Region:Global

Author(s):Shubham

Product Code:KRAA6907

Pages:91

Published On:January 2026

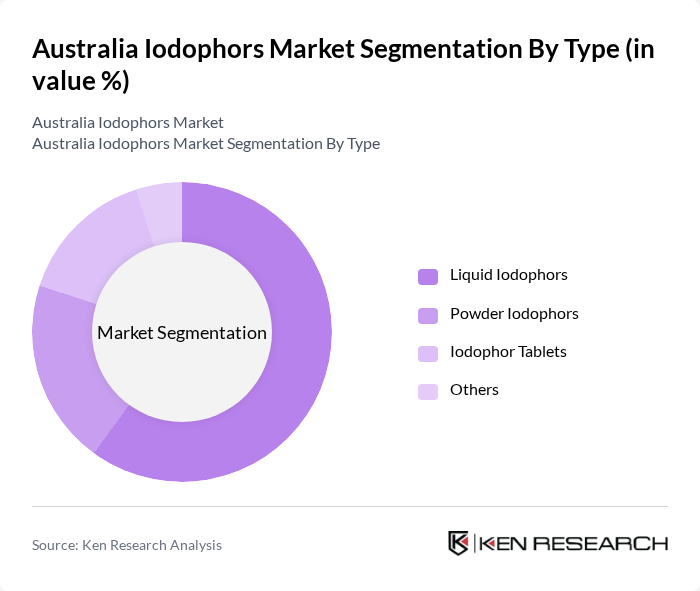

By Type:The market is segmented into Liquid Iodophors, Powder Iodophors, Iodophor Tablets, and Others. Liquid Iodophors are the most widely used due to their ease of application and effectiveness in various disinfection processes. Powder Iodophors are gaining traction in specific applications, while Iodophor Tablets are preferred for convenience in certain settings.

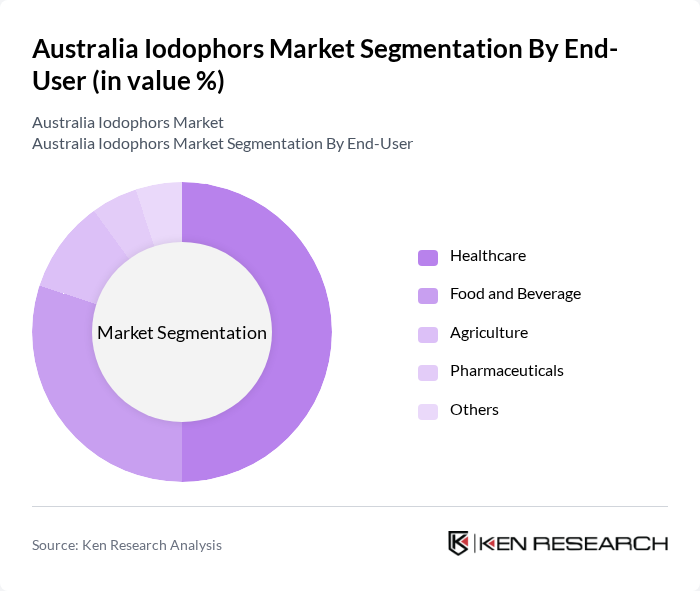

By End-User:The end-user segments include Healthcare, Food and Beverage, Agriculture, Pharmaceuticals, and Others. The Healthcare sector is the largest consumer of iodophors, driven by stringent hygiene standards and the need for effective sterilization methods. The Food and Beverage industry follows closely, as food safety regulations necessitate the use of reliable disinfectants.

The Australia Iodophors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson, Ecolab Inc., Diversey Holdings, Ltd., 3M Company, Neogen Corporation, Steris Corporation, GEA Group AG, Kersia Group, PeroxyChem LLC, BioSafe Systems, LLC, Aqualife, Aseptico, Inc., Hach Company, Chemgene Solutions, Enviro Tech Chemical Services, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the iodophors market in Australia appears promising, driven by increasing health and safety standards across various sectors. The anticipated growth in the healthcare and food industries will likely bolster demand for effective sanitization solutions in future. Additionally, the trend towards sustainable practices will encourage the development of eco-friendly iodophors. Companies that invest in innovative production technologies and strategic partnerships are expected to capitalize on emerging market opportunities, ensuring a competitive edge in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Iodophors Powder Iodophors Iodophor Tablets Others |

| By End-User | Healthcare Food and Beverage Agriculture Pharmaceuticals Others |

| By Application | Surface Disinfection Water Treatment Equipment Sterilization Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Others |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging Others |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Tasmania Others |

| By Customer Type | B2B B2C Government Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Disinfectant Usage | 45 | Hospital Procurement Managers, Infection Control Officers |

| Food Processing Sanitization | 40 | Food Safety Managers, Quality Assurance Supervisors |

| Agricultural Chemical Applications | 40 | Agronomists, Farm Managers |

| Industrial Cleaning Solutions | 40 | Facility Managers, Operations Directors |

| Research and Development Insights | 40 | R&D Scientists, Product Development Managers |

The Australia Iodophors Market is valued at approximately USD 30 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for effective disinfectants across healthcare, food processing, and agricultural sectors.