Region:Middle East

Author(s):Dev

Product Code:KRAC8752

Pages:83

Published On:November 2025

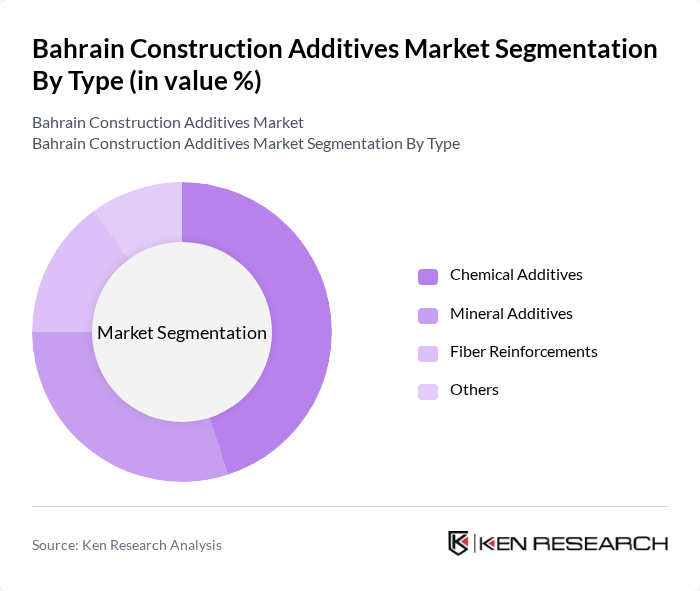

By Type:The market is segmented into various types of construction additives, including chemical additives, mineral additives, fiber reinforcements, and others. Each of these subsegments plays a crucial role in enhancing the performance and longevity of construction materials. Chemical additives remain the largest segment, driven by their role in improving concrete workability, strength, and durability. Mineral additives are increasingly used for sustainability and cost-effectiveness, while fiber reinforcements are gaining traction for their crack resistance and structural benefits .

The chemical additives segment, which includes plasticizers, superplasticizers, retarders, accelerators, air-entraining agents, and waterproofing agents, dominates the market due to their essential role in improving the workability and performance of concrete. The increasing focus on high-strength and durable construction materials has led to a surge in demand for these additives. Additionally, the trend towards sustainable construction practices has further propelled the adoption of eco-friendly chemical additives, making this segment a key driver of market growth .

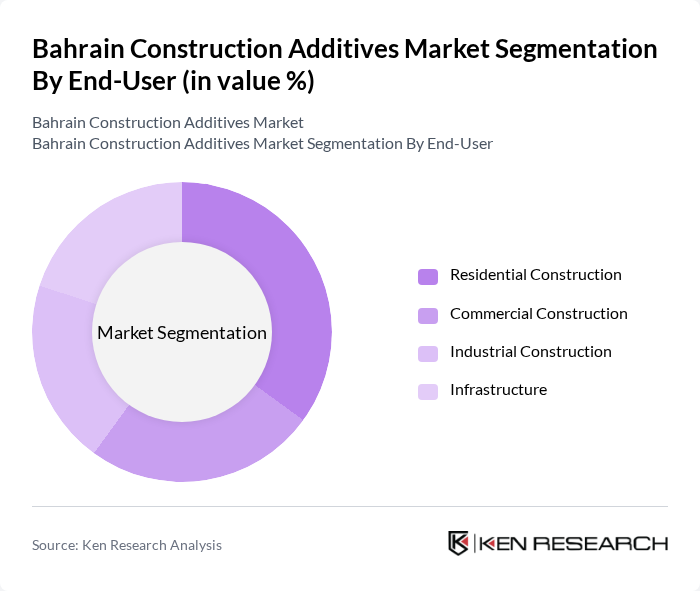

By End-User:The market is segmented based on end-users, including residential construction, commercial construction, industrial construction, and infrastructure projects. Each segment has distinct requirements and contributes differently to the overall market dynamics. Residential and commercial construction are the primary consumers, reflecting Bahrain’s population growth and urban development, while infrastructure and industrial segments are supported by government investments and strategic projects .

The residential construction segment is the largest end-user of construction additives, driven by the growing population and increasing demand for housing. The trend towards modern and sustainable living spaces has led to a rise in the use of advanced construction materials, including various additives that enhance the quality and longevity of residential buildings. Additionally, the commercial construction sector is also witnessing significant growth, fueled by investments in commercial real estate and infrastructure development .

The Bahrain Construction Additives Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Sika AG, GCP Applied Technologies, Mapei S.p.A., Fosroc International, RPM International Inc., Saint-Gobain S.A., Dow Chemical Company, Bostik, Ardex Group, CEMEX S.A.B. de C.V., Knauf Gips KG, Pidilite Industries Ltd., Almoayyed Contracting Group, Nass Corporation, Nasser S. Al Hajri Corporation, Mohammed Jalal & Sons, Mannai Holding, Delta Construction Co. W.L.L., and The Al Namal Group contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Bahrain construction additives market appears promising, driven by ongoing infrastructure projects and a strong push for sustainable building practices. As the government continues to invest in urban development, the demand for innovative and eco-friendly additives is expected to rise. Additionally, advancements in technology will likely lead to the introduction of new materials that enhance construction efficiency and performance, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Chemical Additives (Plasticizers, Superplasticizers, Retarders, Accelerators, Air-Entraining Agents, Waterproofing Agents) Mineral Additives (Fly Ash, Silica Fume, Slag, Metakaolin) Fiber Reinforcements (Steel Fibers, Polypropylene Fibers, Glass Fibers, Others) Others (Corrosion Inhibitors, Shrinkage Reducers, Coloring Agents) |

| By End-User | Residential Construction Commercial Construction Industrial Construction Infrastructure (Transportation, Utilities, Energy) |

| By Application | Concrete Admixtures Mortar Additives Grouts Waterproofing and Sealants |

| By Distribution Channel | Direct Sales Distributors/Dealers Online Sales Others |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate |

| By Product Formulation | Ready-to-Use (Liquid, Powder) Concentrated Others |

| By Performance Characteristics | High-Strength Additives Water-Resistant Additives Fast-Setting Additives Eco-Friendly/Sustainable Additives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 45 | Project Managers, Site Supervisors |

| Commercial Building Developments | 38 | Construction Managers, Architects |

| Infrastructure Projects (Roads, Bridges) | 42 | Civil Engineers, Project Directors |

| Specialty Additives Usage | 35 | Product Development Managers, Quality Control Engineers |

| Regulatory Compliance in Construction | 40 | Compliance Officers, Safety Managers |

The Bahrain Construction Additives Market is valued at approximately USD 30 million, reflecting a five-year historical analysis and proportional allocation from the GCC construction additives market size. This valuation indicates a growing demand for high-performance construction materials.