UK E-Commerce Logistics Outsourcing Market Overview

- The UK E-Commerce Logistics Outsourcing Market is valued at approximately USD 16 billion, based on a five-year historical analysis. This growth is primarily driven by the rapid expansion of online retail, increased consumer demand for same-day and next-day delivery options, and the need for cost-effective logistics solutions. Additional drivers include the accelerated adoption of warehouse automation to offset labor shortages, the proliferation of urban micro-fulfillment centers in tier-1 cities, and the rise of SME direct-to-consumer brands leveraging online marketplaces. The surge in e-commerce activities has led businesses to outsource logistics to enhance efficiency, optimize supply chains, and focus on core competencies.

- Key cities dominating the UK E-Commerce Logistics Outsourcing Market include London, Manchester, and Birmingham. London serves as a major financial and commercial hub, attracting numerous logistics providers due to its extensive transport infrastructure and concentration of fulfillment networks. Manchester and Birmingham benefit from their strategic locations, connectivity, and the emergence of urban micro-fulfillment centers, making them ideal for warehousing and distribution operations and enhancing their market presence.

- In 2023, the UK government implemented the Logistics Decarbonisation Strategy, issued by the Department for Transport, aiming to achieve net-zero emissions in the logistics sector by 2050. This regulation mandates companies to adopt sustainable practices, including transitioning to electric vehicles, optimizing supply chain operations, and reporting emissions data, thereby promoting environmental responsibility and compliance within the logistics outsourcing market.

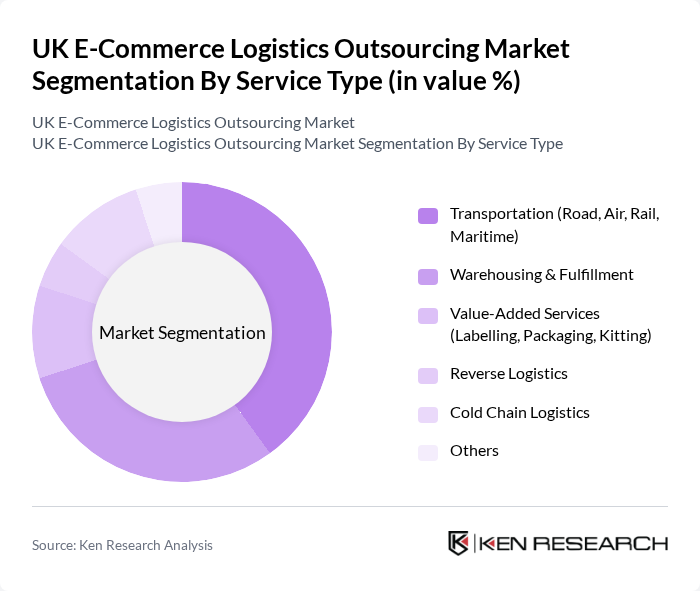

UK E-Commerce Logistics Outsourcing Market Segmentation

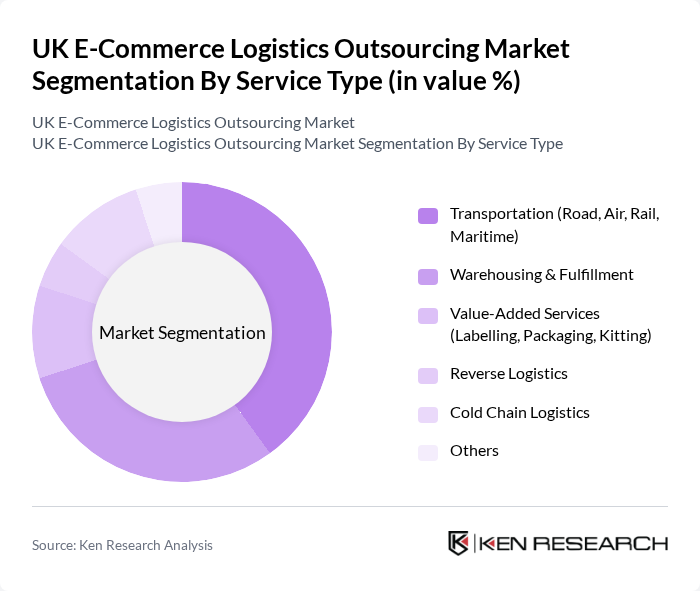

By Service Type:The service type segmentation includes various logistics services that cater to the diverse needs of e-commerce businesses. The primary subsegments are Transportation (Road, Air, Rail, Maritime), Warehousing & Fulfillment, Value-Added Services (Labelling, Packaging, Kitting), Reverse Logistics, Cold Chain Logistics, and Others. Among these, Transportation and Warehousing & Fulfillment are the most significant, driven by the increasing demand for efficient delivery and storage solutions. Value-added services are also gaining traction, reflecting the need for flexible packaging, labeling, and inventory tracking to support omnichannel retail and direct-to-consumer models.

