Region:Middle East

Author(s):Shubham

Product Code:KRAC5227

Pages:92

Published On:January 2026

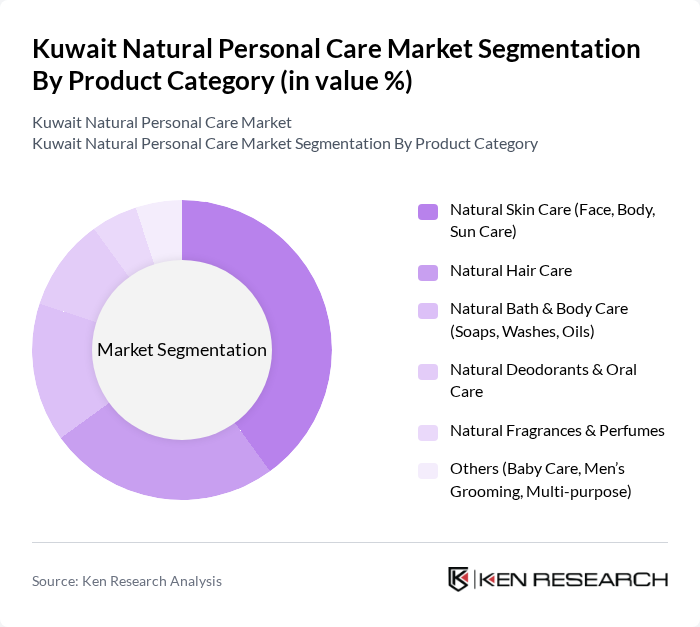

By Product Category:The product category segmentation includes various subsegments such as Natural Skin Care (Face, Body, Sun Care), Natural Hair Care, Natural Bath & Body Care (Soaps, Washes, Oils), Natural Deodorants & Oral Care, Natural Fragrances & Perfumes, and Others (Baby Care, Men’s Grooming, Multi-purpose). Among these, Natural Skin Care is the leading subsegment, driven by the increasing consumer preference for skincare products that utilize organic and natural ingredients and the importance of facial and body care in beauty routines. The trend towards holistic beauty and self-care, including multi-step skincare routines and targeted solutions such as serums and masks, has significantly influenced consumer behavior, leading to a higher demand for products that promise skin health, protection, and overall wellness.

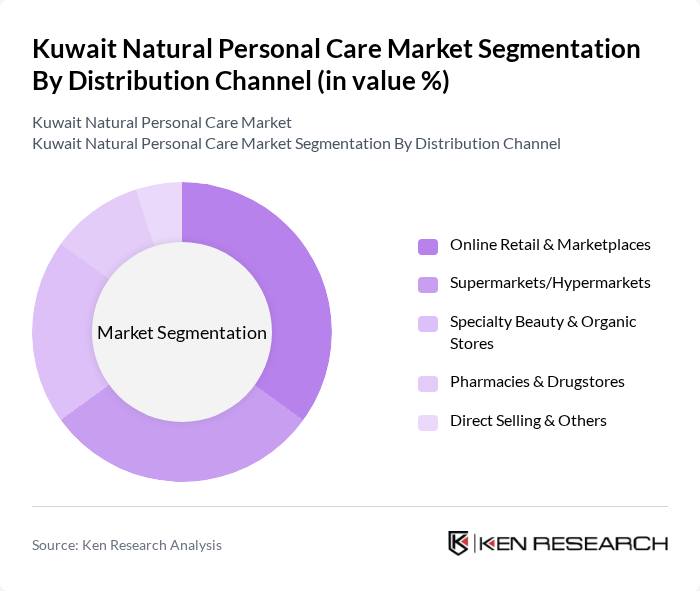

By Distribution Channel:The distribution channel segmentation encompasses Online Retail & Marketplaces, Supermarkets/Hypermarkets, Specialty Beauty & Organic Stores, Pharmacies & Drugstores, and Direct Selling & Others. Online Retail & Marketplaces have emerged as the dominant channel, reflecting the growing trend of e?commerce and the convenience it offers to consumers, in line with the broader shift towards digital purchasing in beauty and personal care across the region. The shift towards digital shopping, accelerated by pandemic-era behavior and sustained by widespread smartphone and social media use, has led to an increase in online sales of natural personal care products, with consumers relying on brand websites, marketplaces, and social commerce for product discovery and repeat purchasing.

The Kuwait Natural Personal Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Haramain Perfumes, Al Shaya Group (Retail & Beauty Franchises), Kiehl’s, The Body Shop, Lush Fresh Handmade Cosmetics, Herbal Essentials, Neal’s Yard Remedies, Weleda, Nuxe, Burt’s Bees, Avalon Organics, Dr. Organic, Faith in Nature, Local Kuwaiti Natural/Organic Brands (e.g., Joelle Paris Kuwait, K7L), Other International Natural Personal Care Brands Present in Kuwait contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait natural personal care market appears promising, driven by increasing consumer demand for transparency and sustainability. As more consumers prioritize health and wellness, brands that emphasize natural ingredients and eco-friendly practices are likely to thrive. Additionally, the rise of digital marketing strategies will enhance brand visibility and consumer engagement, fostering a more informed customer base. This evolving landscape presents opportunities for innovation and collaboration, particularly in product development and marketing approaches.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Natural Skin Care (Face, Body, Sun Care) Natural Hair Care Natural Bath & Body Care (Soaps, Washes, Oils) Natural Deodorants & Oral Care Natural Fragrances & Perfumes Others (Baby Care, Men’s Grooming, Multi-purpose) |

| By Distribution Channel | Online Retail & Marketplaces Supermarkets/Hypermarkets Specialty Beauty & Organic Stores Pharmacies & Drugstores Direct Selling & Others |

| By Consumer Segment | Women Men Baby & Children Premium/Luxury Consumers Mass/Affordable Segment |

| By Claim/Positioning | Organic / Certified Organic Natural / Naturally Derived Clean / Free-from (Paraben, SLS, Silicone) Vegan & Cruelty-Free Halal-certified |

| By Packaging Type | Bottles & Pumps Tubes Jars Solid/Bar & Refill Packs Eco-friendly & Recyclable Formats |

| By Price Tier | Mass/Budget Mid-Range Premium Prestige/Luxury |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Natural Skincare | 120 | Female Consumers, Ages 18-45 |

| Retail Insights on Natural Haircare Products | 80 | Store Managers, Beauty Advisors |

| Market Trends in Organic Body Care | 60 | Health and Wellness Influencers, Bloggers |

| Distribution Channels for Natural Personal Care | 60 | Distributors, Wholesalers |

| Consumer Attitudes Towards Eco-Friendly Packaging | 100 | Environmentally Conscious Consumers |

The Kuwait Natural Personal Care Market is valued at approximately USD 160 million, reflecting a significant share of the broader beauty and personal care market, driven by increasing consumer preference for natural and eco-friendly products.