Region:Asia

Author(s):Shubham

Product Code:KRAA1798

Pages:91

Published On:August 2025

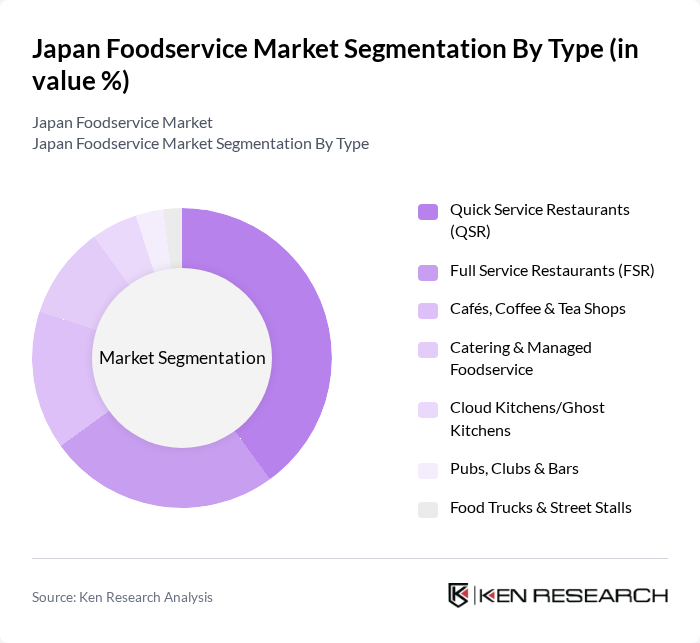

By Type:

The Japan Foodservice Market is segmented into various types, including Quick Service Restaurants (QSR), Full Service Restaurants (FSR), Cafés, Coffee & Tea Shops, Catering & Managed Foodservice, Cloud Kitchens/Ghost Kitchens, Pubs, Clubs & Bars, and Food Trucks & Street Stalls. Among these, Quick Service Restaurants (QSR) are a leading growth format due to convenience, affordability, and fast service, while Full Service Restaurants (FSR) account for a substantial value share given their role in social occasions and dine?in experiences in Japan’s urban centers . The ongoing shift toward online ordering and delivery, alongside international and local QSR brand expansion, continues to strengthen limited?service channels and digital-centric formats such as cloud kitchens .

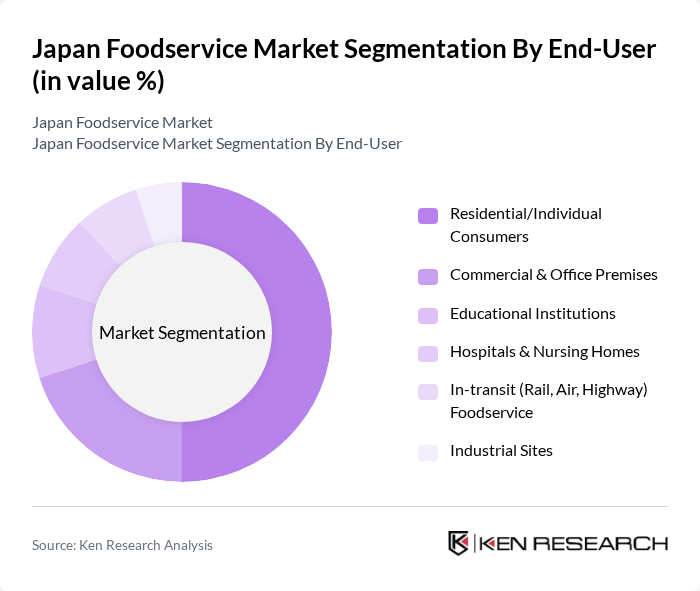

By End-User:

The end-user segmentation of the Japan Foodservice Market includes Residential/Individual Consumers, Commercial & Office Premises, Educational Institutions, Hospitals & Nursing Homes, In-transit (Rail, Air, Highway) Foodservice, and Industrial Sites. The Residential/Individual Consumers segment is the largest, driven by dining-out occasions and the convenience of digital ordering and delivery platforms that have expanded access to QSR, FSR, and café offerings across metropolitan and suburban areas . The rising availability of healthier menu options, seasonal and premium offerings, and specialty beverages has further diversified choices for households and individual diners .

The Japan Foodservice Market is characterized by a dynamic mix of regional and international players. Leading participants such as McDonald's Holdings Company (Japan), Ltd., Yoshinoya Holdings Co., Ltd., FOOD & LIFE COMPANIES Ltd. (Sushiro), Domino's Pizza Japan, Inc., Zensho Holdings Co., Ltd. (Sukiya, Matsuya, etc.), Skylark Holdings Co., Ltd. (Gusto, Jonathan's, Bamiyan), Lotteria Co., Ltd., Seven & i Food Systems Co., Ltd. (Denny's Japan), Royal Holdings Co., Ltd. (Royal Host), Colowide Co., Ltd. (includes Ootoya Holdings Co., Ltd.), Ichibanya Co., Ltd. (Curry House CoCo Ichibanya), Kentucky Fried Chicken Japan, Ltd. (KFC Japan), Saizeriya Co., Ltd., Hot Palette Co., Ltd. (Pepper Lunch), MOS Food Services, Inc. (MOS Burger) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Japan foodservice market appears promising, driven by evolving consumer preferences and technological advancements. The integration of digital platforms for ordering and payment is expected to enhance customer experiences, while the focus on sustainability will likely shape menu offerings. As the market adapts to these trends, foodservice providers will need to innovate continuously to meet the demands of health-conscious consumers and capitalize on the growing interest in diverse culinary experiences.

| Segment | Sub-Segments |

|---|---|

| By Type | Quick Service Restaurants (QSR) Full Service Restaurants (FSR) Cafés, Coffee & Tea Shops Catering & Managed Foodservice Cloud Kitchens/Ghost Kitchens Pubs, Clubs & Bars Food Trucks & Street Stalls |

| By End-User | Residential/Individual Consumers Commercial & Office Premises Educational Institutions Hospitals & Nursing Homes In-transit (Rail, Air, Highway) Foodservice Industrial Sites |

| By Service Model | Dine-in Takeout/Takeaway Delivery (First-party & Third-party) Drive-thru Catering/On-site Services |

| By Cuisine Type | Japanese (Sushi, Ramen, Izakaya, Teishoku, etc.) Western (American, European) Asian (Chinese, Korean, Thai, Indian, etc.) Bakery, Confectionery & Desserts Fast Food & Burgers/Pizza/Chicken |

| By Price Range | Budget Mid-range Premium Luxury/Fine Dining |

| By Location | Urban Suburban Rural Tourist Hotspots (Stations, Airports, Attractions) |

| By Distribution Channel | On-premise (Direct) Brand-owned Online & Apps Aggregators/Third-party Delivery Platforms Vending/Automated Retail |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Full-Service Restaurants | 120 | Restaurant Owners, General Managers |

| Fast Food Chains | 100 | Franchise Operators, Area Managers |

| Cafes and Coffee Shops | 80 | Store Managers, Baristas |

| Catering Services | 60 | Catering Managers, Event Coordinators |

| Food Delivery Services | 90 | Operations Managers, Delivery Coordinators |

The Japan Foodservice Market is valued at approximately USD 256 billion, reflecting a robust sector supported by out-of-home dining and delivery activities. This valuation is based on a five-year historical analysis and aligns with reports from various industry trackers.