Region:Middle East

Author(s):Rebecca

Product Code:KRAB7369

Pages:83

Published On:October 2025

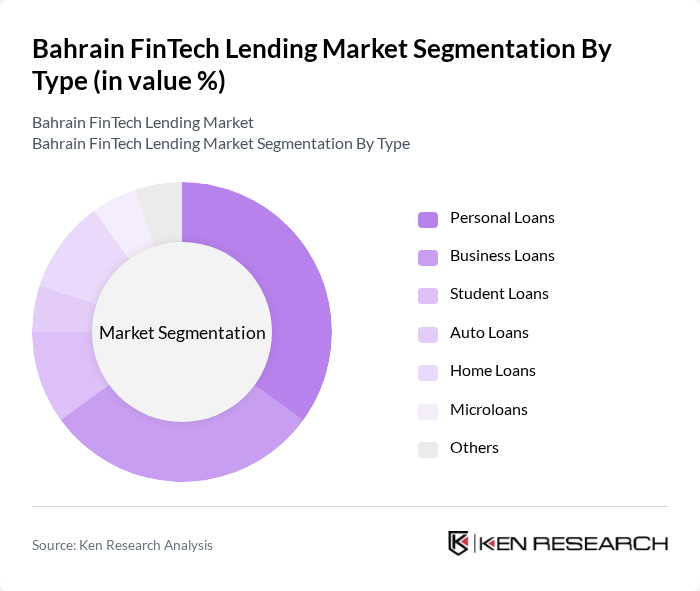

By Type:The market is segmented into various types of loans, including Personal Loans, Business Loans, Student Loans, Auto Loans, Home Loans, Microloans, and Others. Each of these subsegments caters to different consumer needs and preferences, with Personal Loans and Business Loans being the most prominent due to their widespread applicability and demand among individuals and enterprises.

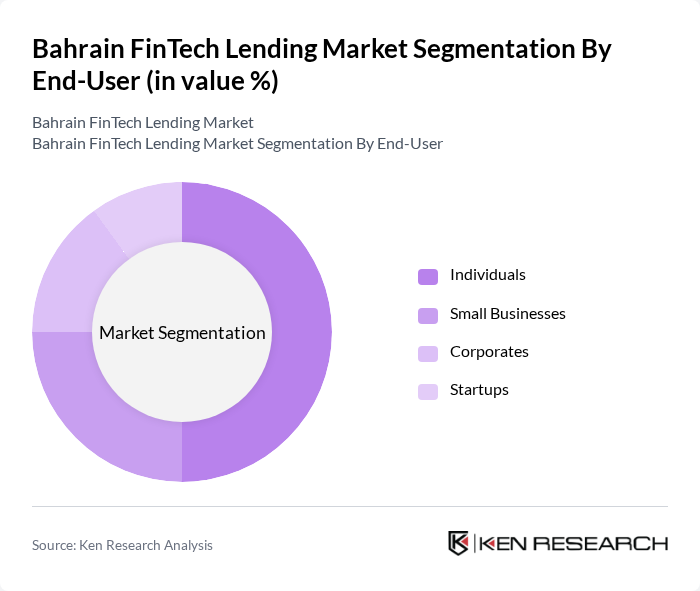

By End-User:The end-user segmentation includes Individuals, Small Businesses, Corporates, and Startups. Individuals represent the largest segment due to the increasing need for personal financing solutions, while Small Businesses and Startups are also significant contributors as they seek funding for growth and operational needs.

The Bahrain FinTech Lending Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tamweelcom, Bahrain Islamic Bank, Al Baraka Banking Group, Gulf Finance House, Bank of Bahrain and Kuwait, Bahrain Development Bank, Aion Digital, FinTech Bahrain, Beehive, Rain Financial, Ethis Crowd, Liwwa, YAPILI, Fawry, Kiva contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain FinTech lending market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As digital literacy improves, more consumers are expected to engage with FinTech solutions, leading to increased adoption of innovative lending products. Additionally, partnerships between FinTech firms and traditional banks are likely to enhance service offerings, creating a more integrated financial ecosystem. This collaborative approach will foster growth and resilience in the market, positioning it for long-term success.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Auto Loans Home Loans Microloans Others |

| By End-User | Individuals Small Businesses Corporates Startups |

| By Loan Amount | Up to BHD 1,000 BHD 1,001 - BHD 5,000 BHD 5,001 - BHD 10,000 Above BHD 10,000 |

| By Loan Duration | Short-term Loans Medium-term Loans Long-term Loans |

| By Interest Rate Type | Fixed Rate Variable Rate |

| By Distribution Channel | Online Platforms Mobile Applications Traditional Banks |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| SME FinTech Lending Users | 150 | Business Owners, Financial Managers |

| Consumer Loan Recipients | 100 | Individual Borrowers, Financial Advisors |

| FinTech Lending Executives | 80 | CEOs, Product Development Heads |

| Regulatory Stakeholders | 50 | Policy Makers, Compliance Officers |

| Industry Analysts and Experts | 70 | Market Researchers, Financial Analysts |

The Bahrain FinTech Lending Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital financial services and consumer demand for accessible loans.