Region:Asia

Author(s):Rebecca

Product Code:KRAE3388

Pages:100

Published On:February 2026

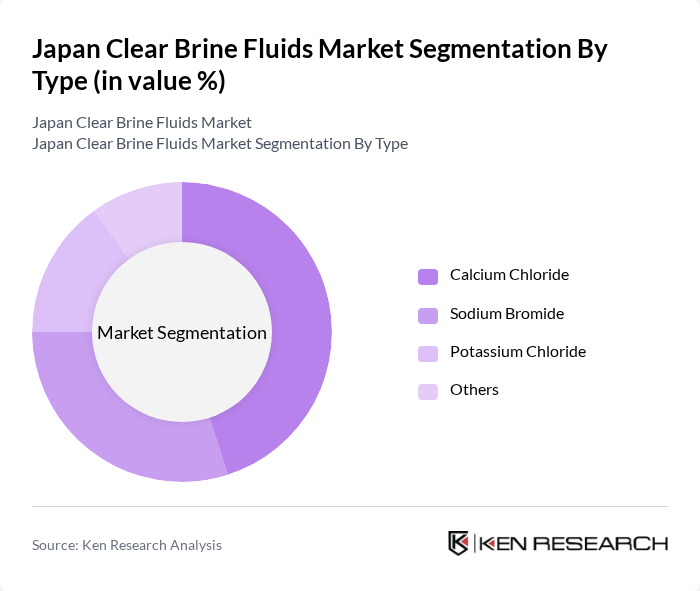

By Type:The market is segmented into various types of clear brine fluids, including Calcium Chloride, Sodium Bromide, Potassium Chloride, and Others. Among these, Calcium Chloride is the leading sub-segment due to its high density and effectiveness in controlling formation pressures during drilling operations. The demand for Sodium Bromide is also significant, particularly in completion fluids, as it offers excellent thermal stability and is less corrosive. The Others category includes various proprietary blends that cater to specific industry needs.

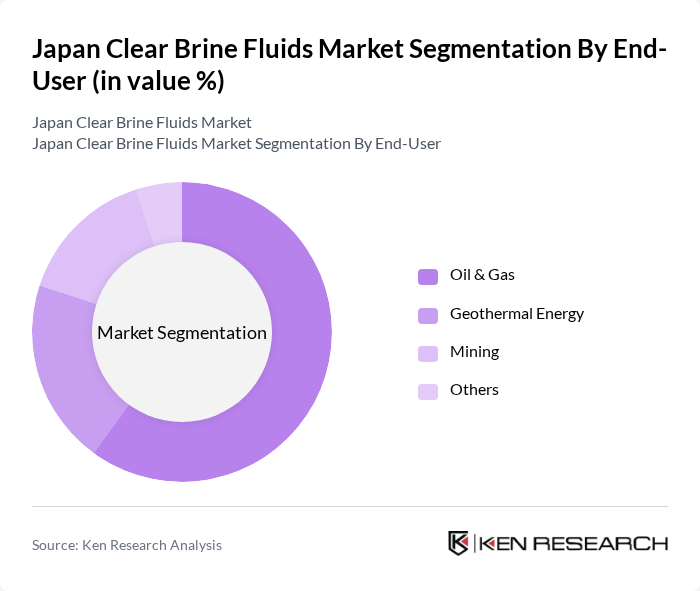

By End-User:The clear brine fluids market is segmented by end-user into Oil & Gas, Geothermal Energy, Mining, and Others. The Oil & Gas sector is the dominant segment, driven by the increasing exploration and production activities in offshore and onshore fields. Geothermal energy is gaining traction as a sustainable energy source, leading to a rise in demand for specialized brine fluids. The Mining sector also contributes significantly, particularly in mineral extraction processes where brine fluids are essential for maintaining pressure and stability.

The Japan Clear Brine Fluids Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schlumberger Limited, Halliburton Company, Baker Hughes Company, Newpark Resources, Inc., Tetra Technologies, Inc., Cargill, Incorporated, Chemours Company, Albemarle Corporation, Solvay S.A., K+S AG, Occidental Petroleum Corporation, AECI Limited, ICL Group Ltd., Qmax Solutions Inc., DOW Chemical Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan clear brine fluids market appears promising, driven by ongoing technological advancements and a shift towards sustainable practices. As companies increasingly adopt eco-friendly solutions, the demand for biodegradable brine fluids is expected to rise. Additionally, the integration of digital technologies in fluid management will enhance operational efficiency. With the government promoting offshore drilling and energy independence, the market is poised for growth, supported by strategic partnerships and investments in innovative fluid formulations.

| Segment | Sub-Segments |

|---|---|

| By Type | Calcium Chloride Sodium Bromide Potassium Chloride Others |

| By End-User | Oil & Gas Geothermal Energy Mining Others |

| By Application | Drilling Fluids Completion Fluids Workover Fluids Others |

| By Region | Hokkaido Honshu Kyushu Shikoku |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Packaging Type | Bulk Packaging Drums Bags Others |

| By Product Form | Liquid Powder Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Exploration Companies | 100 | Drilling Engineers, Project Managers |

| Clear Brine Fluid Manufacturers | 80 | Production Managers, R&D Heads |

| Regulatory Bodies | 50 | Policy Makers, Environmental Analysts |

| Industry Consultants | 60 | Market Analysts, Strategic Advisors |

| End-users in Drilling Operations | 70 | Procurement Officers, Operations Supervisors |

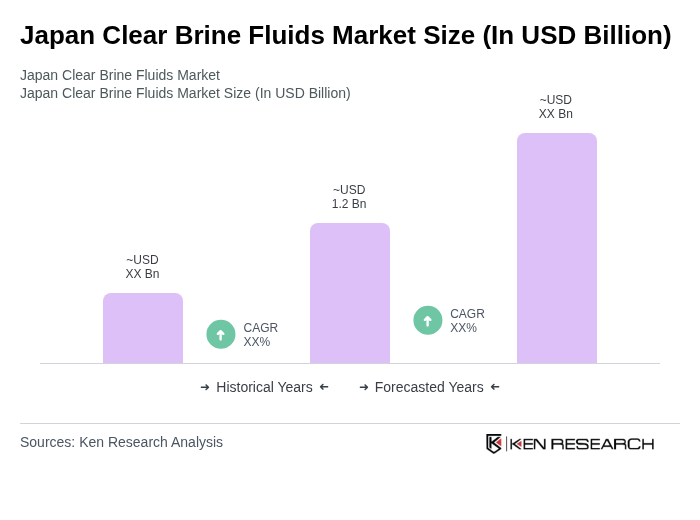

The Japan Clear Brine Fluids Market is valued at approximately USD 1.2 billion, driven by increasing demand in oil and gas exploration, geothermal energy production, and mining activities, along with advancements in drilling technologies.