Region:Asia

Author(s):Dev

Product Code:KRAA0431

Pages:97

Published On:August 2025

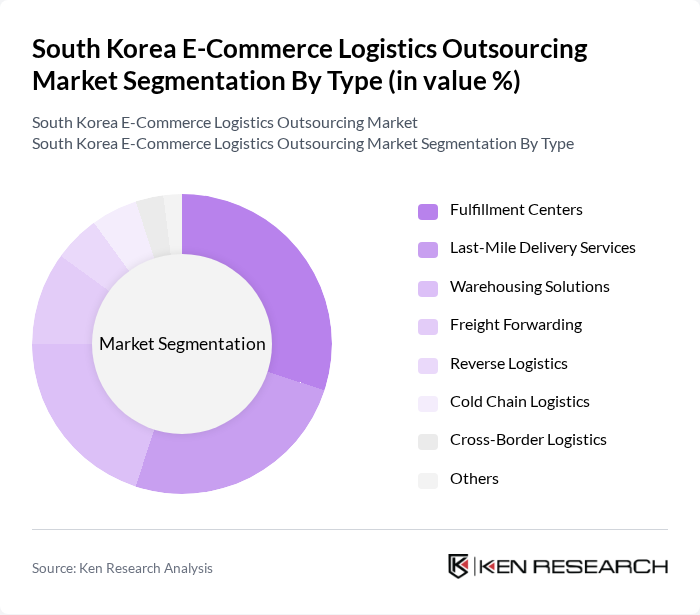

By Type:The market is segmented into various types, including Fulfillment Centers, Last-Mile Delivery Services, Warehousing Solutions, Freight Forwarding, Reverse Logistics, Cold Chain Logistics, Cross-Border Logistics, and Others. Each of these segments plays a crucial role in the overall logistics ecosystem, catering to different aspects of e-commerce logistics .

The Fulfillment Centers segment is currently dominating the market due to the increasing demand for efficient order processing and inventory management. As e-commerce continues to grow, businesses are investing in fulfillment centers to streamline their operations and enhance customer satisfaction. The trend towards same-day and next-day delivery has further propelled the need for strategically located fulfillment centers, making them a critical component of the logistics landscape .

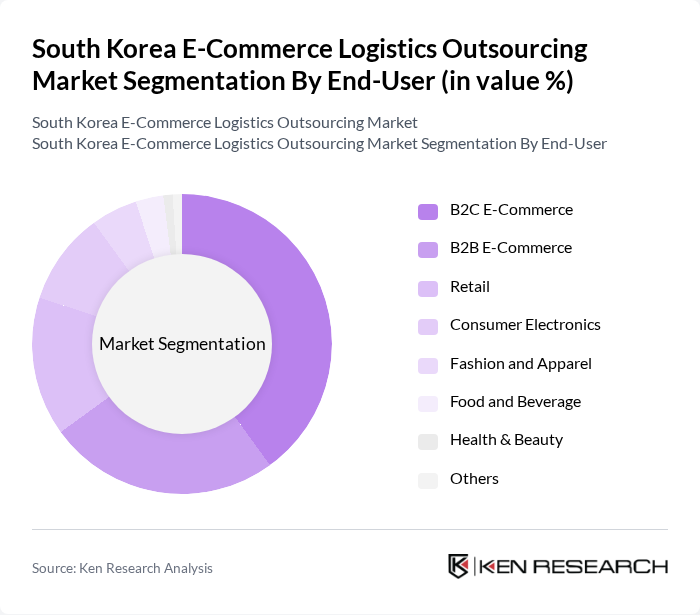

By End-User:The market is segmented by end-user into B2C E-Commerce, B2B E-Commerce, Retail, Consumer Electronics, Fashion and Apparel, Food and Beverage, Health & Beauty, and Others. Each segment reflects the diverse needs of different industries and consumer preferences .

The B2C E-Commerce segment is leading the market, driven by the increasing number of online shoppers and the growing preference for home delivery services. This segment benefits from the rise of mobile commerce and social media marketing, which have significantly influenced consumer purchasing behavior. As more consumers turn to online platforms for their shopping needs, the demand for logistics services tailored to B2C operations continues to rise .

The South Korea E-Commerce Logistics Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as CJ Logistics, Hanjin Transportation, Lotte Global Logistics, Hyundai Glovis, SK Networks, DB Schenker Korea, Kuehne + Nagel Korea, DPD Korea, GS Global, YTO Express Korea, S.F. Express Korea, ZTO Express Korea, Alibaba Cainiao Network, Amazon Global Logistics Korea, Coupang Logistics Service contribute to innovation, geographic expansion, and service delivery in this space .

The South Korean e-commerce logistics outsourcing market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As companies increasingly adopt automation and AI, operational efficiencies are expected to improve, enhancing service delivery. Furthermore, the shift towards sustainable logistics practices will likely reshape industry standards, compelling providers to innovate. The focus on rural market expansion will also create new opportunities, allowing logistics firms to tap into previously underserved demographics, thereby broadening their customer base and enhancing profitability.

| Segment | Sub-Segments |

|---|---|

| By Type | Fulfillment Centers Last-Mile Delivery Services Warehousing Solutions Freight Forwarding Reverse Logistics Cold Chain Logistics Cross-Border Logistics Others |

| By End-User | B2C E-Commerce B2B E-Commerce Retail Consumer Electronics Fashion and Apparel Food and Beverage Health & Beauty Others |

| By Delivery Method | Standard Delivery Express Delivery Scheduled Delivery Curbside Pickup Click and Collect Locker Delivery Others |

| By Technology | Automated Warehousing Route Optimization Software Inventory Management Systems Tracking and Visibility Solutions Robotics in Logistics IoT-Enabled Logistics Others |

| By Packaging Type | Standard Packaging Custom Packaging Eco-Friendly Packaging Bulk Packaging Temperature-Controlled Packaging Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Startups Individual Consumers Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Cross-Border Logistics Major Logistics Hubs (e.g., Seoul-Incheon, Busan, Daegu) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Fulfillment Strategies | 100 | Logistics Coordinators, E-commerce Operations Managers |

| Last-Mile Delivery Solutions | 80 | Delivery Managers, Supply Chain Analysts |

| Returns Management Practices | 60 | Customer Service Managers, Returns Specialists |

| Warehouse Automation Trends | 50 | Warehouse Managers, Technology Officers |

| Partnerships with 3PL Providers | 40 | Business Development Managers, Procurement Officers |

The South Korea E-Commerce Logistics Outsourcing Market is valued at approximately USD 15 billion, reflecting significant growth driven by the expansion of online retail and consumer demand for faster delivery options.