Region:Africa

Author(s):Shubham

Product Code:KRAA1007

Pages:86

Published On:August 2025

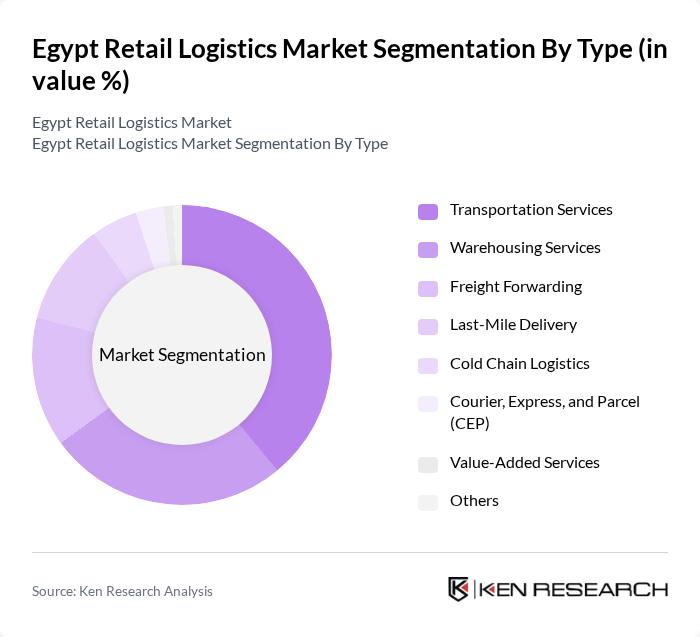

By Type:The market is segmented into various types, including Transportation Services, Warehousing Services, Freight Forwarding, Last-Mile Delivery, Cold Chain Logistics, Courier, Express, and Parcel (CEP), Value-Added Services, and Others. Among these, Transportation Services continue to dominate the market due to the increasing demand for efficient and timely delivery solutions. The surge in e-commerce activity has significantly boosted the need for reliable transportation networks, making this segment a critical component of the logistics ecosystem. Warehousing and last-mile delivery are also experiencing robust growth, driven by the expansion of fulfillment centers and the need for rapid, flexible delivery options .

By End-User:The end-user segmentation includes Wholesale and Retail Trade, E-commerce, Food and Beverage, Pharmaceuticals, Consumer Electronics, Apparel and Footwear, Automotive, Agriculture, and Others. The E-commerce sector is the leading end-user, driven by the rapid growth of online shopping and consumer demand for fast delivery services. This trend has led to increased investments in logistics capabilities, particularly in last-mile delivery and real-time tracking solutions, to meet the evolving needs of e-commerce businesses .

The Egypt Retail Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Agility Logistics, DHL Supply Chain, Aramex, FedEx Express Egypt, Maersk Egypt, Kuehne + Nagel Egypt, CEVA Logistics, DB Schenker Egypt, Naqla, Bosta, Rhenus Logistics, Geodis, DSV Egypt, Trella, and EgyTrans contribute to innovation, geographic expansion, and service delivery in this space.

The future of Egypt's retail logistics market appears promising, driven by ongoing digital transformation and the rise of omnichannel retailing. As logistics providers increasingly adopt advanced technologies, such as automation and data analytics, operational efficiencies are expected to improve. Additionally, the focus on sustainable practices will likely shape logistics strategies, aligning with global trends. The combination of these factors is anticipated to create a more resilient and responsive logistics ecosystem in Egypt, catering to evolving consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Services Warehousing Services Freight Forwarding Last-Mile Delivery Cold Chain Logistics Courier, Express, and Parcel (CEP) Value-Added Services Others |

| By End-User | Wholesale and Retail Trade E-commerce Food and Beverage Pharmaceuticals Consumer Electronics Apparel and Footwear Automotive Agriculture Others |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport Intermodal Transport Others |

| By Sales Channel | Direct Sales Online Sales Retail Partnerships Distributors Others |

| By Service Level | Standard Services Premium Services Customized Solutions Others |

| By Pricing Strategy | Competitive Pricing Value-Based Pricing Cost-Plus Pricing Others |

| By Technology Adoption | Traditional Logistics Digital Logistics Solutions Automated Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Grocery Retail Logistics | 60 | Logistics Managers, Supply Chain Coordinators |

| Electronics Retail Supply Chain | 50 | Operations Directors, Inventory Managers |

| Apparel Distribution Networks | 40 | Warehouse Supervisors, Distribution Managers |

| E-commerce Fulfillment Strategies | 55 | eCommerce Operations Managers, Logistics Analysts |

| Pharmaceutical Supply Chain Management | 45 | Supply Chain Directors, Compliance Officers |

The Egypt Retail Logistics Market is valued at approximately USD 20 billion, reflecting significant growth driven by the demand for efficient supply chain solutions, the rise of e-commerce, and the expansion of retail sectors.