Region:Middle East

Author(s):Shubham

Product Code:KRAA6594

Pages:96

Published On:January 2026

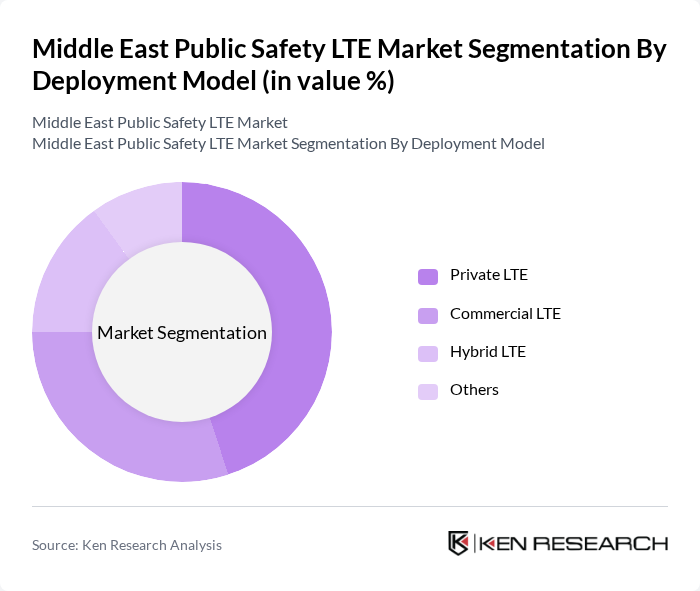

By Deployment Model:

The deployment model segment includes Private LTE, Commercial LTE, Hybrid LTE, and Others. Among these, Private LTE is the leading subsegment, primarily due to its ability to provide dedicated networks for public safety agencies, ensuring secure and reliable communication. The increasing focus on data privacy and security in emergency services has driven the adoption of Private LTE solutions, making it a preferred choice for many government agencies and organizations.

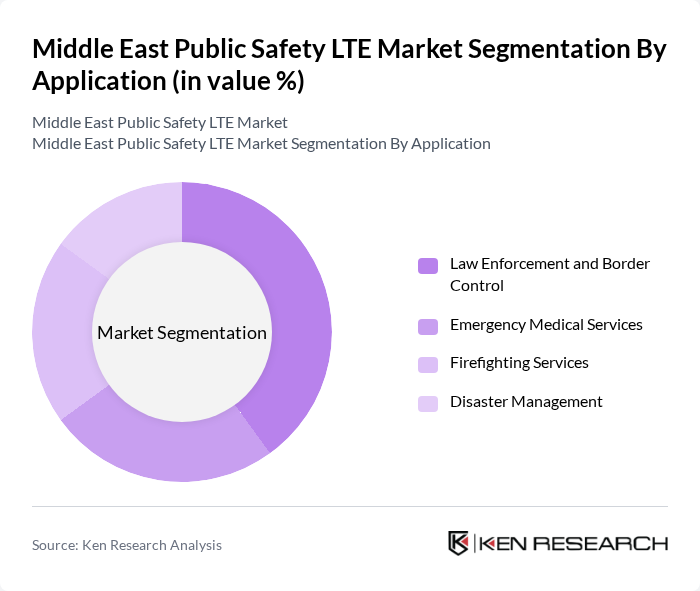

By Application:

This segment includes Law Enforcement and Border Control, Emergency Medical Services, Firefighting Services, and Disaster Management. Law Enforcement and Border Control is the dominant application area, driven by the increasing need for real-time communication and data sharing among law enforcement agencies. The rise in security threats and the need for efficient border management have led to a higher demand for LTE solutions tailored for these applications, making it a critical focus for public safety investments.

The Middle East Public Safety LTE Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ericsson, Nokia, Huawei Technologies, Motorola Solutions, Cisco Systems, ZTE Corporation, Samsung Electronics, Thales Group, NEC Corporation, AT&T, Verizon Communications, Qualcomm, L3Harris Technologies, General Dynamics, BAE Systems contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East Public Safety LTE market appears promising, driven by technological advancements and increasing government support. As smart city initiatives gain momentum, the integration of IoT technologies will enhance public safety applications, enabling real-time data sharing and improved emergency response. Furthermore, the shift towards cloud-based solutions will facilitate better resource management and operational efficiency, positioning the region for significant advancements in public safety communication systems.

| Segment | Sub-Segments |

|---|---|

| By Deployment Model | Private LTE Commercial LTE Hybrid LTE Others |

| By Application | Law Enforcement and Border Control Emergency Medical Services Firefighting Services Disaster Management |

| By End-User | Government Agencies Emergency Services Transportation and Logistics Utilities and Critical Infrastructure |

| By Infrastructure Type | Public Safety LTE Infrastructure Devices and Equipment Software Solutions Services |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate |

| By Technology | LTE Advanced G Integration Network Slicing Others |

| By Funding Source | Government Funding Private Investments Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Safety Agencies | 75 | Chief Officers, Operations Managers |

| Telecommunications Providers | 60 | Network Engineers, Business Development Managers |

| Emergency Response Teams | 55 | Paramedics, Fire Chiefs |

| Government Regulatory Bodies | 45 | Policy Makers, Regulatory Analysts |

| Technology Vendors | 65 | Product Managers, Sales Directors |

The Middle East Public Safety LTE Market is valued at approximately USD 1.2 billion, driven by investments in public safety infrastructure and the need for efficient communication systems among emergency services.