Region:Asia

Author(s):Shubham

Product Code:KRAC5230

Pages:87

Published On:January 2026

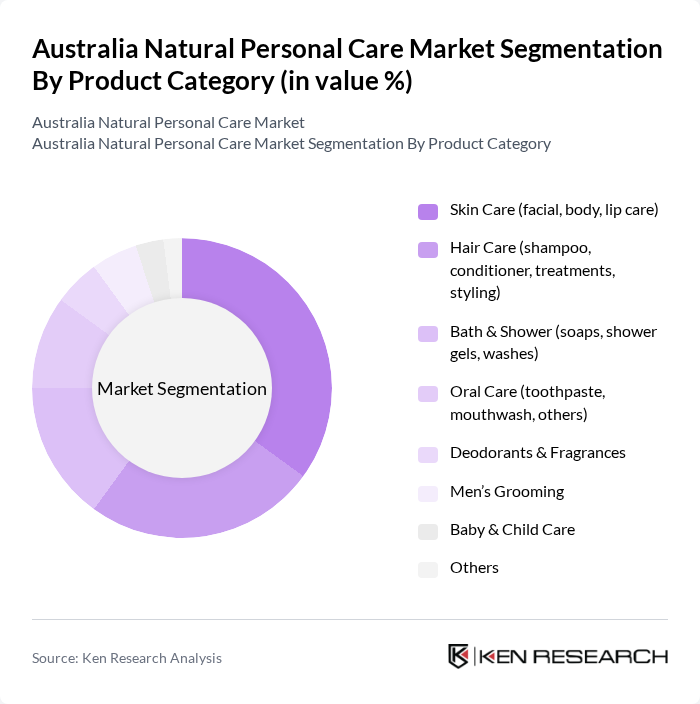

By Product Category:The product category segmentation of the market includes various segments such as Skin Care, Hair Care, Bath & Shower, Oral Care, Deodorants & Fragrances, Men’s Grooming, Baby & Child Care, and Others. Among these, Skin Care is the leading segment, supported by the strong overall performance of the Australian skincare market and consumer focus on daily routines, facial care, and targeted treatments using natural and botanical ingredients. Consumers are increasingly seeking products that offer both efficacy and safety, with preference for claims such as organic, clean, fragrance-free, and sensitive-skin friendly, which has driven a surge in demand for natural moisturisers, serums, sunscreens, and face and body cleansers.

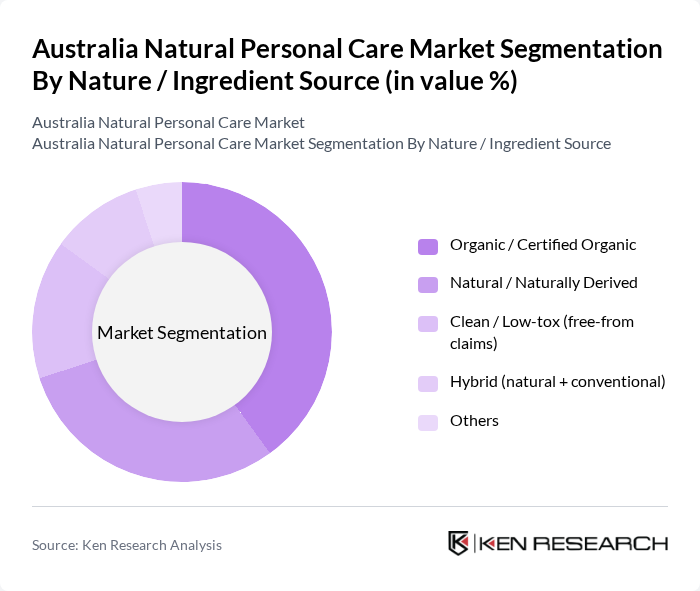

By Nature / Ingredient Source:This segmentation includes Organic / Certified Organic, Natural / Naturally Derived, Clean / Low-tox (free-from claims), Hybrid (natural + conventional), and Others. The Organic / Certified Organic and broader clean/natural segments are the key growth engines in the market, reflecting consumers’ prioritization of formulations that minimise synthetic chemicals such as parabens, sulfates, and phthalates, and that are aligned with organic farming and sustainable sourcing practices. This trend is further fueled by the growing availability of organic and clean products in supermarkets, specialty beauty retailers, pharmacies, and online channels, where detailed ingredient information, certifications, and user reviews help consumers validate safety, origin, and environmental credentials.

The Australia Natural Personal Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aesop, Jurlique, Sukin, Eco Tan, The Body Shop, Kora Organics, Biologi, MooGoo, Bondi Wash, Frank Body, Natio, Dr. Bronner's, Weleda, Trilogy, Black Chicken Remedies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the natural personal care market in Australia appears promising, driven by evolving consumer preferences and increasing environmental awareness. As more consumers seek products that align with their values, brands that prioritize sustainability and transparency are likely to thrive. Additionally, the integration of technology in product development and marketing strategies will enhance consumer engagement, fostering brand loyalty. The market is expected to adapt to these trends, creating a dynamic landscape for innovation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Skin Care (facial, body, lip care) Hair Care (shampoo, conditioner, treatments, styling) Bath & Shower (soaps, shower gels, washes) Oral Care (toothpaste, mouthwash, others) Deodorants & Fragrances Men’s Grooming Baby & Child Care Others |

| By Nature / Ingredient Source | Organic / Certified Organic Natural / Naturally Derived Clean / Low-tox (free-from claims) Hybrid (natural + conventional) Others |

| By Distribution Channel | Supermarkets/Hypermarkets Pharmacies & Drugstores Specialist Beauty & Health Stores Online (brand D2C, marketplaces, subscription) Department Stores & Duty-Free Others |

| By Consumer Demographics | Age Group (Gen Z, Millennials, Gen X, Boomers) Gender (Female, Male, Unisex) Income Level (Mass, Masstige, Premium) Lifestyle & Values (eco-conscious, vegan, sensitive-skin, etc.) |

| By Packaging Type | Recyclable Packaging Biodegradable / Compostable Packaging Refillable / Reusable Packaging Minimal / Plastic-free Packaging Others |

| By Brand Positioning | Mass / Value Brands Masstige / Mid-range Brands Premium / Prestige Brands Niche / Indie Brands Private Label |

| By Product Claims | Cruelty-Free Vegan Organic / Certified Organic Hypoallergenic / Dermatologically Tested Free-from (paraben-free, sulfate-free, etc.) Sustainable / Ethical (fair trade, carbon-neutral, etc.) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Natural Skincare | 120 | Health-conscious Consumers, Beauty Enthusiasts |

| Market Insights from Retailers | 80 | Store Managers, Category Buyers |

| Trends in Natural Haircare Products | 60 | Haircare Product Developers, Salon Owners |

| Impact of Sustainability on Purchasing Decisions | 100 | Eco-conscious Consumers, Sustainability Advocates |

| Distribution Channels for Natural Personal Care | 70 | Logistics Managers, E-commerce Directors |

The Australia Natural Personal Care Market is valued at approximately USD 200 million, reflecting a significant growth trend driven by increasing consumer awareness of health, wellness, and demand for sustainable products.