Region:Asia

Author(s):Shubham

Product Code:KRAC5226

Pages:89

Published On:January 2026

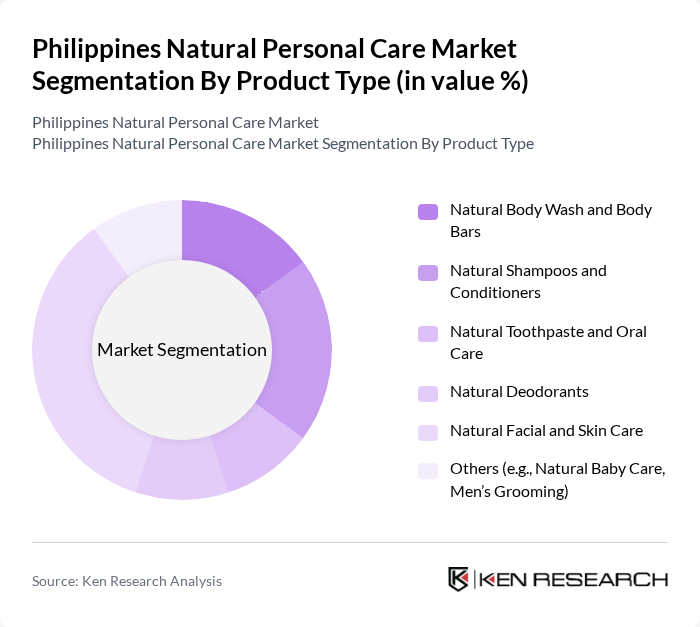

By Product Type:The product type segmentation of the market includes various categories that cater to different consumer needs. The subsegments include Natural Body Wash and Body Bars, Natural Shampoos and Conditioners, Natural Toothpaste and Oral Care, Natural Deodorants, Natural Facial and Skin Care, and Others (e.g., Natural Baby Care, Men’s Grooming). Among these, Natural Facial and Skin Care products dominate the market due to the increasing focus on skincare routines, the influence of the clean beauty trend, and the rising popularity of organic and naturally derived ingredients in moisturizers, serums, sunscreens, and treatment products. Consumers are increasingly inclined towards products that promise natural benefits, shorter ingredient lists, and multi-functional skin benefits, leading to a surge in demand for facial and skin care items positioned as natural or clean.

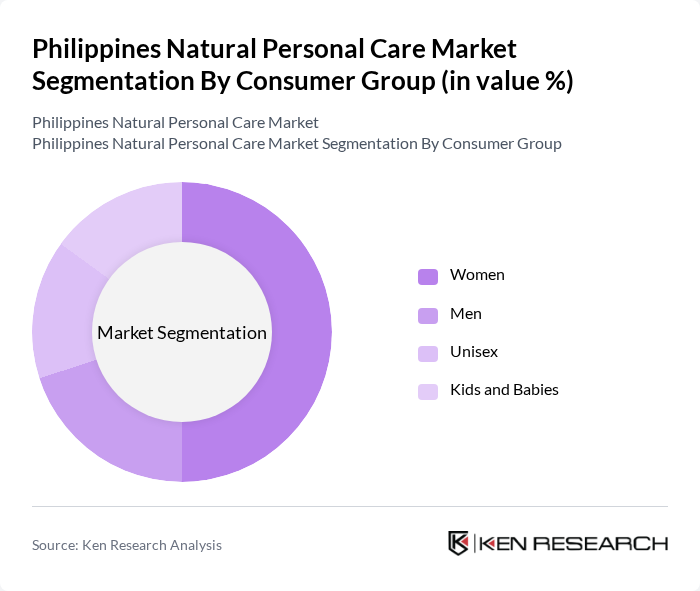

By Consumer Group:This segmentation focuses on the different demographics that utilize natural personal care products. The subsegments include Women, Men, Unisex, and Kids and Babies. Women represent the largest consumer group, driven by a growing interest in skincare and beauty products that are perceived as safer and more effective, as well as strong adoption of natural and clean beauty concepts among female consumers. The trend towards gender-neutral products is also gaining traction, with unisex offerings appealing to a broader audience that values minimalist routines, shared household products, and inclusive branding, while parents increasingly seek natural formulations for kids and babies, particularly in bath, skincare, and hair care products.

The Philippines Natural Personal Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Human Nature (Gandang Kalikasan Inc.), Zenutrients, VMV Hypoallergenics, Snoe Beauty, Pili Ani, Ellana Mineral Cosmetics, Be Organic Bath & Body, Belo Essentials, Ever Bilena (EB Naturals and Related Lines), The Body Shop Philippines, Lush Philippines, Happy Skin, Herbalife Nutrition Philippines (Personal Care Line), Organique, Other Emerging Natural Indie Brands contribute to innovation, geographic expansion, and service delivery in this space.

The future of the natural personal care market in the Philippines appears promising, driven by increasing consumer demand for sustainable and health-conscious products. As awareness of the benefits of natural ingredients continues to rise, brands are likely to innovate and expand their offerings. Additionally, the growth of e-commerce will facilitate greater access to these products, allowing brands to reach a wider audience. Collaborations with influencers and educational campaigns will further enhance consumer understanding and acceptance of natural personal care solutions.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Natural Body Wash and Body Bars Natural Shampoos and Conditioners Natural Toothpaste and Oral Care Natural Deodorants Natural Facial and Skin Care Others (e.g., Natural Baby Care, Men’s Grooming) |

| By Consumer Group | Women Men Unisex Kids and Babies |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Beauty and Personal Care Stores Pharmacies/Drugstores Convenience Stores E-commerce and Online Marketplaces Direct Selling and Others |

| By Nature/Certification | Natural Organic Vegan/Cruelty-Free Halal-Certified Others (e.g., Dermatologist-Tested, Hypoallergenic) |

| By Price Segment | Mass Mid-Priced Premium |

| By Packaging Format | Bottles and Jars Tubes and Sticks Bars and Solid Formats Refill and Bulk Packs Others (e.g., Sachets, Kits) |

| By End Use | Household/Individual Use Professional Use (Salons, Spas, Dermatology Clinics) Hospitality and Corporate Gifting Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Natural Skincare | 140 | Women aged 18-45, Skincare Enthusiasts |

| Market Insights from Retailers | 80 | Store Managers, Beauty Product Buyers |

| Trends in Haircare Products | 110 | Haircare Professionals, Salon Owners |

| Consumer Attitudes towards Organic Cosmetics | 70 | Eco-conscious Consumers, Health & Wellness Advocates |

| Distribution Channel Effectiveness | 60 | Distributors, E-commerce Managers |

The Philippines Natural Personal Care Market is valued at approximately USD 270 million, reflecting a growing trend towards health-conscious and eco-friendly personal care products among consumers.