Region:Middle East

Author(s):Shubham

Product Code:KRAA6662

Pages:83

Published On:January 2026

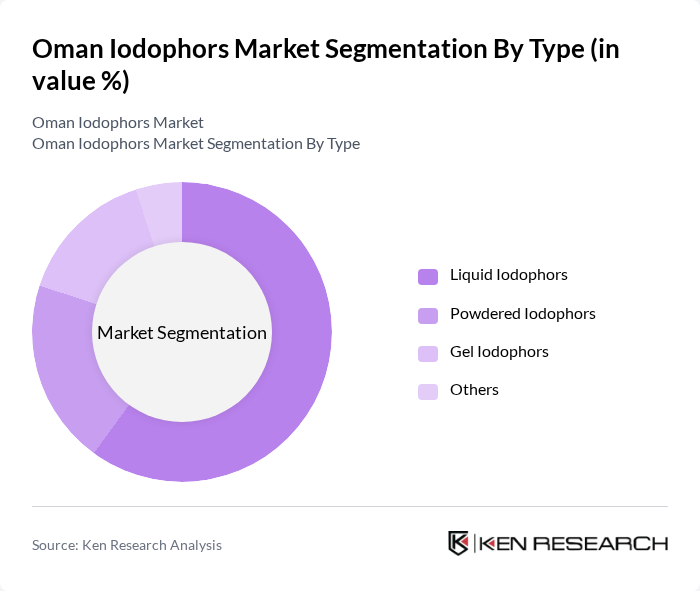

By Type:The market is segmented into Liquid Iodophors, Powdered Iodophors, Gel Iodophors, and Others. Among these, Liquid Iodophors dominate the market due to their ease of use and effectiveness in various applications, particularly in healthcare and food processing. The convenience of liquid formulations makes them a preferred choice for disinfection and sterilization processes.

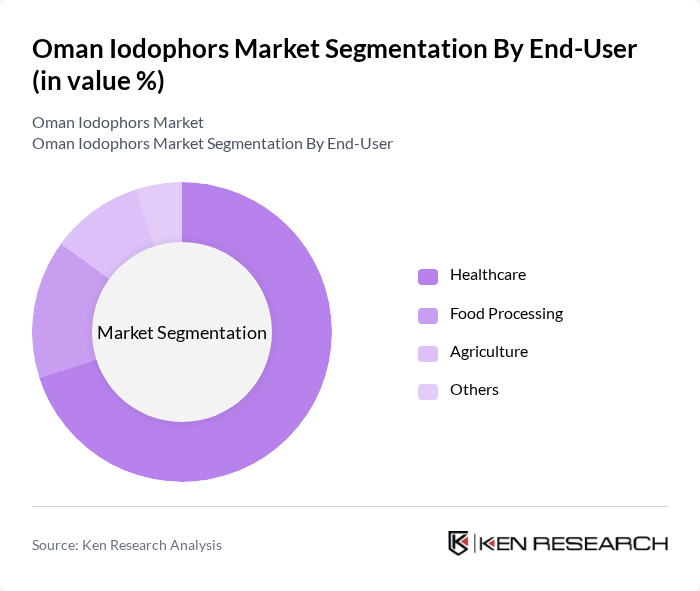

By End-User:The end-user segmentation includes Healthcare, Food Processing, Agriculture, and Others. The Healthcare sector is the leading end-user, driven by the increasing need for sterilization and disinfection in hospitals and clinics. The rise in healthcare-associated infections has led to a surge in the adoption of iodophors for effective infection control.

The Oman Iodophors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ecolab, Diversey Holdings, Ltd., 3M Company, Johnson & Johnson, Procter & Gamble, Henkel AG & Co. KGaA, Reckitt Benckiser Group plc, Clorox Company, Unilever, Solvay S.A., BASF SE, Dow Chemical Company, Merck Group, Albemarle Corporation, FMC Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the iodophors market in Oman appears promising, driven by increasing investments in healthcare infrastructure and a growing emphasis on hygiene. As the government continues to promote public health initiatives, the demand for effective disinfectants is expected to rise. Additionally, technological advancements in iodophor formulations will likely enhance product efficacy, positioning iodophors as a preferred choice in various sectors, including healthcare and food safety, thereby expanding market opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Iodophors Powdered Iodophors Gel Iodophors Others |

| By End-User | Healthcare Food Processing Agriculture Others |

| By Application | Surface Disinfection Water Treatment Equipment Sterilization Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Others |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging Others |

| By Region | Muscat Dhofar Al Batinah Others |

| By Market Segment | Institutional Commercial Industrial Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 45 | Quality Control Managers, Production Supervisors |

| Food Processing Sector | 40 | Food Safety Officers, Operations Managers |

| Agricultural Use Cases | 35 | Agronomists, Supply Chain Managers |

| Industrial Cleaning Applications | 42 | Facility Managers, Procurement Specialists |

| Research and Development Insights | 38 | R&D Managers, Product Development Scientists |

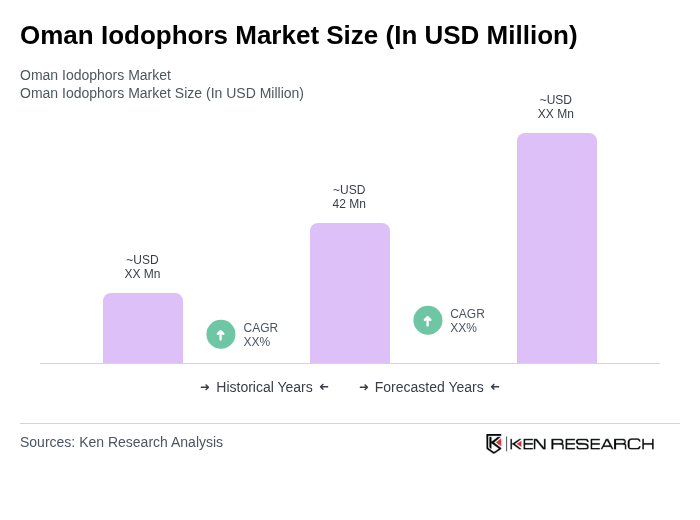

The Oman Iodophors Market is valued at approximately USD 42 million, reflecting a significant increase driven by the rising demand for effective disinfectants in healthcare, food processing, and agriculture sectors, particularly following heightened hygiene awareness post-pandemic.