Region:Asia

Author(s):Shubham

Product Code:KRAA6658

Pages:86

Published On:January 2026

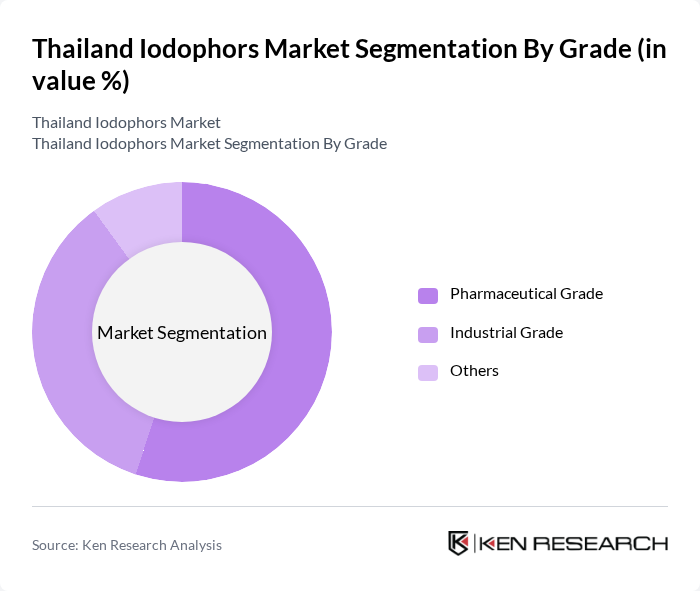

By Grade:The market is segmented into Pharmaceutical Grade, Industrial Grade, and Others. The Pharmaceutical Grade segment is leading due to its stringent quality requirements and high demand in healthcare applications. Industrial Grade iodophors are also significant, primarily used in food processing and agriculture. The Others segment includes various niche applications that contribute to the overall market.

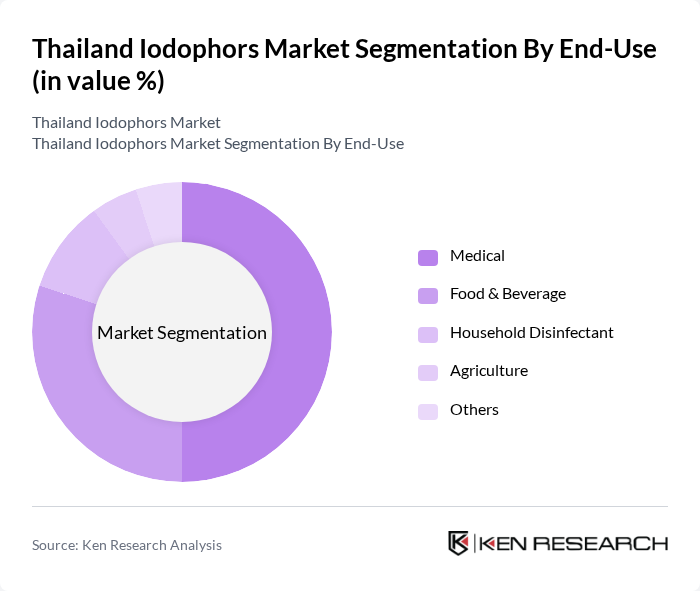

By End-Use:The market is categorized into Medical, Food & Beverage, Household Disinfectant, Agriculture, and Others. The Medical segment is the largest due to the heightened focus on infection control in healthcare settings. The Food & Beverage segment follows closely, driven by the need for safe food processing practices. Household disinfectants and agricultural applications also play vital roles in market dynamics.

The Thailand Iodophors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ecolab Inc., Diversey Holdings, Ltd., 3M Company, Johnson & Johnson, Procter & Gamble Co., Henkel AG & Co. KGaA, Reckitt Benckiser Group plc, Unilever PLC, Solvay S.A., BASF SE, Clorox Company, BioSafe Systems, LLC, Stepan Company, Spartan Chemical Company, Inc., Kersia Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the iodophors market in Thailand appears promising, driven by ongoing trends in sustainability and technological advancements. As consumers increasingly demand eco-friendly products, manufacturers are likely to invest in developing biodegradable iodophors. Additionally, advancements in production technology are expected to enhance efficiency and reduce costs, making iodophors more accessible. Collaborations with healthcare institutions will further bolster market growth, ensuring that iodophors remain a vital component in infection control and sanitation practices.

| Segment | Sub-Segments |

|---|---|

| By Grade | Pharmaceutical Grade Industrial Grade Others |

| By End-Use | Medical Food & Beverage Household Disinfectant Agriculture Others |

| By Application | Surface Disinfection Water Treatment Medical Equipment Sterilization Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging Others |

| By Region | Central Thailand Northern Thailand Southern Thailand Eastern Thailand |

| By Customer Type | B2B Customers B2C Customers Institutional Customers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Sector Usage | 45 | Pharmacy Managers, Hospital Procurement Officers |

| Food Processing Applications | 40 | Quality Control Managers, Production Supervisors |

| Agricultural Disinfectant Use | 35 | Farm Managers, Agricultural Specialists |

| Research and Development Insights | 30 | R&D Scientists, Product Development Managers |

| Distribution and Supply Chain | 50 | Supply Chain Managers, Distribution Specialists |

The Thailand Iodophors Market is valued at approximately USD 15 million, driven by increased demand for disinfectants in healthcare, food processing, and agricultural applications, particularly following heightened hygiene awareness post-pandemic.