Region:Europe

Author(s):Shubham

Product Code:KRAA1748

Pages:92

Published On:August 2025

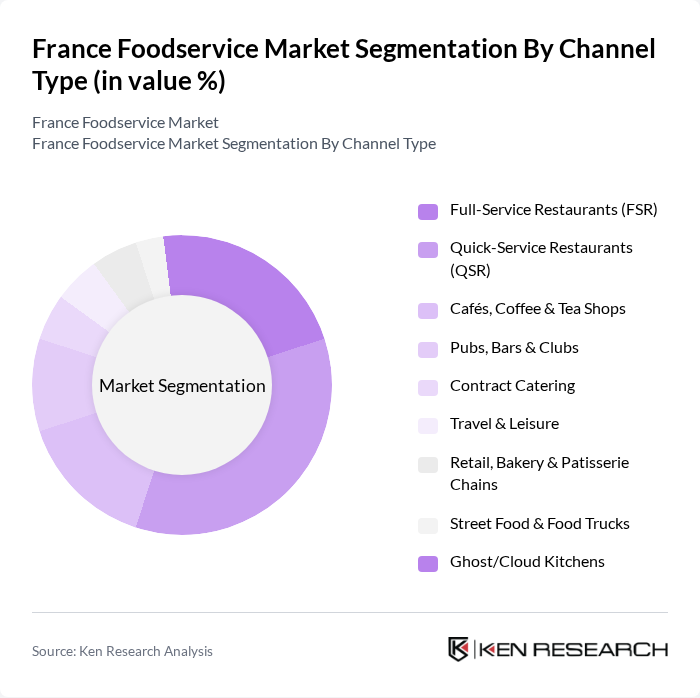

By Channel Type:The France Foodservice Market is segmented into various channel types, including Full-Service Restaurants (FSR), Quick-Service Restaurants (QSR), Cafés, Coffee & Tea Shops, Pubs, Bars & Clubs, Contract Catering, Travel & Leisure, Retail, Bakery & Patisserie Chains, Street Food & Food Trucks, and Ghost/Cloud Kitchens. Among these, Quick-Service Restaurants (QSR) have emerged as the dominant segment due to their convenience, affordability, and the growing trend of on-the-go dining, supported by digital ordering and delivery adoption. The fast-paced lifestyle of consumers has led to an increased preference for QSRs, which offer quick meals without compromising on quality .

By Consumer Segment (Profit vs Cost):The market is also segmented by consumer segments, distinguishing between the Profit Sector and the Cost Sector. The Profit Sector, which includes Full-Service Restaurants, Quick-Service Restaurants, Cafés, Pubs, and Retail, is currently leading the market. This segment benefits from higher margins and consumer willingness to spend on dining experiences, particularly in urban areas where disposable income is higher. The Cost Sector, which includes Education, Healthcare, and Military catering, is essential for providing affordable meal options but does not drive the same level of revenue growth. The strength of digital ordering and delivery has been especially supportive for profit-sector operators .

The France Foodservice Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sodexo S.A., Elior Group S.A., Compass Group PLC, Accor S.A., Groupe Bertrand, Autogrill S.p.A. (now part of Dufry/Autogrill Group), Groupe Le Duff (Brioche Dorée, Del Arte), Délifrance S.A.S., La Maison du Chocolat, Groupe Flo (Hippopotamus), McDonald’s France, Starbucks Coffee France, Burger King France (Burger King/Quick), Domino’s Pizza France, KFC France, Flunch, Paul (Holder Group), Courtepaille, Buffalo Grill, Pret A Manger France contribute to innovation, geographic expansion, and service delivery in this space .

The future of the France foodservice market appears promising, driven by evolving consumer preferences and technological advancements. The integration of digital solutions, such as AI-driven menu personalization and enhanced delivery logistics, is expected to streamline operations. Additionally, the focus on sustainability will likely shape menu offerings, with more establishments adopting eco-friendly practices. As the market adapts to these trends, opportunities for growth in niche segments, such as plant-based dining, will emerge, catering to the increasing demand for healthier and sustainable options.

| Segment | Sub-Segments |

|---|---|

| By Channel Type | Full-Service Restaurants (FSR) Quick-Service Restaurants (QSR) Cafés, Coffee & Tea Shops Pubs, Bars & Clubs Contract Catering (Business & Industry, Education, Healthcare, Defense) Travel & Leisure (Hotels, Airports, Motorways) Retail, Bakery & Patisserie Chains Street Food & Food Trucks Ghost/Cloud Kitchens |

| By Consumer Segment (Profit vs Cost) | Profit Sector (FSR, QSR, Café/Tea, Pub/Bar, Accommodation, Retail) Cost Sector (Education, Healthcare, Military & Civil Defense, Welfare & Services) |

| By Service Mode | Dine-in Takeaway Delivery (First-party and Third-party) Drive-thru Catering & On-site Services |

| By Cuisine Type | French Cuisine & Regional Specialties Italian Asian (Chinese, Japanese, Thai, etc.) American/Fast Food Middle Eastern & North African Plant-based/Vegetarian Others |

| By Price Tier | Premium Mid-range Budget/Value |

| By Location | Urban Suburban Rural |

| By Distribution/Ordering Channel | On-premise/Direct Online Aggregators (e.g., Uber Eats, Deliveroo, Just Eat) Brand Apps & Websites Telephone/Other |

| By Ownership | Independent Outlets Chained Outlets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Full-Service Restaurants | 120 | Restaurant Owners, Head Chefs |

| Quick-Service Restaurants | 110 | Franchise Managers, Operations Directors |

| Catering Services | 70 | Catering Managers, Event Planners |

| Food Delivery Services | 90 | Logistics Coordinators, Marketing Managers |

| Consumer Preferences | 140 | General Consumers, Food Enthusiasts |

The France Foodservice Market is valued at approximately EUR 85 billion, reflecting a robust growth driven by increasing consumer demand for diverse dining experiences, food delivery services, and health-conscious eating trends.