Region:Asia

Author(s):Shubham

Product Code:KRAC5231

Pages:82

Published On:January 2026

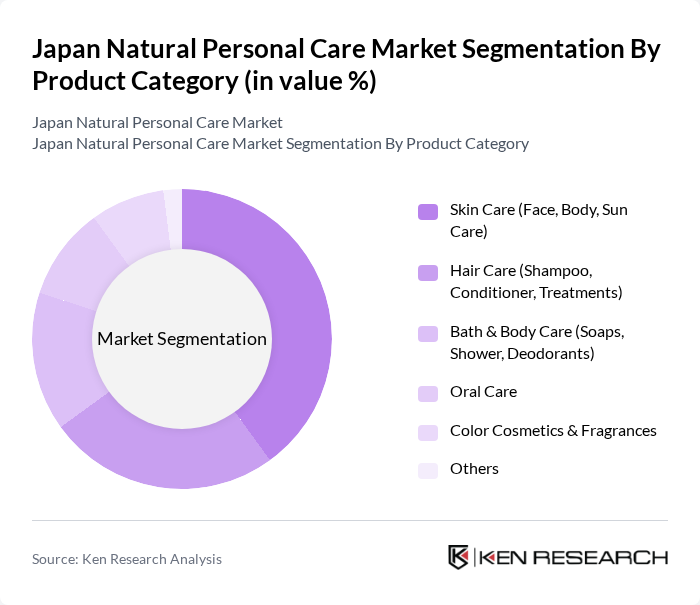

By Product Category:The product category segmentation includes various subsegments such as Skin Care (Face, Body, Sun Care), Hair Care (Shampoo, Conditioner, Treatments), Bath & Body Care (Soaps, Shower, Deodorants), Oral Care, Color Cosmetics & Fragrances, and Others. Among these, Skin Care is the leading subsegment, supported by the importance of multi-step skincare routines in Japan and the strong shift toward natural, clean, and anti-aging formulations enriched with botanical and fermentation-derived ingredients. Consumers are increasingly seeking products that offer anti-aging benefits, hydration, barrier repair, and sensitive-skin compatibility while being free from perceived harmful chemicals such as certain parabens, mineral oils, and artificial fragrances, which further accelerates demand for natural and organic skincare solutions.

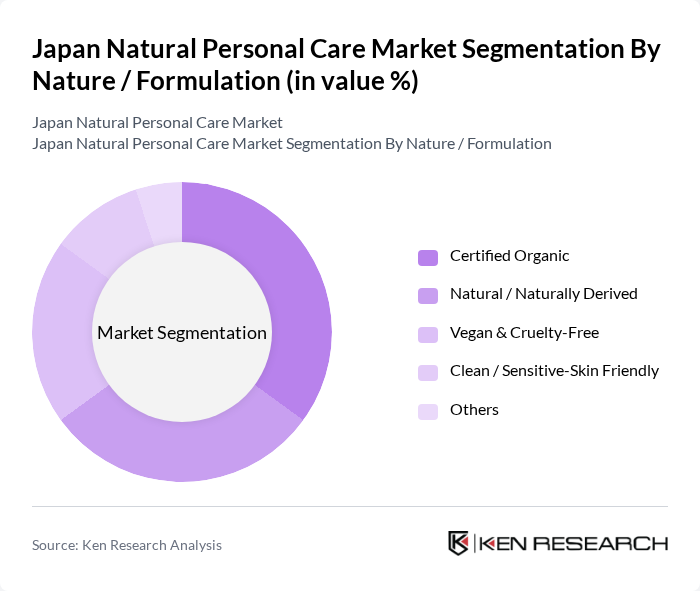

By Nature / Formulation:This segmentation includes Certified Organic, Natural / Naturally Derived, Vegan & Cruelty-Free, Clean / Sensitive-Skin Friendly, and Others. Within Japan, natural or naturally derived formulations currently account for a substantial share of demand, as many consumers prioritize plant-based, low-irritant ingredients and Japanese botanical extracts, even when products are not fully certified organic. Certified organic and third?party certification schemes are gaining traction, especially in premium and specialty retail channels, as consumers become more aware of certification labels and seek products that are demonstrably free from synthetic additives, aligned with sustainable sourcing, cruelty?free testing, and environmentally responsible packaging.

The Japan Natural Personal Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Shiseido Company, Limited, Kao Corporation, Fancl Corporation, DHC Corporation, Aveda Corporation (The Estée Lauder Companies Inc.), The Body Shop International Limited, Lush Fresh Handmade Cosmetics Ltd., Amway Japan G.K., Mandom Corporation, POLA ORBIS HOLDINGS INC., ORBIS Inc., Neal’s Yard Remedies, Jurlique International Pty Ltd, Melvita Japan, HABA Laboratories, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan natural personal care market appears promising, driven by evolving consumer preferences and increasing environmental consciousness. As more consumers seek products that align with their values, brands that emphasize sustainability and transparency are likely to thrive. Additionally, the integration of technology in product development and marketing strategies will enhance consumer engagement, fostering brand loyalty. The market is expected to adapt to these trends, paving the way for innovative solutions that cater to the growing demand for natural and eco-friendly personal care products.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Skin Care (Face, Body, Sun Care) Hair Care (Shampoo, Conditioner, Treatments) Bath & Body Care (Soaps, Shower, Deodorants) Oral Care Color Cosmetics & Fragrances Others |

| By Nature / Formulation | Certified Organic Natural / Naturally Derived Vegan & Cruelty-Free Clean / Sensitive-Skin Friendly Others |

| By Distribution Channel | Supermarkets/Hypermarkets Drugstores & Pharmacies Specialty & Health & Beauty Stores Department Stores Online Retail (E-commerce & D2C) Others |

| By End User | Female Male Unisex Kids |

| By Price Tier | Mass Masstige Premium / Luxury Others |

| By Packaging Sustainability | Recyclable Packaging Biodegradable / Compostable Packaging Refillable / Reusable Packaging Minimal / Plastic-free Packaging Others |

| By Claims & Benefits | Anti-Aging & Firming Hydration & Moisturizing Sensitive-Skin / Hypoallergenic Whitening / Brightening Acne / Oil Control Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Natural Skincare | 150 | Skincare Users, Beauty Enthusiasts |

| Market Trends in Organic Haircare | 120 | Haircare Product Users, Salon Owners |

| Insights on Eco-friendly Cosmetics | 90 | Makeup Users, Environmental Advocates |

| Distribution Channel Effectiveness | 70 | Retail Managers, E-commerce Specialists |

| Impact of Influencer Marketing | 100 | Social Media Influencers, Marketing Professionals |

The Japan Natural Personal Care Market is valued at approximately USD 3.5 billion, reflecting a significant growth driven by increasing consumer awareness of health and wellness, and a rising demand for organic and natural ingredients in personal care products.