Region:Africa

Author(s):Geetanshi

Product Code:KRAA1960

Pages:87

Published On:August 2025

By Type:The logistics market in Nigeria is segmented into Courier, Express, and Parcel (CEP) Services, Freight Forwarding, Warehousing & Storage, Transportation Services, Last-Mile Delivery, Cold Chain Logistics, and Value-Added Logistics Services. Among these,Last-Mile Deliveryis currently the leading sub-segment, driven by the surge in e-commerce and rising consumer expectations for rapid delivery. The demand for efficient last-mile solutions has led logistics providers to invest in advanced tracking, route optimization, and digital customer interfaces.

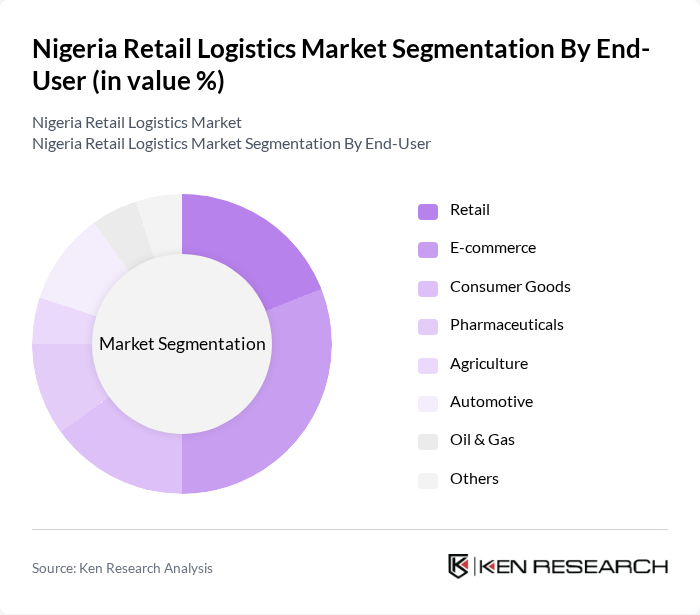

By End-User:The end-user segmentation of the Nigeria Retail Logistics Market includes Retail, E-commerce, Consumer Goods, Pharmaceuticals, Agriculture, Automotive, Oil & Gas, and Others. TheE-commercesector is the most significant contributor, as rapid online shopping growth has increased demand for reliable, technology-driven logistics solutions. Retailers and brands are increasingly partnering with logistics providers to ensure timely, traceable deliveries and maintain customer satisfaction.

The Nigeria Retail Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Nigeria, GIG Logistics, Konga Logistics, Jumia Logistics, Red Star Express, Transport Services Limited (TSL), FedEx Nigeria, UPS Nigeria, Maersk Nigeria, Nigerian Ports Authority, Bolloré Transport & Logistics Nigeria, Swift Logistics, APM Terminals Nigeria, TSL Logistics, Cargo Services Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's retail logistics market appears promising, driven by technological advancements and a growing consumer base. As urbanization continues, logistics providers are expected to adopt innovative solutions, such as automation and AI, to enhance operational efficiency. Furthermore, the increasing demand for sustainable practices will likely push companies to invest in eco-friendly logistics solutions. These trends indicate a shift towards a more integrated and responsive logistics ecosystem, positioning Nigeria as a key player in the African retail logistics landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Courier, Express, and Parcel (CEP) Services Freight Forwarding Warehousing & Storage Transportation Services Last-Mile Delivery Cold Chain Logistics Value-Added Logistics Services |

| By End-User | Retail E-commerce Consumer Goods Pharmaceuticals Agriculture Automotive Oil & Gas Others |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport Multimodal Transport Others |

| By Sales Channel | Direct Sales Online Sales Retail Partnerships Distributors Others |

| By Service Type | Standard Services Value-Added Services Customized Solutions Reverse Logistics Others |

| By Pricing Strategy | Competitive Pricing Premium Pricing Discount Pricing Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Non-Governmental Organizations (NGOs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| FMCG Retail Logistics | 120 | Logistics Managers, Supply Chain Analysts |

| Electronics Distribution Networks | 90 | Operations Managers, Inventory Managers |

| Apparel Supply Chain Management | 60 | Procurement Managers, Warehouse Supervisors |

| Last-Mile Delivery Solutions | 50 | Delivery Operations Managers, Customer Experience Leads |

| Logistics Technology Adoption | 70 | IT Managers, Digital Transformation Officers |

The Nigeria Retail Logistics Market is valued at approximately USD 11 billion, driven by the rapid growth of e-commerce, increasing consumer demand for faster delivery services, and significant improvements in infrastructure.