Region:Middle East

Author(s):Geetanshi

Product Code:KRVN4346

Pages:116

Published On:December 2025

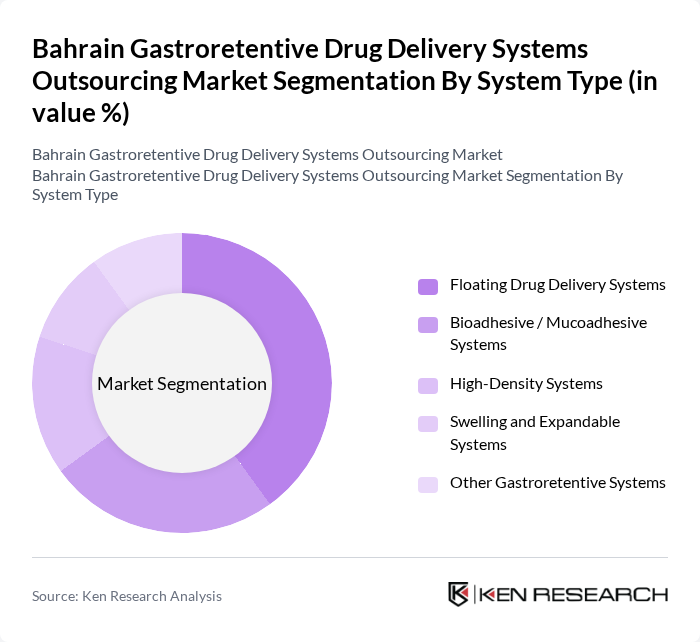

By System Type:The market is segmented into various system types, including Floating Drug Delivery Systems, Bioadhesive / Mucoadhesive Systems, High-Density Systems, Swelling and Expandable Systems, and Other Gastroretentive Systems. Among these, Floating Drug Delivery Systems are leading due to their ability to remain buoyant in the gastric environment, thus providing prolonged drug release and improved bioavailability, in line with global trends where floating systems account for the largest share of gastroretentive technologies. The increasing focus on patient-centric drug delivery solutions, including reduced dosing frequency, better symptom control for upper gastrointestinal disorders, and improved adherence in chronic therapy, is driving the demand for these systems in outsourcing and contract development projects across the Middle East and Bahrain.

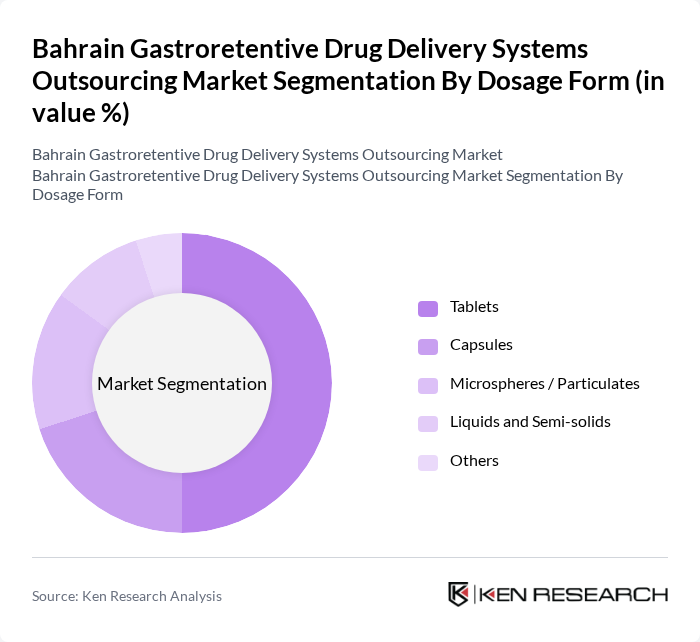

By Dosage Form:The market is categorized into Tablets, Capsules, Microspheres / Particulates, Liquids and Semi-solids, and Others. Tablets are the dominant dosage form due to their widespread acceptance, ease of administration, cost-effectiveness, and suitability for modified-release and gastroretentive technologies, reflecting the broader pattern in the global gastroretentive and oral drug delivery markets where solid oral dosage forms remain the primary format. The growing trend towards robust solid dosage formulations that offer improved stability, scalable manufacturing for outsourcing, and better patient compliance is further propelling the demand for gastroretentive tablets and multiparticulate systems in Bahrain and the wider Middle East.

The Bahrain Gastroretentive Drug Delivery Systems Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Pharmaceutical Industries (Julphar), Bahrain Pharma, Hikma Pharmaceuticals, Aster DM Healthcare, United Pharmaceuticals, Badr Al Samaa Group, Al Noor Hospitals Group, Al-Dawaa Pharmacies, Bahrain Specialist Hospital, Bahrain Medical Technology, Gulf Biotech, KIMSHEALTH Hospital Bahrain, Bahrain International Hospital, Dallah Healthcare Company, Al Salam Specialist Hospital contribute to innovation, geographic expansion, and service delivery in this space, by integrating advanced oral and controlled-release technologies into their broader pharmaceutical manufacturing, hospital, and pharmacy service portfolios across the Gulf region.

The future of the gastroretentive drug delivery systems outsourcing market in Bahrain appears promising, driven by increasing healthcare investments and a growing emphasis on patient-centric solutions. As the healthcare infrastructure expands, more companies are likely to seek outsourcing partnerships to enhance their product offerings. Additionally, the integration of digital health technologies is expected to streamline drug development processes, making them more efficient and responsive to market needs, thus fostering innovation in this sector.

| Segment | Sub-Segments |

|---|---|

| By System Type | Floating Drug Delivery Systems Bioadhesive / Mucoadhesive Systems High-Density Systems Swelling and Expandable Systems Other Gastroretentive Systems |

| By Dosage Form | Tablets Capsules Microspheres / Particulates Liquids and Semi-solids Others |

| By Application / Indication | Gastrointestinal Disorders (e.g., ulcers, GERD) Diabetes and Metabolic Disorders Cardiovascular Diseases Infectious Diseases Other Chronic Indications |

| By Service Type (Outsourcing) | Drug Discovery & Preclinical Formulation Clinical Trial Services Contract Development & Manufacturing (CDMO / CMO) Scale-up & Commercial Manufacturing Support Regulatory & Quality Consulting Others |

| By End-User / Client Type | Global and Regional Pharmaceutical Companies Biotechnology and Specialty Pharma Firms Academic & Research Institutions Contract Research Organizations (CROs) Others |

| By Distribution Channel (Finished GRDDS) | Hospital Pharmacies Retail Pharmacies Online Pharmacies Specialty Clinics Others |

| By Region in Bahrain | Capital Governorate Muharraq Governorate Northern Governorate Southern Governorate |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 100 | R&D Managers, Product Development Leads |

| Healthcare Providers | 80 | Pharmacists, Physicians, Clinical Researchers |

| Regulatory Bodies | 50 | Regulatory Affairs Specialists, Compliance Officers |

| Market Analysts | 60 | Healthcare Market Analysts, Business Development Managers |

| Patients and End-users | 70 | Chronic Disease Patients, Caregivers |

The Bahrain Gastroretentive Drug Delivery Systems Outsourcing Market is valued at approximately USD 40 million, contributing to the broader Middle East market, which is valued at around USD 1.4 billion. This growth is driven by increasing chronic disorders and demand for advanced drug delivery systems.