Region:Middle East

Author(s):Shubham

Product Code:KRAB7296

Pages:80

Published On:October 2025

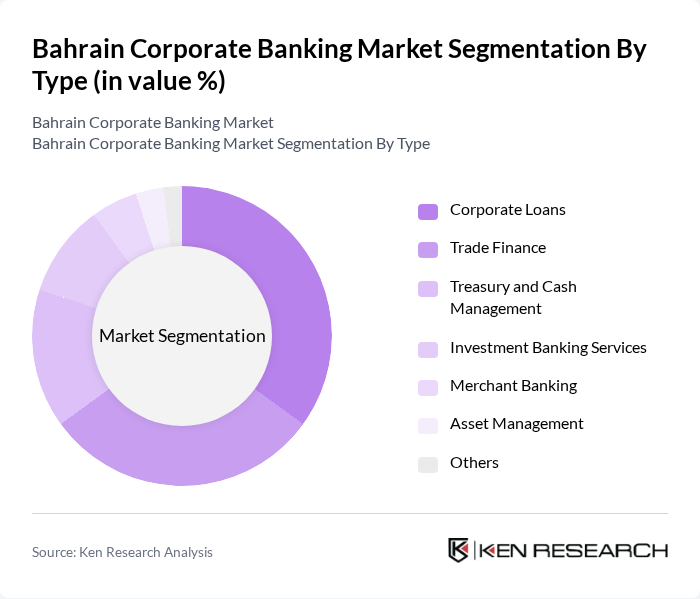

By Type:The corporate banking market can be segmented into various types, including corporate loans, trade finance, treasury and cash management, investment banking services, merchant banking, asset management, and others. Among these, corporate loans and trade finance are the most significant segments, driven by the increasing need for businesses to finance their operations and manage international trade transactions effectively.

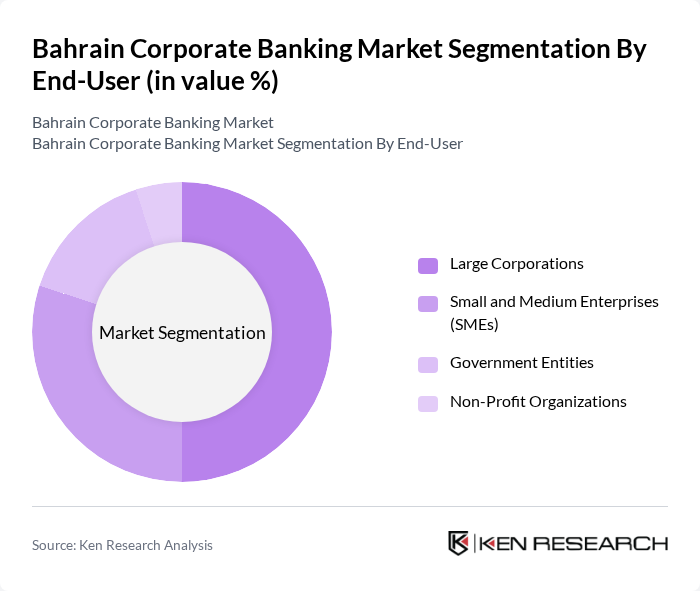

By End-User:The end-user segmentation includes large corporations, small and medium enterprises (SMEs), government entities, and non-profit organizations. Large corporations dominate the market due to their substantial financing needs and the complexity of their banking requirements, while SMEs are increasingly seeking tailored banking solutions to support their growth.

The Bahrain Corporate Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as National Bank of Bahrain, Bahrain Islamic Bank, Ahli United Bank, Gulf International Bank, Bank of Bahrain and Kuwait, Arab Banking Corporation, Al Baraka Banking Group, Standard Chartered Bank Bahrain, Qatar National Bank Bahrain, HSBC Bank Middle East, Emirates NBD, Bank of America Merrill Lynch, Citibank Bahrain, Mashreq Bank, Abu Dhabi Commercial Bank contribute to innovation, geographic expansion, and service delivery in this space.

The future of Bahrain's corporate banking market appears promising, driven by ongoing economic diversification and technological advancements. As the government continues to invest in infrastructure and non-oil sectors, corporate financing demand is expected to rise. Additionally, the integration of digital banking solutions will enhance customer engagement and streamline operations. However, banks must navigate regulatory complexities and competitive pressures to capitalize on these opportunities effectively, ensuring sustainable growth in the evolving financial landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Corporate Loans Trade Finance Treasury and Cash Management Investment Banking Services Merchant Banking Asset Management Others |

| By End-User | Large Corporations Small and Medium Enterprises (SMEs) Government Entities Non-Profit Organizations |

| By Industry Sector | Manufacturing Services Construction Retail Technology Healthcare Others |

| By Service Channel | Direct Banking Online Banking Mobile Banking Relationship Managers |

| By Financing Type | Secured Financing Unsecured Financing Structured Financing |

| By Risk Profile | Low Risk Medium Risk High Risk |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Banking Services | 150 | Corporate Bank Managers, Relationship Managers |

| SME Financing Solutions | 100 | SME Owners, Financial Advisors |

| Trade Finance Products | 80 | Trade Finance Officers, Export Managers |

| Investment Banking Services | 70 | Investment Bankers, Corporate Finance Executives |

| Risk Management in Corporate Banking | 60 | Risk Managers, Compliance Officers |

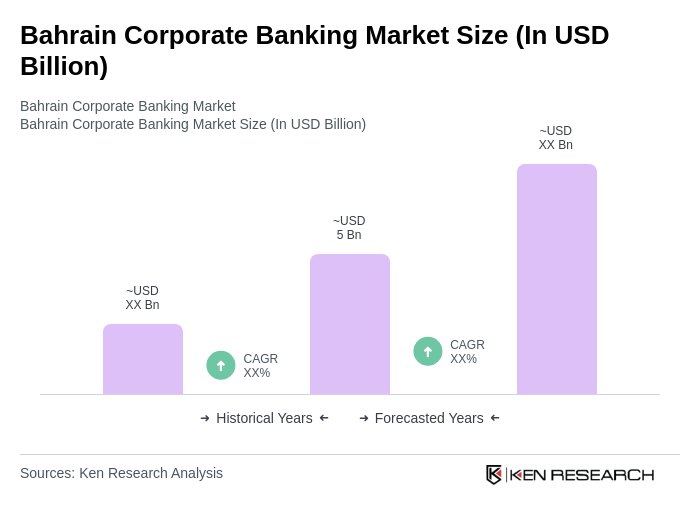

The Bahrain Corporate Banking Market is valued at approximately USD 5 billion, reflecting a five-year historical analysis. This growth is driven by increasing demand for corporate loans and trade finance as businesses expand and manage cash flow effectively.