Region:Middle East

Author(s):Shubham

Product Code:KRAA6452

Pages:95

Published On:January 2026

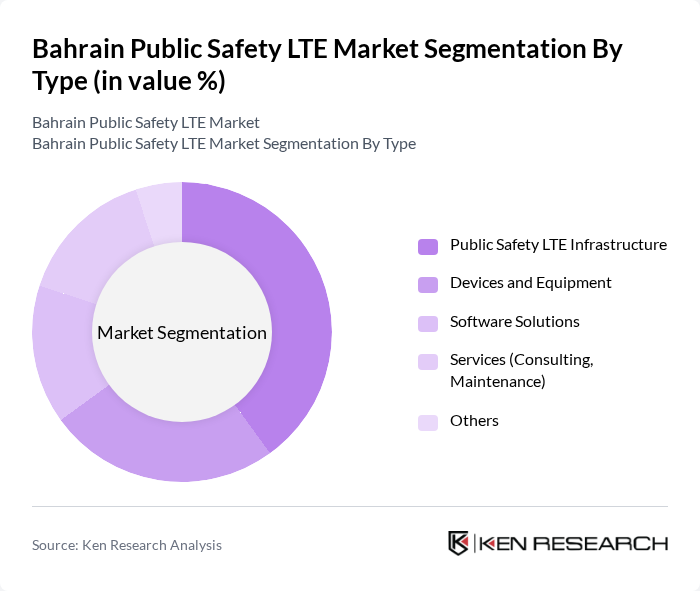

By Type:The market is segmented into various types, including Public Safety LTE Infrastructure, Devices and Equipment, Software Solutions, Services (Consulting, Maintenance), and Others. Each of these subsegments plays a crucial role in the overall functionality and efficiency of public safety operations.

The Public Safety LTE Infrastructure subsegment is currently dominating the market due to the increasing investments in building robust communication networks that support emergency services. The need for reliable and high-speed connectivity during critical situations has led to a surge in demand for infrastructure development. Additionally, advancements in technology and government initiatives to enhance public safety are further propelling this subsegment's growth.

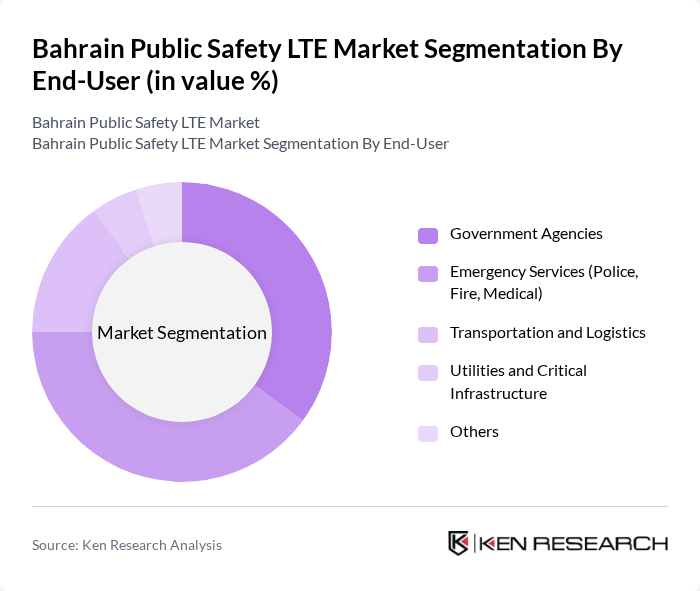

By End-User:The market is segmented by end-users, including Government Agencies, Emergency Services (Police, Fire, Medical), Transportation and Logistics, Utilities and Critical Infrastructure, and Others. Each end-user category has unique requirements and applications for public safety LTE solutions.

The Emergency Services (Police, Fire, Medical) subsegment is leading the market due to the critical need for reliable communication during emergencies. These services require immediate and uninterrupted connectivity to coordinate responses effectively. The increasing frequency of natural disasters and public safety threats has heightened the demand for advanced communication solutions tailored to the needs of emergency responders.

The Bahrain Public Safety LTE Market is characterized by a dynamic mix of regional and international players. Leading participants such as Batelco, Zain Bahrain, VIVA Bahrain, Huawei Technologies, Nokia Networks, Ericsson, Motorola Solutions, Cisco Systems, Thales Group, NEC Corporation, Samsung Networks, Alcatel-Lucent, Avaya, Siemens, and General Dynamics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain Public Safety LTE market appears promising, driven by ongoing government initiatives and technological advancements. As the nation continues to invest in smart city projects, the integration of LTE networks with IoT technologies will enhance public safety measures. Furthermore, the increasing focus on cybersecurity will ensure that communication systems remain secure and reliable, fostering greater trust among users. These trends indicate a robust growth trajectory for the market, with significant improvements in emergency response capabilities anticipated.

| Segment | Sub-Segments |

|---|---|

| By Type | Public Safety LTE Infrastructure Devices and Equipment Software Solutions Services (Consulting, Maintenance) Others |

| By End-User | Government Agencies Emergency Services (Police, Fire, Medical) Transportation and Logistics Utilities and Critical Infrastructure Others |

| By Application | Disaster Management Public Event Security Traffic Management Surveillance and Monitoring Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| By Technology | LTE Advanced G Integration Network Slicing Others |

| By Funding Source | Government Funding Private Investments Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Safety Agencies | 100 | Police Chiefs, Fire Department Heads |

| Telecommunications Providers | 50 | Network Engineers, Business Development Managers |

| Emergency Response Teams | 70 | Paramedics, Emergency Management Coordinators |

| Government Regulatory Bodies | 40 | Policy Makers, Telecommunications Regulators |

| Public Safety Technology Vendors | 60 | Product Managers, Sales Directors |

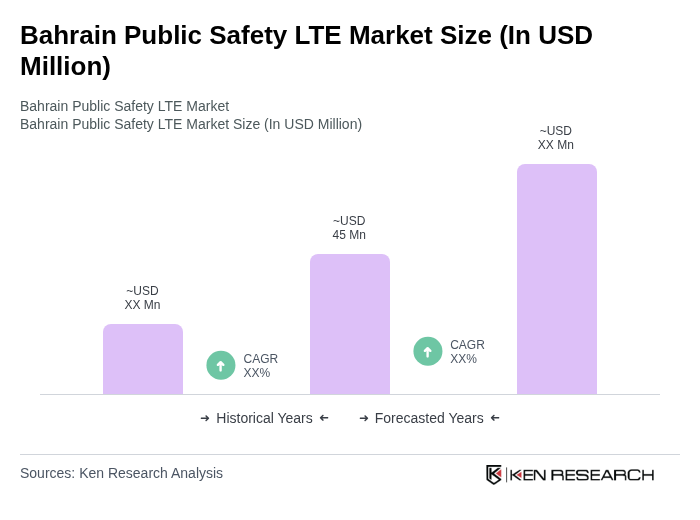

The Bahrain Public Safety LTE market is valued at approximately USD 45 million, reflecting a growing demand for reliable communication systems among emergency services and government agencies, particularly in urban areas.