Region:Global

Author(s):Shubham

Product Code:KRAA6667

Pages:96

Published On:January 2026

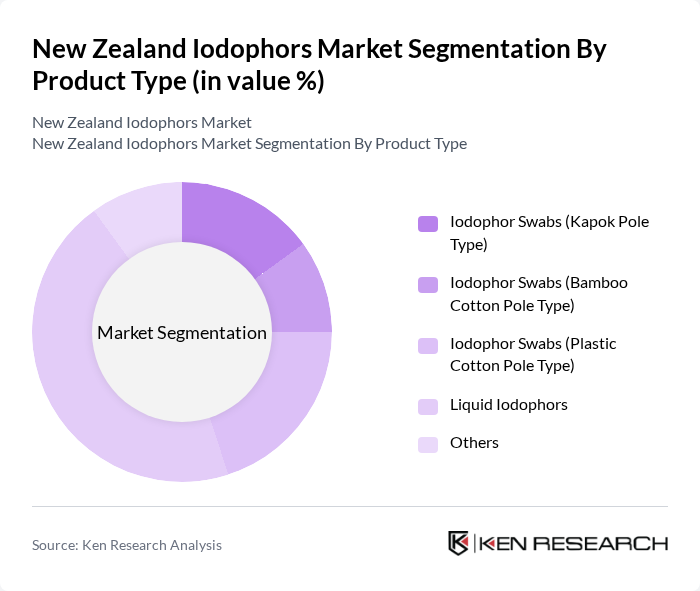

By Product Type:The product type segmentation includes various forms of iodophors, which cater to different applications and consumer preferences. The subsegments include Iodophor Swabs (Kapok Pole Type), Iodophor Swabs (Bamboo Cotton Pole Type), Iodophor Swabs (Plastic Cotton Pole Type), Liquid Iodophors, and Others. Among these, Liquid Iodophors are dominating the market due to their versatility and effectiveness in various sanitization processes. The growing trend towards liquid formulations is driven by their ease of use and application in both industrial and household settings.

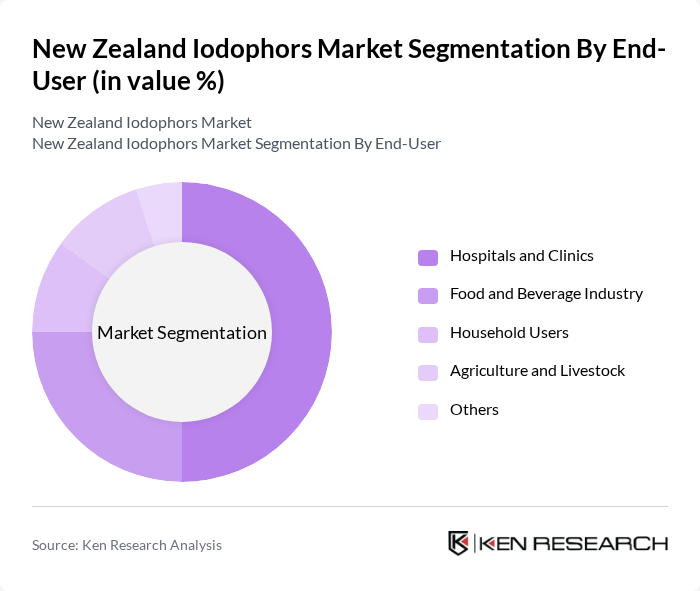

By End-User:The end-user segmentation encompasses various sectors utilizing iodophors, including Hospitals and Clinics, Food and Beverage Industry, Household Users, Agriculture and Livestock, and Others. Hospitals and Clinics are the leading end-users, driven by stringent hygiene standards and the need for effective disinfectants in medical settings. The increasing focus on infection control and patient safety in healthcare facilities significantly contributes to the demand for iodophors.

The New Zealand Iodophors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ecolab Inc., Diversey Holdings Ltd., Neogen Corporation, Stepan Company, Kersia Group, BioSafe Systems LLC, PeroxyChem LLC, Cargill Incorporated, Chr. Hansen A/S, GEA Group AG, Hach Company, Merck KGaA, Procter & Gamble Co., Univar Solutions Inc., BASF SE contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand iodophors market is poised for significant evolution, driven by increasing consumer demand for sustainable and effective sanitization solutions. As businesses adapt to stricter health regulations and consumer preferences shift towards eco-friendly products, manufacturers are likely to innovate and diversify their offerings. Additionally, the growth of e-commerce platforms will facilitate wider distribution, enabling easier access to iodophors. This dynamic environment presents opportunities for companies to enhance their market presence and capitalize on emerging trends in sanitization.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Iodophor Swabs (Kapok Pole Type) Iodophor Swabs (Bamboo Cotton Pole Type) Iodophor Swabs (Plastic Cotton Pole Type) Liquid Iodophors Others |

| By End-User | Hospitals and Clinics Food and Beverage Industry Household Users Agriculture and Livestock Others |

| By Application | Surface Sanitization Equipment Sanitization Water Treatment Surgical Hand Disinfection Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Specialty Suppliers Others |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging Others |

| By Region | North Island South Island Others |

| By Product Formulation | Concentrated Formulations Ready-to-Use Formulations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Processing Industry | 45 | Quality Assurance Managers, Production Supervisors |

| Healthcare Sector | 40 | Infection Control Specialists, Hospital Procurement Officers |

| Agricultural Applications | 35 | Agronomists, Farm Managers |

| Cleaning Product Manufacturers | 42 | Product Development Managers, Marketing Directors |

| Regulatory Bodies | 28 | Compliance Officers, Environmental Health Inspectors |

The New Zealand Iodophors Market is valued at approximately USD 42 million, reflecting a significant increase driven by heightened demand for effective disinfectants in healthcare, food processing, and agricultural applications, particularly following the COVID-19 pandemic.