Region:Middle East

Author(s):Shubham

Product Code:KRAA6661

Pages:89

Published On:January 2026

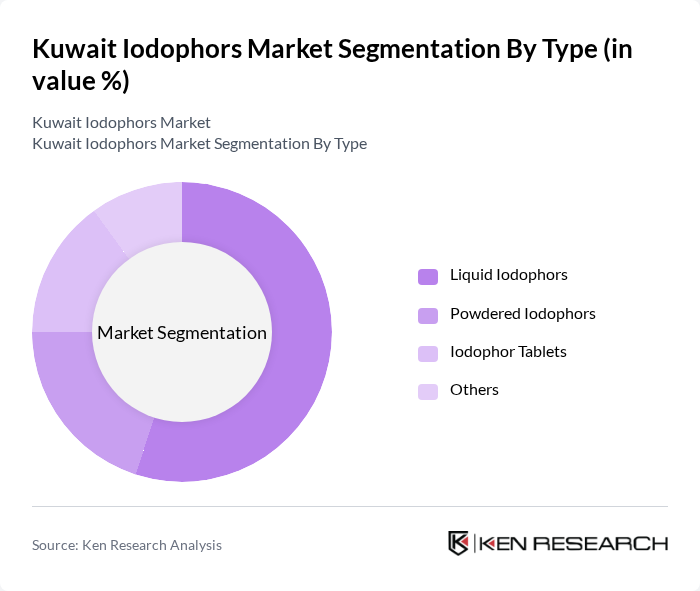

By Type:The market is segmented into Liquid Iodophors, Powdered Iodophors, Iodophor Tablets, and Others. Among these, Liquid Iodophors dominate the market due to their ease of use and effectiveness in various applications, particularly in healthcare and food processing. The convenience of liquid formulations makes them a preferred choice for end-users, leading to a significant market share.

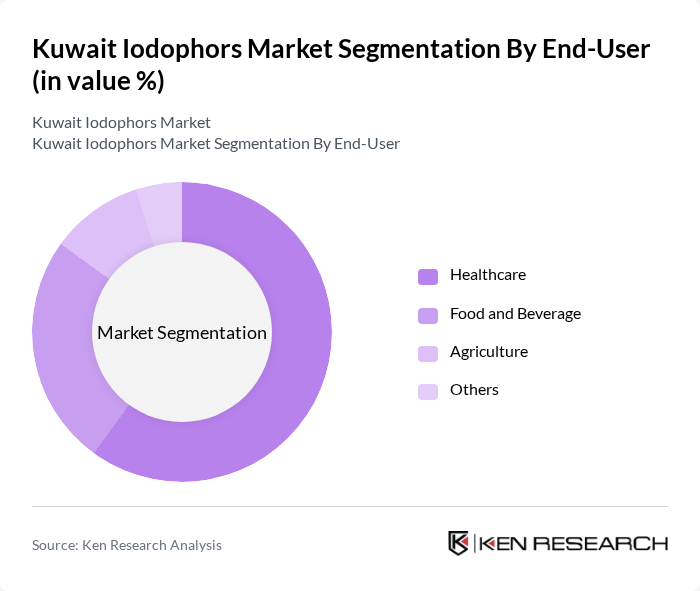

By End-User:The end-user segmentation includes Healthcare, Food and Beverage, Agriculture, and Others. The Healthcare sector is the leading end-user, driven by the stringent hygiene requirements in hospitals and clinics. The increasing focus on infection control and patient safety has led to a higher adoption of iodophors in medical settings, making it the most significant segment in this category.

The Kuwait Iodophors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ecolab, Diversey Holdings, Ltd., 3M Company, Johnson & Johnson, Procter & Gamble, Henkel AG & Co. KGaA, Reckitt Benckiser Group plc, Clorox Company, Unilever, STERIS plc, BioSafe Systems, Spartan Chemical Company, Inc., Virox Technologies Inc., Medline Industries, Inc., PDI, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the iodophors market in Kuwait appears promising, driven by increasing health awareness and stringent hygiene regulations. As the healthcare and food sectors continue to expand, the demand for effective disinfectants is expected to rise. Additionally, technological advancements in iodophor formulations may enhance their efficacy and appeal. Companies that adapt to these trends and invest in product innovation will likely capture significant market share, positioning themselves favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Iodophors Powdered Iodophors Iodophor Tablets Others |

| By End-User | Healthcare Food and Beverage Agriculture Others |

| By Application | Surface Disinfection Water Treatment Equipment Sterilization Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Others |

| By Packaging Type | Bottles Drums Sachets Others |

| By Region | Central Kuwait Southern Kuwait Northern Kuwait Others |

| By Customer Type | B2B B2C Government Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Industry Usage | 100 | Quality Control Managers, Production Supervisors |

| Food Processing Applications | 80 | Food Safety Officers, Production Managers |

| Distributors and Suppliers | 70 | Sales Managers, Supply Chain Coordinators |

| Regulatory Compliance Insights | 50 | Regulatory Affairs Specialists, Compliance Officers |

| Market Trends and Innovations | 60 | Research and Development Managers, Industry Analysts |

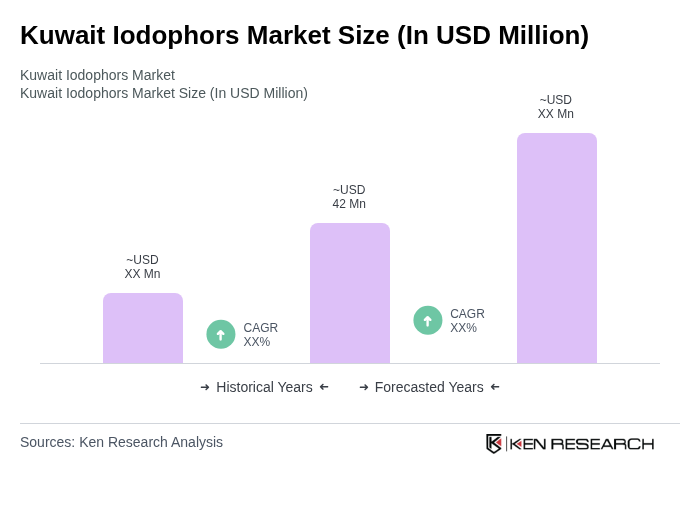

The Kuwait Iodophors Market is valued at approximately USD 42 million, reflecting a significant growth driven by increased demand for disinfectants in healthcare, food processing, and agricultural sectors, particularly following heightened hygiene awareness post-pandemic.