Region:Global

Author(s):Shubham

Product Code:KRAA0958

Pages:89

Published On:August 2025

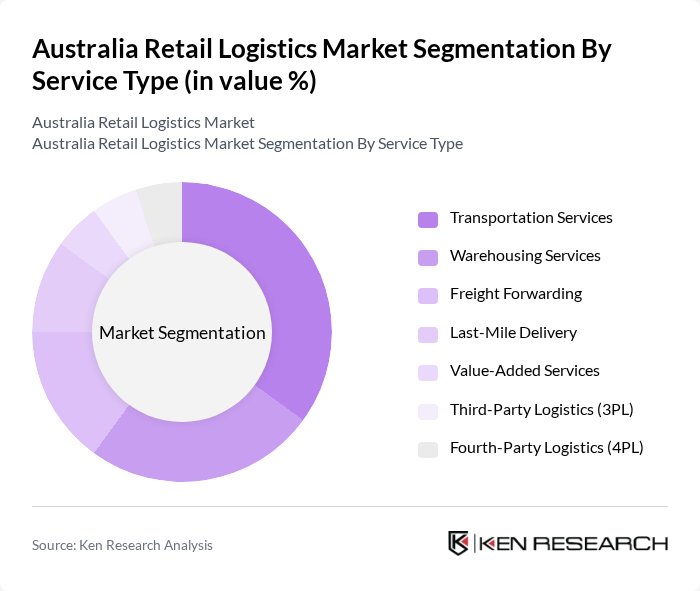

By Service Type:The service type segmentation encompasses Transportation Services, Warehousing Services, Freight Forwarding, Last-Mile Delivery, Value-Added Services, Third-Party Logistics (3PL), and Fourth-Party Logistics (4PL). Transportation Services remains the leading sub-segment, driven by the surge in e-commerce and the need for timely, flexible delivery solutions. Warehousing Services are also critical, with businesses investing in advanced inventory management systems and automation to reduce costs and improve fulfillment speed. Freight Forwarding and Last-Mile Delivery are increasingly important as omnichannel retailing and consumer expectations for rapid delivery rise .

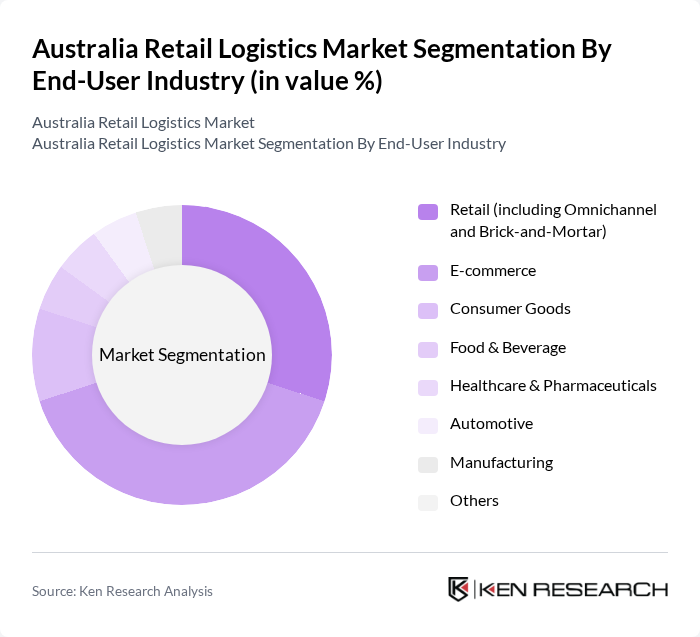

By End-User Industry:The end-user industry segmentation includes Retail (encompassing Omnichannel and Brick-and-Mortar), E-commerce, Consumer Goods, Food & Beverage, Healthcare & Pharmaceuticals, Automotive, Manufacturing, and Others. E-commerce is the dominant sub-segment, propelled by a double-digit annual increase in online shopping and evolving consumer preferences for fast, flexible delivery options. Retailers are investing in logistics innovation to meet demand for rapid fulfillment and seamless customer experiences. The Food & Beverage and Healthcare sectors are also significant, requiring specialized logistics for temperature control, compliance, and product integrity .

The Australia Retail Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toll Group, Linfox, DB Schenker Australia, DHL Supply Chain Australia, CEVA Logistics Australia, Kuehne + Nagel Australia, Mainfreight Australia, StarTrack (Australia Post Group), Qube Holdings, Australia Post, FedEx Express Australia, UPS Australia, XPO Logistics Australia, Pacific National, and SCT Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia retail logistics market is poised for transformation, driven by technological innovations and evolving consumer preferences. As e-commerce continues to expand, logistics providers will increasingly adopt automation and data analytics to enhance efficiency. Additionally, sustainability will become a focal point, with companies investing in green logistics solutions to meet regulatory demands and consumer expectations. The integration of AI and smart technologies will further streamline operations, positioning the sector for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Transportation Services Warehousing Services Freight Forwarding Last-Mile Delivery Value-Added Services Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) |

| By End-User Industry | Retail (including Omnichannel and Brick-and-Mortar) E-commerce Consumer Goods Food & Beverage Healthcare & Pharmaceuticals Automotive Manufacturing Others |

| By Mode of Transport | Road Transport Rail Transport Air Transport Sea Transport Intermodal Transport |

| By Sales Channel | Direct Sales Online Sales Distributors Retail Partnerships |

| By Service Level | Standard Services Expedited Services Customized Solutions Value-Added Services |

| By Pricing Strategy | Competitive Pricing Premium Pricing Discount Pricing Dynamic Pricing |

| By Technology Adoption | Traditional Logistics Digital Logistics Solutions Automated Warehousing IoT in Logistics |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Grocery Retail Logistics | 60 | Logistics Managers, Supply Chain Coordinators |

| Apparel Supply Chain Management | 45 | Operations Managers, Inventory Managers |

| Electronics Distribution Networks | 40 | Warehouse Supervisors, Logistics Analysts |

| Online Retail Fulfillment Strategies | 50 | eCommerce Managers, Fulfillment Managers |

| Returns Management in Retail | 40 | Customer Service Managers, Returns Analysts |

The Australia Retail Logistics Market is valued at approximately USD 15 billion, driven by the growth of e-commerce, consumer demand for fast deliveries, and advancements in logistics technology such as automation and real-time tracking.