Region:Global

Author(s):Shubham

Product Code:KRAA6455

Pages:90

Published On:January 2026

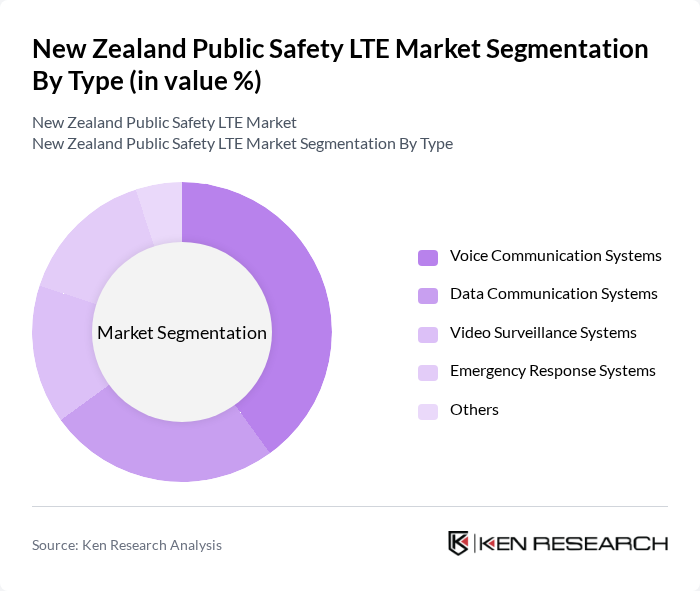

By Type:The market is segmented into various types, including Voice Communication Systems, Data Communication Systems, Video Surveillance Systems, Emergency Response Systems, and Others. Each of these sub-segments plays a crucial role in enhancing public safety and emergency response capabilities. Among these, Voice Communication Systems are particularly dominant due to their critical role in real-time communication during emergencies, enabling swift decision-making and coordination among various agencies. Mission-Critical PTT (MCPTT) voice services and broadband capabilities for video, high-resolution imagery, and multimedia messaging are increasingly integrated within modern public safety platforms.

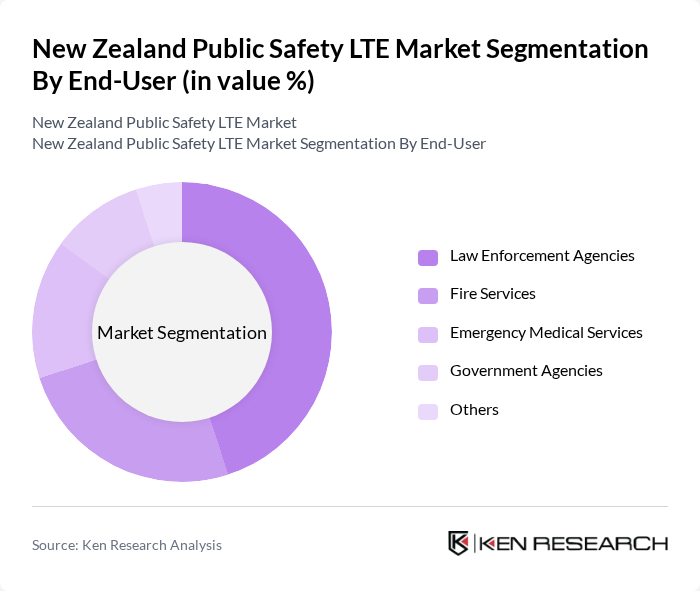

By End-User:The end-user segmentation includes Law Enforcement Agencies, Fire Services, Emergency Medical Services, Government Agencies, and Others. Law Enforcement Agencies are the leading end-users, driven by the need for effective communication tools to ensure public safety and crime prevention. The increasing focus on community policing and emergency response has led to a higher demand for advanced communication systems among these agencies.

The New Zealand Public Safety LTE Market is characterized by a dynamic mix of regional and international players. Leading participants such as Spark New Zealand, Vodafone New Zealand, 2degrees, Motorola Solutions, Harris Corporation, Nokia Networks, Ericsson, Cisco Systems, Thales Group, NEC Corporation, Huawei Technologies, ZTE Corporation, Avaya, Alcatel-Lucent, Samsung Networks contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand public safety LTE market appears promising, driven by ongoing technological advancements and increased government support. As agencies continue to adopt 5G technology, the potential for enhanced communication capabilities will grow, allowing for improved emergency response. Additionally, the integration of IoT devices will facilitate real-time data sharing, further enhancing situational awareness. These trends indicate a shift towards more efficient and effective public safety operations, ultimately benefiting the entire community.

| Segment | Sub-Segments |

|---|---|

| By Type | Voice Communication Systems Data Communication Systems Video Surveillance Systems Emergency Response Systems Others |

| By End-User | Law Enforcement Agencies Fire Services Emergency Medical Services Government Agencies Others |

| By Region | North Island South Island |

| By Technology | LTE Advanced LTE-M NB-IoT Others |

| By Application | Disaster Management Public Safety Communications Surveillance and Monitoring Others |

| By Investment Source | Government Funding Private Investments Public-Private Partnerships Others |

| By Policy Support | Government Grants Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Police Department LTE Usage | 100 | Police Chiefs, IT Managers |

| Fire and Emergency Services LTE Implementation | 80 | Fire Chiefs, Communications Officers |

| Ambulance Services LTE Integration | 70 | Ambulance Directors, Operations Managers |

| Local Government Public Safety Initiatives | 60 | City Managers, Public Safety Coordinators |

| Telecommunications Provider Perspectives | 90 | Network Engineers, Business Development Managers |

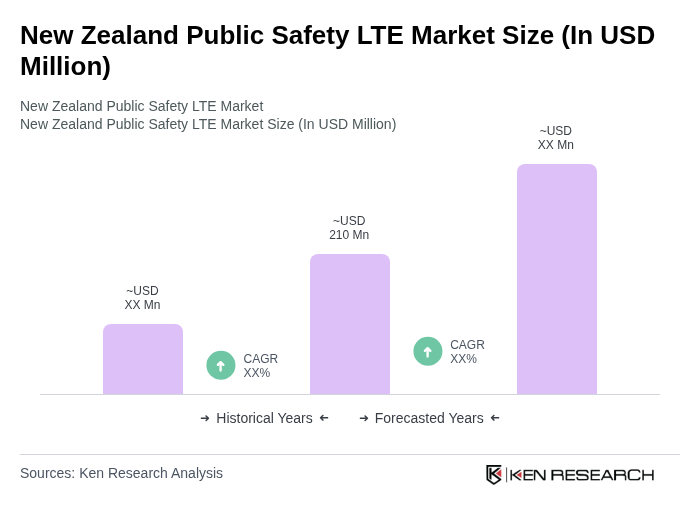

The New Zealand Public Safety LTE Market is valued at approximately USD 210 million, reflecting significant growth driven by investments in public safety infrastructure and the demand for reliable communication systems among emergency services.