, Transplace (now part of Uber Freight), DSV Panalpina contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA e-commerce logistics outsourcing market appears promising, driven by technological advancements and evolving consumer expectations. As companies increasingly adopt AI and automation, operational efficiencies are expected to improve significantly. Additionally, the rise of subscription-based services will likely create new logistics demands, pushing providers to innovate. The focus on sustainability will also shape logistics strategies, as businesses seek eco-friendly solutions to meet consumer preferences and regulatory requirements, enhancing market competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Transportation Warehousing and Inventory Management Value-Added Services (Labeling, Packaging, Kitting, etc.) Returns Management Cross-Border Logistics Others |

| By Business Model | B2C E-Commerce B2B E-Commerce Direct-to-Consumer Brands Marketplace Sellers Others |

| By Delivery Destination | Domestic International/Cross-Border |

| By Product Category | Fashion and Apparel Consumer Electronics Home Appliances Furniture Beauty and Personal Care Products Others (Toys, Food Products, etc.) |

| By Service Model | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Managed Transportation Services Integrated Logistics Services Others |

| By Technology Adoption | Automated Warehousing Real-Time Tracking Systems Robotics in Logistics Data Analytics for Supply Chain Others |

| By Geographic Coverage | National Coverage Regional Coverage Local Coverage International Coverage Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Last-Mile Delivery Solutions | 100 | Logistics Coordinators, Delivery Operations Managers |

| Warehouse Management Systems | 80 | Warehouse Managers, IT Systems Analysts |

| Returns Processing Strategies | 60 | Customer Experience Managers, Returns Analysts |

| Cross-Border E-Commerce Logistics | 50 | International Trade Specialists, Compliance Officers |

| Inventory Management Practices | 70 | Inventory Managers, Supply Chain Analysts |

The USA E-Commerce Logistics Outsourcing Market is valued at approximately USD 141 billion, reflecting significant growth driven by the expansion of online retail and increasing consumer demand for efficient logistics solutions.