Region:Asia

Author(s):Shubham

Product Code:KRAA1028

Pages:82

Published On:August 2025

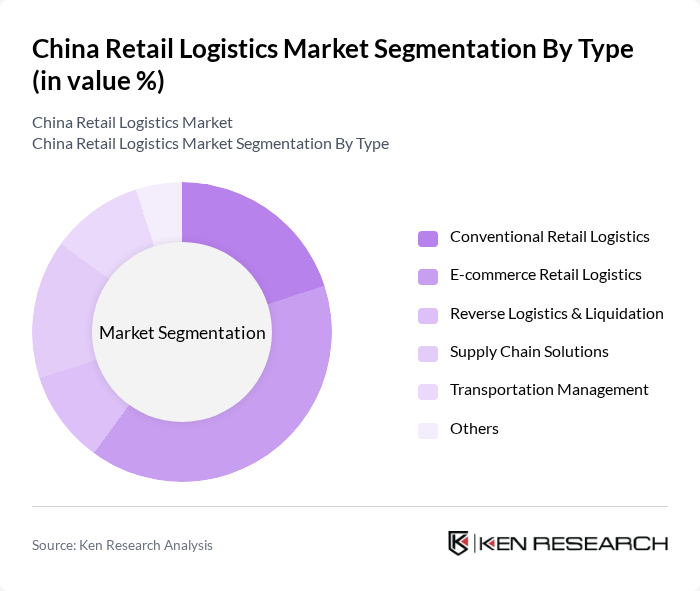

By Type:The retail logistics market can be segmented into various types, including Conventional Retail Logistics, E-commerce Retail Logistics, Reverse Logistics & Liquidation, Supply Chain Solutions, Transportation Management, and Others. Among these, E-commerce Retail Logistics is currently the most dominant segment, driven by the surge in online shopping and the need for efficient last-mile delivery solutions. The increasing reliance on digital platforms has led to a significant rise in demand for logistics services tailored to e-commerce, making it a key focus area for logistics providers .

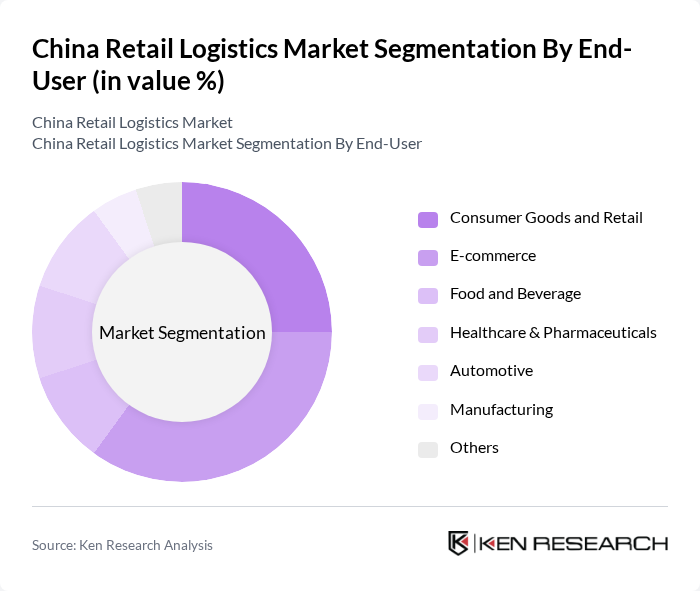

By End-User:The end-user segmentation of the retail logistics market includes Consumer Goods and Retail, E-commerce, Food and Beverage, Healthcare & Pharmaceuticals, Automotive, Manufacturing, and Others. The E-commerce segment is leading this category, fueled by the rapid growth of online shopping platforms and changing consumer preferences towards convenience and speed. This shift has prompted logistics providers to innovate and enhance their service offerings to meet the demands of e-commerce businesses .

The China Retail Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as SF Express, JD Logistics, ZTO Express, YTO Express, STO Express, Yunda Express, Best Inc., Cainiao Network, China Post, Sinotrans Limited, Deppon Logistics, DHL Supply Chain, FedEx, UPS, Kuehne + Nagel contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China retail logistics market appears promising, driven by ongoing technological advancements and the increasing demand for efficient delivery solutions. As urbanization continues, logistics providers will need to adapt to the complexities of urban distribution. Additionally, the integration of sustainable practices and smart technologies will play a crucial role in shaping the logistics landscape, ensuring that companies can meet consumer expectations while minimizing their environmental impact. The focus on innovation will be key to overcoming existing challenges and seizing new opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Conventional Retail Logistics E-commerce Retail Logistics Reverse Logistics & Liquidation Supply Chain Solutions Transportation Management Others |

| By End-User | Consumer Goods and Retail E-commerce Food and Beverage Healthcare & Pharmaceuticals Automotive Manufacturing Others |

| By Mode of Transport | Roadways Railways Airways Waterways Multimodal Transport Others |

| By Solution | Commerce Enablement Supply Chain Solutions Reverse Logistics & Liquidation Transportation Management Others |

| By Service Model | PL (First-Party Logistics) PL (Second-Party Logistics) PL (Third-Party Logistics) Others |

| By Customer Segment | Small and Medium Enterprises Large Corporations Government Agencies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Operations | 120 | Logistics Managers, Supply Chain Executives |

| E-commerce Fulfillment Strategies | 90 | eCommerce Directors, Operations Managers |

| Last-Mile Delivery Solutions | 60 | Delivery Managers, Logistics Coordinators |

| Warehouse Management Practices | 50 | Warehouse Supervisors, Inventory Managers |

| Returns Management in Retail | 40 | Customer Service Managers, Returns Analysts |

The China Retail Logistics Market is valued at approximately USD 40 billion, driven by the rapid growth of e-commerce, increasing consumer demand for faster delivery services, and advancements in logistics technology.