Region:Global

Author(s):Shubham

Product Code:KRAC5232

Pages:94

Published On:January 2026

By Product Category:The product category segmentation includes various subsegments that cater to different consumer needs and preferences. The natural skincare segment, which encompasses face, body, and sun care products, is particularly popular and remains the anchor category, supported by strong consumer focus on skin health, sensitivity to synthetic ingredients, and interest in botanicals such as manuka honey, kawakawa, and plant oils. Natural haircare products, including shampoos, conditioners, and treatments, are also gaining traction as consumers seek formulations free from sulfates, parabens, and silicones and look for products positioned as gentle, vegan, and cruelty-free. Other notable subsegments include natural bath and body products, deodorants, oral care, cosmetics, and specialized offerings for babies and men, where demand is supported by the broader clean beauty movement, fragrance-free and hypoallergenic positioning, and interest in minimalist and multi-purpose formats.

By Distribution Channel:The distribution channel segmentation highlights the various avenues through which natural personal care products reach consumers. Supermarkets and hypermarkets are the leading channels, providing convenience, national coverage, and visibility for both domestic and imported natural brands within broader beauty and personal care assortments. Pharmacies and drugstores also play a significant role, particularly for health-focused consumers who associate natural and dermocosmetic products with safety, efficacy, and professional recommendation. Specialty beauty and health stores cater to niche and premium segments, often emphasizing organic certification, local provenance, and zero-waste concepts, while direct-to-consumer online sales have surged in line with the rapid growth of e-commerce and brand-owned digital channels in beauty and personal care. Other channels include third-party online retailers, health food stores, and various specialty outlets such as eco-stores and refill shops that appeal to sustainability-conscious consumers.

The New Zealand Natural Personal Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trilogy Natural Products, Antipodes, ecostore, Living Nature, Weleda New Zealand, Pure Fiji, Skinfood, The Herb Farm, Ethique, Aotea, Linden Leaves, Tailor Skincare, Essano, Oxygen Skincare, and other emerging natural personal care brands contribute to innovation, geographic expansion, and service delivery in this space, leveraging New Zealand’s reputation for clean, green sourcing and native botanicals in brand positioning.

The future of the New Zealand natural personal care market appears promising, driven by evolving consumer preferences and increasing environmental consciousness. As more consumers seek products that align with their values, brands that emphasize transparency and sustainability are likely to thrive. Additionally, the integration of technology in product development will enhance innovation, allowing companies to create personalized solutions that cater to individual consumer needs, further driving market growth and engagement.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Natural Skincare (Face, Body, Sun Care) Natural Haircare (Shampoo, Conditioner, Treatments) Natural Bath & Body (Soaps, Washes, Oils) Natural Deodorants Natural Oral Care (Toothpaste, Mouthwash) Natural Cosmetics & Makeup Others (Baby Care, Men’s Grooming, Multi-purpose Balms) |

| By Distribution Channel | Supermarkets/Hypermarkets Pharmacies & Drugstores Specialty Beauty & Health Stores Direct-to-Consumer Online (Brand E-commerce) Third-party Online Retailers & Marketplaces Health Food Stores & Organic Shops Others (Salons, Spas, Duty Free, Boutique Stores) |

| By Consumer Segment | Women Men Unisex Babies & Kids |

| By Claim / Positioning | Organic / Certified Organic Natural / Naturally Derived Vegan & Cruelty-free Clean / Free-from (Parabens, Sulphates, Synthetic Fragrances) Sensitivity / Dermatologically Tested Others (Microbiome-friendly, Allergy-friendly) |

| By Packaging & Sustainability Attributes | Plastic (Recycled / Recyclable) Glass & Aluminum Paper & Cardboard-based Solid / Package-free Formats (Bars, Concentrates) Refillable / Reusable Systems |

| By Price Tier | Mass / Value Masstige Premium Luxury |

| By End-use Context | Household / Individual Use Professional Use (Spas, Salons, Clinics) Hospitality & Tourism (Hotels, Lodges, Wellness Retreats) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Natural Skincare Products | 110 | Product Managers, Brand Strategists |

| Organic Haircare Lines | 85 | Retail Buyers, Marketing Directors |

| Cosmetics with Natural Ingredients | 75 | Cosmetic Chemists, Sales Executives |

| Consumer Preferences in Personal Care | 95 | End Consumers, Market Researchers |

| Trends in Sustainable Packaging | 65 | Sustainability Managers, Packaging Engineers |

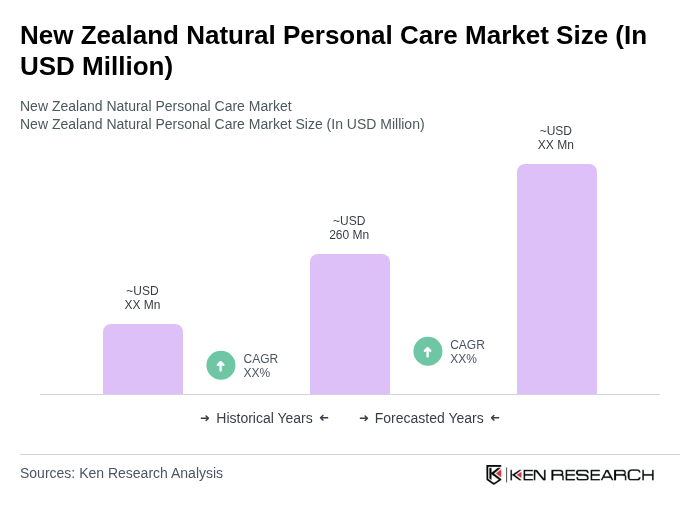

The New Zealand Natural Personal Care Market is valued at approximately USD 260 million, reflecting a significant growth trend driven by increasing consumer awareness of health, wellness, and the demand for organic and natural products.