Region:Europe

Author(s):Dev

Product Code:KRAC0534

Pages:84

Published On:August 2025

By Type:The foodservice market can be segmented into various types, including Full-service restaurants (FSR), Quick-service restaurants (QSR), Cafés, bars & coffee shops, Contract catering & institutional foodservice, Cloud/ghost kitchens, Pizzerias & bakeries, Bars, pubs & nightlife, Food trucks & street food, and Others. Each of these segments caters to different consumer preferences and dining experiences. Cafés and bars account for the highest number of outlets nationally, pizza-focused venues are widespread (tens of thousands of outlets offering pizza), and cloud kitchens remain a small but growing base driven by delivery demand.

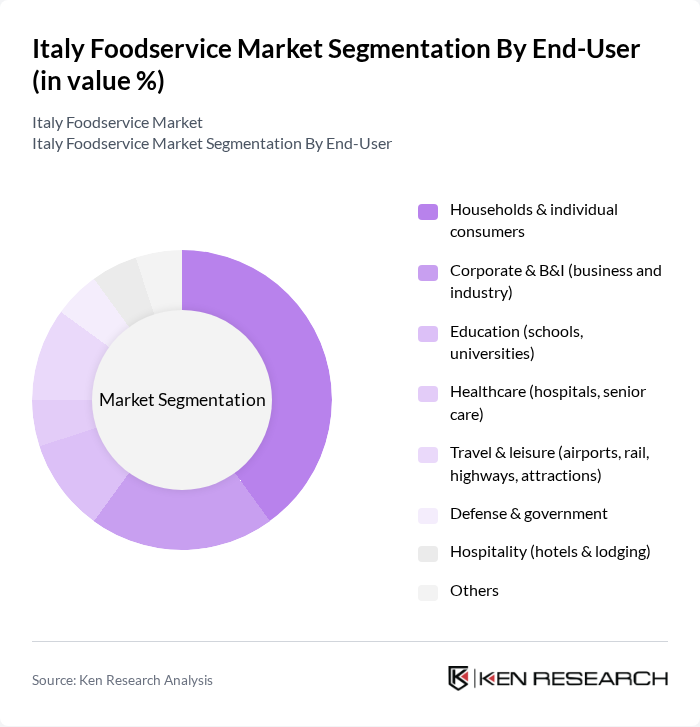

By End-User:The end-user segmentation includes Households & individual consumers, Corporate & B&I (business and industry), Education (schools, universities), Healthcare (hospitals, senior care), Travel & leisure (airports, rail, highways, attractions), Defense & government, Hospitality (hotels & lodging), and Others. This segmentation reflects the diverse consumer base and varying needs across different sectors. Travel, leisure, and transport hubs (airports, rail, highways) are important channels given Italy’s tourism and mobility footprint, while corporate, education, and healthcare are core contracted catering end-markets.

The Italy Foodservice Market is characterized by a dynamic mix of regional and international players. Leading participants such as Autogrill S.p.A. (now part of Dufry Group/AEG Holding), Eataly S.p.A., Camst – La Ristorazione Italiana Soc. Coop. (Gruppo Camst), Compass Group Italia S.p.A., Sodexo Italia S.p.A., Dussmann Service Italia S.r.l., CIRFOOD – Cooperativa Italiana di Ristorazione, Elior Italia S.p.A., Chef Express S.p.A. (Gruppo Cremonini), McDonald’s Italy (McDonald’s Development Italy LLC), Roadhouse S.p.A. (Roadhouse Grill, Gruppo Cremonini), Pizzium S.r.l., Gruppo Sebeto (Rossopomodoro), Gruppo Caffè Vergnano S.p.A., illycaffè S.p.A., Lavazza Group (Luigi Lavazza S.p.A.), Starbucks Italy (Percassi/Alsea franchise operations), KFC Italia (Yum! Brands), Deliveroo Italy S.r.l., Glovoapp23 S.r.l. (Glovo Italy) contribute to innovation, geographic expansion, and service delivery in this space. Chain penetration is expanding, cafés/bars remain the most numerous outlets, and delivery platforms continue to support off-premise sales growth.

The future of the Italian foodservice market appears promising, driven by evolving consumer preferences and technological advancements. As health-conscious dining continues to gain traction, restaurants are likely to adapt their menus to include more nutritious options. Additionally, the expansion of foodservice into rural areas presents a significant opportunity for growth, as these regions increasingly seek diverse dining experiences. The integration of technology in operations will further enhance efficiency and customer engagement, shaping the market's trajectory.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-service restaurants (FSR) Quick-service restaurants (QSR) Cafés, bars & coffee shops Contract catering & institutional foodservice Cloud/ghost kitchens Pizzerias & bakeries Bars, pubs & nightlife Food trucks & street food Others |

| By End-User | Households & individual consumers Corporate & B&I (business and industry) Education (schools, universities) Healthcare (hospitals, senior care) Travel & leisure (airports, rail, highways, attractions) Defense & government Hospitality (hotels & lodging) Others |

| By Service Model | Dine-in Takeaway Delivery Drive-thru Click-and-collect Others |

| By Cuisine Type | Italian cuisine Pizza & pasta Mediterranean cuisine International (Asian, American, Middle Eastern, etc.) Plant-based & health-focused Others |

| By Price Range | Budget Mid-range Premium Luxury/fine dining Others |

| By Location | Standalone street locations Retail & malls Travel (airports, rail, highways, service areas) Leisure & attractions Lodging (hotels & resorts) Urban Suburban Rural Tourist hotspots Others |

| By Distribution Channel | On-premise (direct) First-party digital (owned apps/web) Third-party delivery aggregators Catering & events Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Full-Service Restaurants | 120 | Restaurant Owners, Managers, Head Chefs |

| Quick-Service Restaurants | 100 | Franchise Owners, Operations Managers |

| Catering Services | 80 | Catering Managers, Event Planners |

| Food Delivery Services | 100 | Delivery Managers, Marketing Directors |

| Consumer Dining Preferences | 150 | General Consumers, Food Enthusiasts |

The Italy Foodservice Market is valued at approximately USD 100 billion, reflecting a robust growth trajectory driven by increasing consumer demand for diverse dining options, food delivery services, and health-conscious eating trends.