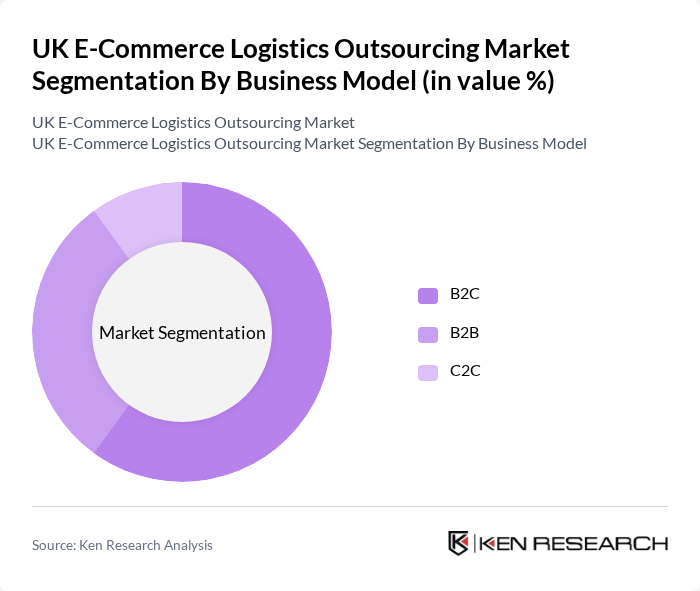

By Business Model:The business model segmentation encompasses various approaches to e-commerce logistics, including B2C (Business to Consumer), B2B (Business to Business), and C2C (Consumer to Consumer). The B2C model is the most dominant, driven by the surge in online shopping, consumer expectations for quick delivery, and the expansion of omnichannel click-and-collect models. B2B logistics is also significant, catering to wholesale and retail businesses that require efficient supply chain solutions, while C2C logistics supports peer-to-peer transactions facilitated by online marketplaces.

UK E-Commerce Logistics Outsourcing Market Competitive Landscape

The UK E-Commerce Logistics Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, XPO Logistics, DPDgroup, Royal Mail Group, Evri (formerly Hermes UK), Whistl, Yodel Delivery Network, FedEx Express, UPS, GEODIS, Kuehne + Nagel, DB Schenker, GXO Logistics, DSV, Tuffnells Parcels Express contribute to innovation, geographic expansion, and service delivery in this space.

UK E-Commerce Logistics Outsourcing Market Industry Analysis

Growth Drivers

- Increasing Online Shopping Trends:The UK e-commerce sector has seen a remarkable surge, with online retail sales reaching £99.31 billion in future, a 12% increase from the previous year. This growth is driven by changing consumer behaviors, with 82% of UK adults shopping online at least once in future. The shift towards digital shopping is expected to continue, further fueling demand for efficient logistics outsourcing solutions to meet consumer expectations for convenience and speed.

- Demand for Faster Delivery Services:The average delivery time for e-commerce orders in the UK has decreased to 2.5 days in future, down from 3.2 days in the previous period. This trend reflects a growing consumer expectation for rapid delivery, with 56% of shoppers prioritizing same-day or next-day delivery options. As a result, logistics outsourcing providers are increasingly focusing on optimizing their operations to meet these demands, driving market growth in the logistics outsourcing sector.

- Technological Advancements in Logistics:The integration of advanced technologies such as AI and automation in logistics operations has led to significant efficiency improvements. In future, 45% of logistics companies in the UK reported using AI-driven solutions to enhance their supply chain processes. This technological shift not only reduces operational costs but also improves service delivery, making logistics outsourcing more attractive to e-commerce businesses looking to streamline their operations.

Market Challenges

- Rising Operational Costs:The logistics sector in the UK is facing increasing operational costs, with fuel prices averaging £1.50 per liter in future, a 15% rise compared to the previous period. Additionally, labor costs have surged, with the average wage for logistics workers reaching £12.54 per hour. These rising costs pose significant challenges for logistics outsourcing providers, impacting their profitability and pricing strategies in a competitive market.

- Regulatory Compliance Issues:The logistics industry is subject to stringent regulations, particularly concerning environmental standards. In future, the UK government implemented new emissions regulations requiring logistics companies to reduce carbon emissions by 20% by 2025. Compliance with these regulations necessitates significant investment in sustainable practices, which can strain the resources of logistics outsourcing providers and hinder their operational flexibility.

UK E-Commerce Logistics Outsourcing Market Future Outlook

The UK e-commerce logistics outsourcing market is poised for continued evolution, driven by technological advancements and changing consumer preferences. As businesses increasingly adopt automation and AI, operational efficiencies will improve, enabling faster delivery times. Additionally, the focus on sustainability will shape logistics strategies, with companies investing in eco-friendly practices. The expansion into rural markets will also present new opportunities, allowing logistics providers to tap into previously underserved areas, thereby enhancing their service offerings and market reach.

Market Opportunities

- Growth in Cross-Border E-Commerce:The value of cross-border e-commerce in the UK is projected to reach £30 billion in future, driven by increasing consumer interest in international products. This growth presents significant opportunities for logistics outsourcing providers to develop specialized services that cater to the complexities of international shipping, customs clearance, and delivery.

- Adoption of Automation and AI:The logistics sector is expected to invest over £1 billion in automation technologies in future. This investment will enhance operational efficiency and reduce costs, allowing logistics outsourcing providers to offer competitive pricing and improved service levels. The integration of AI in logistics operations will also facilitate better demand forecasting and inventory management, further driving market growth.