Region:Middle East

Author(s):Shubham

Product Code:KRAC5228

Pages:86

Published On:January 2026

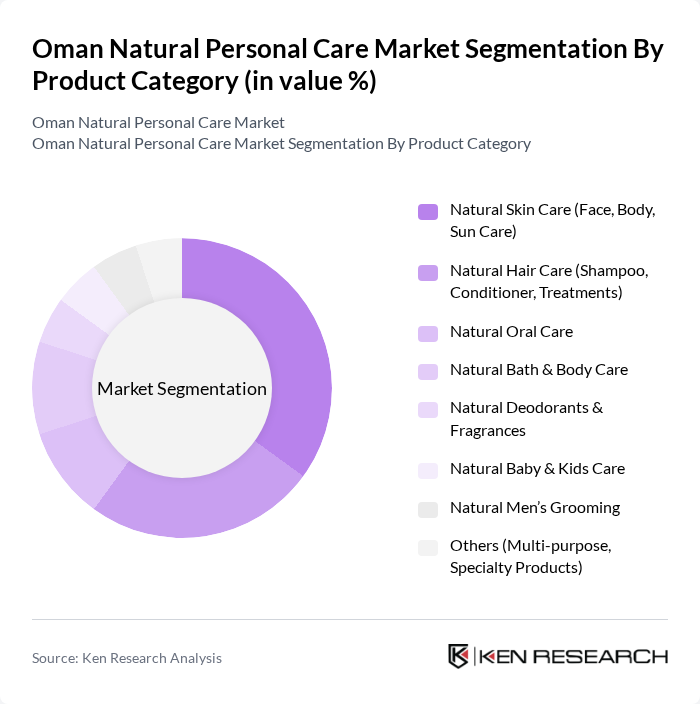

By Product Category:The product category segmentation includes various subsegments such as Natural Skin Care, Natural Hair Care, Natural Oral Care, Natural Bath & Body Care, Natural Deodorants & Fragrances, Natural Baby & Kids Care, Natural Men’s Grooming, and Others. Among these, Natural Skin Care is the leading subsegment, driven by increasing consumer preference for organic and chemical-free products and a growing focus on preventive skincare routines. The demand for facial and body care products has surged, particularly among millennials and health-conscious consumers, who are increasingly influenced by social media, dermatology-led recommendations, and interest in products with plant-based actives, minimal additives, and sustainable packaging.

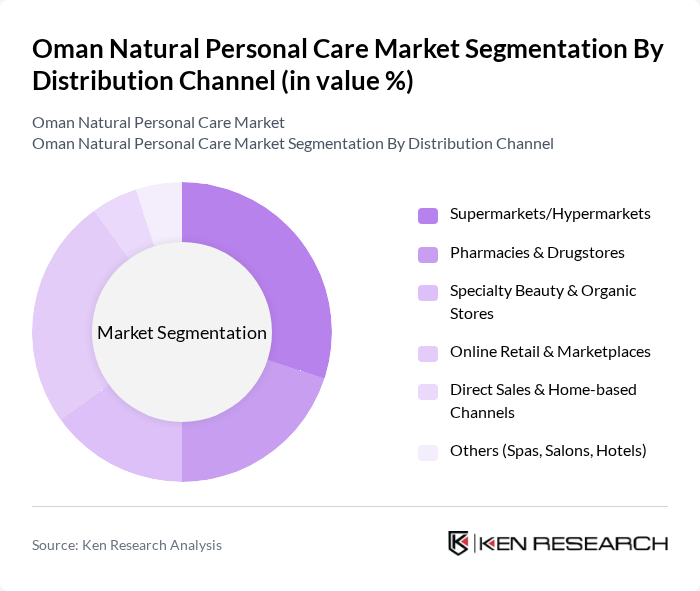

By Distribution Channel:The distribution channel segmentation includes Supermarkets/Hypermarkets, Pharmacies & Drugstores, Specialty Beauty & Organic Stores, Online Retail & Marketplaces, Direct Sales & Home-based Channels, and Others. The Online Retail & Marketplaces subsegment is currently one of the fastest-growing parts of the market, driven by the increasing trend of e-commerce, wider product assortment, and the convenience it offers to consumers, particularly younger and urban shoppers. The rise of social media marketing, influencer collaborations, and digital product education has also played a significant role in promoting natural personal care products and accelerating discovery of niche and imported brands.

The Oman Natural Personal Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Body Shop, L’Occitane en Provence, Neal’s Yard Remedies, Khadi Natural, Himalaya Wellness, Faith In Nature, Avalon Organics, Dr. Organic, Weleda, Desert Essence, Sukin, Love Beauty and Planet, Local Omani Natural Brand 1, Local Omani Natural Brand 2, Private Label / Retailer Natural Brand contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman natural personal care market appears promising, driven by increasing consumer demand for transparency and sustainability. As the government implements stricter regulations on ingredient transparency, brands that prioritize eco-friendly practices are likely to gain a competitive edge. Additionally, the rise of social media influencers is expected to play a pivotal role in educating consumers about natural products, further enhancing market growth. The combination of these factors will likely foster a more informed consumer base, leading to increased adoption of natural personal care products.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Natural Skin Care (Face, Body, Sun Care) Natural Hair Care (Shampoo, Conditioner, Treatments) Natural Oral Care Natural Bath & Body Care Natural Deodorants & Fragrances Natural Baby & Kids Care Natural Men’s Grooming Others (Multi-purpose, Specialty Products) |

| By Distribution Channel | Supermarkets/Hypermarkets Pharmacies & Drugstores Specialty Beauty & Organic Stores Online Retail & Marketplaces Direct Sales & Home-based Channels Others (Spas, Salons, Hotels) |

| By Consumer Profile | Women Men Children & Babies Millennials & Gen Z High-income & Expat Consumers Others |

| By Ingredient & Claim | Certified Organic Herbal / Botanical-based Halal-certified Vegan & Cruelty-free Free-from (Paraben-free, Sulfate-free, etc.) Others |

| By Price Positioning | Mass / Budget Mid-range / Masstige Premium Luxury Others |

| By Packaging Sustainability | Recyclable Packaging Biodegradable / Compostable Packaging Refillable / Reusable Packaging Standard Packaging Others |

| By Origin of Brand | Local Omani Brands Regional GCC Brands International Brands Private Label & Retailer Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Natural Skincare | 120 | Women aged 18-45, Skincare Enthusiasts |

| Market Insights from Retailers | 60 | Store Managers, Beauty Product Buyers |

| Trends in Haircare Products | 50 | Haircare Professionals, Salon Owners |

| Consumer Attitudes towards Organic Ingredients | 80 | Health-Conscious Consumers, Eco-Friendly Product Users |

| Distribution Channel Effectiveness | 40 | Distributors, E-commerce Managers |

The Oman Natural Personal Care Market is valued at approximately USD 17 million, reflecting a growing trend towards natural and organic products among consumers, driven by increased awareness of the benefits of natural ingredients.