Region:Asia

Author(s):Shubham

Product Code:KRAA6595

Pages:84

Published On:January 2026

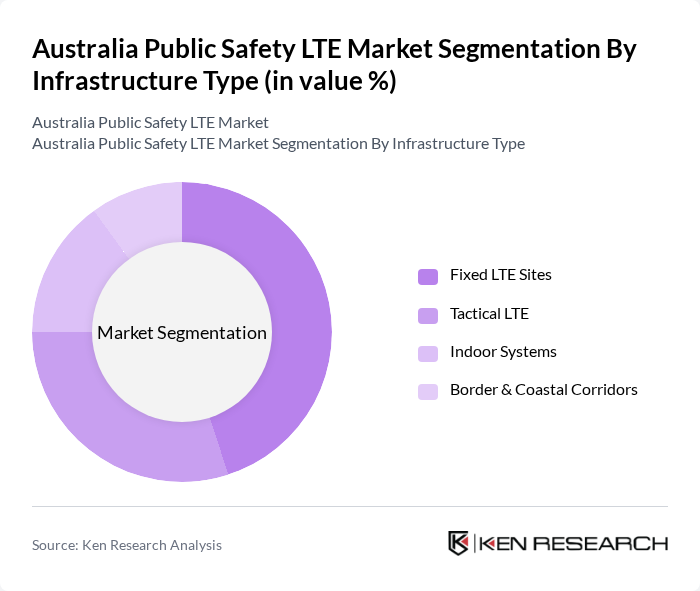

By Infrastructure Type:The infrastructure type segmentation includes Fixed LTE Sites, Tactical LTE, Indoor Systems, and Border & Coastal Corridors. Among these, Fixed LTE Sites are currently leading the market due to their reliability and extensive coverage, which are essential for public safety operations. Tactical LTE is also gaining traction, particularly for temporary setups during emergencies, with this segment expected to experience accelerated growth driven by demand for portable and rapidly deployable solutions. The demand for Indoor Systems is increasing as agencies seek to improve communication in buildings, while Border & Coastal Corridors are critical for national security and surveillance.

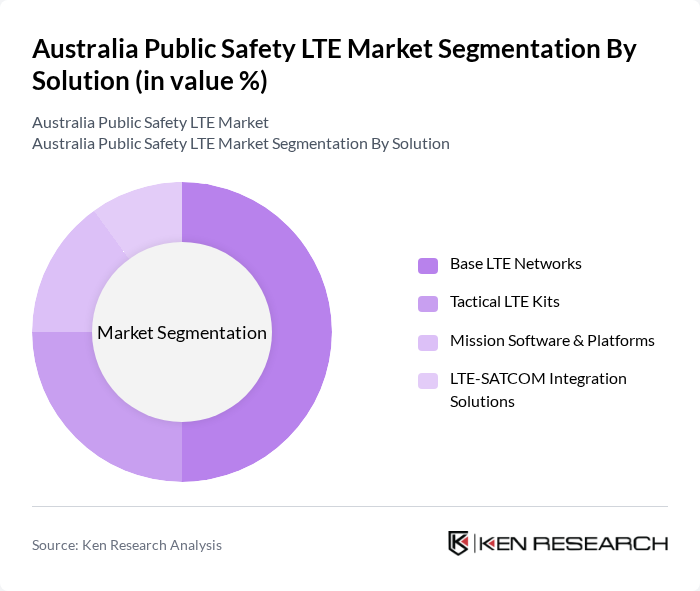

By Solution:The solution segmentation encompasses Base LTE Networks, Tactical LTE Kits, Mission Software & Platforms, and LTE-SATCOM Integration Solutions. Base LTE Networks dominate the market due to their foundational role in establishing communication infrastructure for public safety agencies, driven by the gradual shift from voice-centric traditional radio access network systems toward broadband-capable LTE/5G mission networks. Tactical LTE Kits are increasingly popular for their portability and ease of deployment in emergency situations and are projected to experience the highest growth rates among solution categories. Mission Software & Platforms are essential for managing operations and enabling real-time data sharing and situational awareness, while LTE-SATCOM Integration Solutions are crucial for remote areas where traditional networks may not be available.

The Australia Public Safety LTE Market is characterized by a dynamic mix of regional and international players. Leading participants such as Telstra Corporation Limited, Optus Networks Pty Limited, Motorola Solutions, Inc., Harris Corporation, Nokia Corporation, Ericsson AB, Cisco Systems, Inc., Hytera Communications Corporation Limited, ZTE Corporation, Samsung Electronics Co., Ltd., Thales Group, NEC Corporation, Fujitsu Limited, Tait Communications, Unify Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia Public Safety LTE market appears promising, driven by ongoing technological advancements and increased government support. As agencies continue to adopt integrated communication solutions, the focus will shift towards enhancing data analytics capabilities for improved decision-making. Furthermore, the expansion of 5G technology is expected to revolutionize public safety communications, providing faster and more reliable connectivity. This evolution will enable agencies to respond more effectively to emergencies, ultimately leading to safer communities and improved public trust in emergency services.

| Segment | Sub-Segments |

|---|---|

| By Infrastructure Type | Fixed LTE Sites Tactical LTE Indoor Systems Border & Coastal Corridors |

| By Solution | Base LTE Networks Tactical LTE Kits Mission Software & Platforms LTE-SATCOM Integration Solutions |

| By Application | Law Enforcement and Border Control Firefighting Services Emergency Medical Services Disaster Management |

| By Deployment Model | Private LTE Commercial LTE Hybrid LTE Other Models |

| By End-User | Public Safety Agencies Armed Forces Border Security & Coast Guard Agencies Civil Defense & Disaster Management Authorities |

| By Region | New South Wales Victoria Queensland Other Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Police Department LTE Adoption | 100 | Chiefs of Police, IT Managers |

| Fire Services Communication Systems | 80 | Fire Chiefs, Communications Officers |

| Emergency Medical Services (EMS) Integration | 70 | EMS Directors, Operations Managers |

| Telecommunications Provider Insights | 90 | Network Engineers, Business Development Managers |

| Public Safety Technology Consultants | 60 | Consultants, Policy Advisors |

The Australia Public Safety LTE market is valued at approximately USD 1.3 billion, reflecting significant growth driven by the demand for reliable communication systems among public safety agencies and advancements in LTE technology.