Region:Global

Author(s):Geetanshi

Product Code:KRAA2354

Pages:94

Published On:August 2025

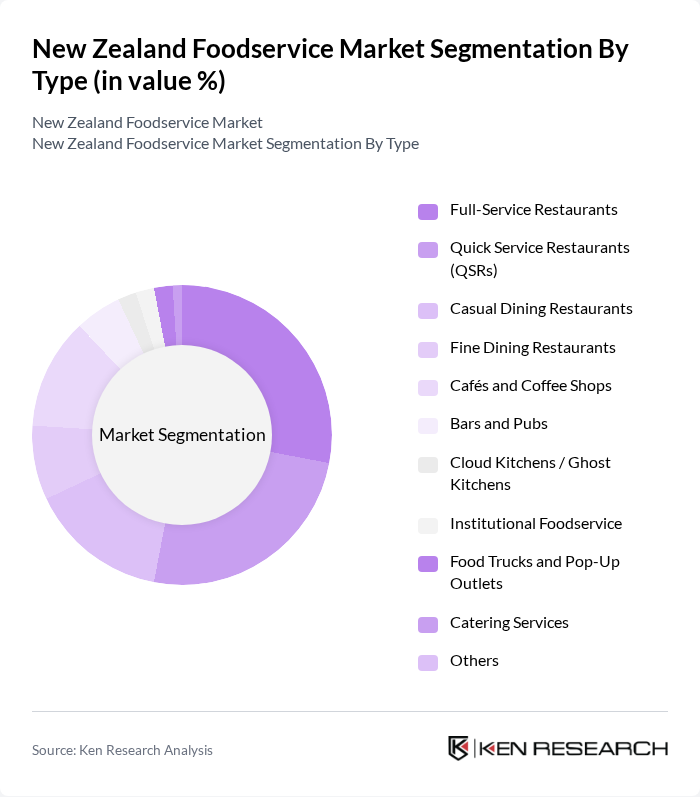

By Type:The foodservice market in New Zealand can be segmented into Full-Service Restaurants, Quick Service Restaurants (QSRs), Casual Dining Restaurants, Fine Dining Restaurants, Cafés and Coffee Shops, Bars and Pubs, Cloud Kitchens / Ghost Kitchens, Institutional Foodservice (Schools, Hospitals, Corporate Cafeterias), Food Trucks and Pop-Up Outlets, Catering Services, and Others. Among these, Full-Service Restaurants represent the leading segment by revenue, supported by strong consumer demand for premium dining experiences. Quick Service Restaurants (QSRs) remain highly competitive, driven by their convenience, affordability, and the rapid adoption of online ordering and delivery platforms. Cafés and Coffee Shops are also prominent, reflecting New Zealand’s strong café culture and preference for specialty coffee and casual dining .

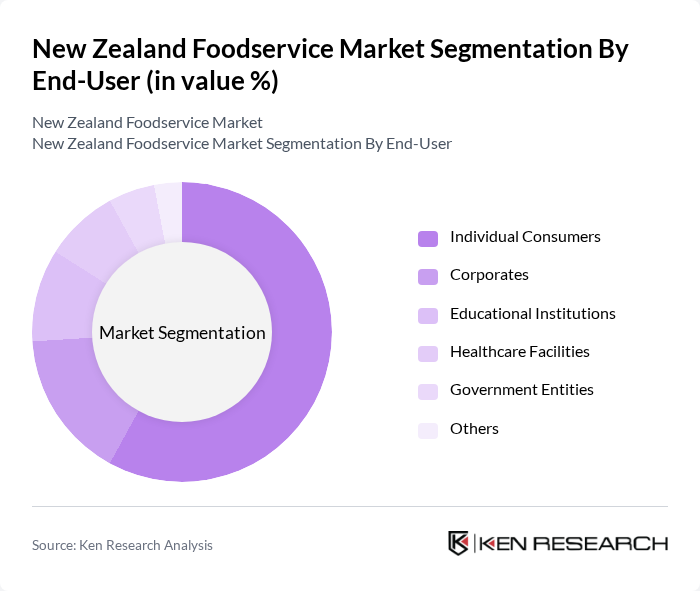

By End-User:The end-user segmentation of the foodservice market includes Individual Consumers, Corporates, Educational Institutions, Healthcare Facilities, Government Entities, and Others. Individual Consumers represent the largest segment, driven by the increasing trend of dining out, the popularity of food delivery services, and the demand for convenience and personalized dining experiences. Corporates and institutions contribute steadily, supported by catering and institutional foodservice contracts .

The New Zealand Foodservice Market is characterized by a dynamic mix of regional and international players. Leading participants such as Restaurant Brands New Zealand Limited, McDonald's New Zealand, Domino's Pizza Enterprises Limited, Foodstuffs North Island Limited, Restaurant Association of New Zealand, Silver Chef Limited, The Coffee Club New Zealand, BurgerFuel Worldwide Limited, Hell Pizza, Pita Pit New Zealand, Nando's New Zealand, KFC New Zealand, Subway New Zealand, St Pierre's Sushi, Little India, Columbus Coffee, Wendy's Supa Sundaes New Zealand, Mexicali Fresh, Lone Star New Zealand, Starbucks New Zealand contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand foodservice market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. The increasing integration of digital ordering systems and the rise of ghost kitchens are expected to reshape the competitive landscape. Additionally, the focus on sustainability and local sourcing will likely influence menu offerings, aligning with consumer demand for transparency and ethical practices. As the market adapts, foodservice providers must innovate to meet these changing expectations while navigating regulatory challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Restaurants Quick Service Restaurants (QSRs) Casual Dining Restaurants Fine Dining Restaurants Cafés and Coffee Shops Bars and Pubs Cloud Kitchens / Ghost Kitchens Institutional Foodservice (Schools, Hospitals, Corporate Cafeterias) Food Trucks and Pop-Up Outlets Catering Services Others |

| By End-User | Individual Consumers Corporates Educational Institutions Healthcare Facilities Government Entities Others |

| By Distribution Channel | Direct Sales Online Delivery Platforms Third-Party Distributors Retail Outlets Others |

| By Cuisine Type | Asian Cuisine European Cuisine American Cuisine Middle Eastern Cuisine Pacific/Polynesian Cuisine Fusion Cuisine Others |

| By Service Style | Dine-In Takeaway Delivery Buffet Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Customer Demographics | Age Groups Income Levels Family Size Lifestyle Preferences Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Full-Service Restaurants | 60 | Restaurant Owners, Head Chefs |

| Fast Food Chains | 50 | Franchise Managers, Operations Directors |

| Catering Services | 40 | Catering Managers, Event Coordinators |

| Food Delivery Services | 45 | Logistics Managers, Marketing Directors |

| Consumer Preferences | 100 | Regular Diners, Food Enthusiasts |

The New Zealand Foodservice Market is valued at approximately USD 8.8 billion, reflecting a significant growth trend driven by consumer demand for diverse dining options, food delivery services, and a focus on health-conscious eating.